Concept explainers

Classifying costs

The following is a list of costs that were incurred in the production and sale of all-terrain vehicles (ATVs).

a.Attorney fees for drafting a new lease for headquarters offices.

b.Cash paid to outside firm for janitorial services for factory.

c. Commissions paid to sales representatives, based on the number of ATVs sold.

d.Cost of advertising in a national magazine.

e.Cost of boxes used in packaging ATVs.

f. Electricity used to run the robotic machinery.

g.Engine oil used in engines prior to shipment. h. Factory cafeteria cashier's wages.

i. Filler for spray gun used to paint the ATVs.

j. Gasoline engines used for ATVs.

k.Hourly wages of operators of robotic machinery used in production.

I. License fees for use of patent for transmission assembly, based on the number of ATVs produced.

m. Maintenance costs for new robotic factory equipment, based on hours of usage.

n. Paint used to coat the ATVs.

o.Payroll taxes on hourly assembly line employees.

p.Plastic for outside housing of ATVs.

q.Premiums on insurance policy for factory buildings.

r. Properly taxes on the factory building and equipment.

s.Salary of factory supervisor.

t. Salary of quality control supervisor who inspects each ATV before it is shipped.

u.Salary of vice president of marketing.

v. Steering wheels for ATVs.

w. Straight-line

x.Steel used in producing the ATVs.

y.Telephone charges for company controller's office.

z.Tires for ATVs.

Instructions

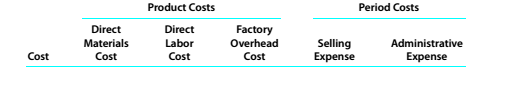

Classify each cost as either a product cost or a period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Survey of Accounting - With CengageNOW 1Term

- Question: Kukur Inc.'s net income for the most recent year was $15,985. The tax rate was 35 percent. The firm paid $3,886 in total interest expense and deducted $2,565 in depreciation expense. What was the company's cash coverage ratio for the year? Financial accounting problemarrow_forwarddo fast of this General accounting questionarrow_forwardgeneral accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning