(a-1)

Bonds

Bonds are a kind of interest bearing notes payable, usually issued by companies, universities and governmental organizations. It is a debt instrument used for the purpose of raising fund of the corporations or governmental agencies. If selling price of the bond is equal to its face value, it is called as par on bond. If selling price of the bond is lesser than the face value, it is known as discount on bond. If selling price of the bond is greater than the face value, it is known as premium on bond.

Straight-line amortization bond

Effective interest rate of amortization bond

Effective interest rate method of amortization is a process of amortizing premium on bond or discount on bond, which allocates the different amount of interest expense in each period of interest payment, but a constant percentage rate.

To Prepare: The

2017.

(a-1)

Answer to Problem 10.11AP

Prepare the journal entry to record the issuance of bonds of Company O on January 1, 2017as shown below:

| Date | Account title and Explanation | Debit | Credit |

| January 1, 2017 | Cash | $2,147,202 | |

| Premium on bonds payable (1) | $147,202 | ||

| Bonds payable | $2,000,000 | ||

| (To record the issuance of bonds payable at premium value for Company O ) |

Table (1)

Working note:

Calculate premium on bonds payable of Company O is shown below:

Explanation of Solution

- Cash is a current asset, and increased. Therefore, debit cash account for $2,147,202.

- Premium on bonds payable is a contra liability, and increased. Therefore, credit premium on bonds payable for $147,202.

- Bonds payable is a long-term liability, and increased. Therefore, credit bonds payable account for $2,000,000.

(a-2)

To Prepare: The journal entry to record the accrued interest expense and premium on amortize bond for Company O on December 31, 2017.

(a-2)

Answer to Problem 10.11AP

Prepare the journal entry to record the accrued interest expense and premium on amortize bond for Company O on December 31, 2017 as shown below:

| Date | Account title and Explanation | Debit | Credit |

| December 31, 2017 | Interest expense (2) | $128,832 | |

| Premium on bonds payable (3) | $11,168 | ||

| Interest payable (1) | $140,000 | ||

| (To record the accrued interest expense and premium on amortize bond for Company O) |

Table (2)

Working notes:

Calculate interest payable amount of Company O is shown below:

Calculate interest expense of Company O is shown below:

Calculate premium of bonds payable for Company O is shown below:

Explanation of Solution

- Interest expense is a component of

stockholders’ equity , and decreased it. Therefore, debit interest expense account for $128,832. - Premium on bonds payable is a contra liability, and decreased. Therefore, debit premium on bonds payable for $11,168.

- Interest payable is a current liability, and increased. Therefore, credit interest payable account for $140,000.

(a-3)

To Prepare: The journal entry to record the payment of interest of Company O on January 1, 2018.

(a-3)

Answer to Problem 10.11AP

Prepare the journal entry to record the payment of interest of Company O on January 1, 2018 as shown below:

| Date | Account title and Explanation | Debit | Credit |

| January 1, 2018 | Interest payable | $140,000 | |

| Cash | $140,000 | ||

| (To record the payment of interest expenses for Company O) |

Table (3)

Explanation of Solution

- Interest payable is a current liability, and decreased. Therefore, debit interest payable account for $140,000.

- Cash is a current asset, and decreased. Therefore, credit cash account for $140,000.

(a-4)

To Prepare: The journal entry to record the accrued interest expense and discount on amortize bond for Corporation L on December 31, 2018.

(a-4)

Answer to Problem 10.11AP

Prepare the journal entry to record the accrued interest expense and discount on amortize bond for Company O on December 31, 2018 as shown below:

| Date | Account title and Explanation | Debit | Credit |

| December 31, 2018 | Interest expense (2) | $128,162 | |

| Premium on bonds payable (3) | $11,838 | ||

| Interest payable (1) | $140,000 | ||

| (To record the accrued interest expense and premium on amortize bond for Company O) |

Table (4)

Working notes:

Calculate interest payable amount of Company O as shown below:

Calculate interest expense of Company O as shown below:

Calculate premium of bonds payable for Company O as shown below:

Explanation of Solution

- Interest expense is a component of stockholders’ equity, and decreased it. Therefore, debit interest expense account for $128,162.

- Premium on bonds payable is a contra liability, and decreased. Therefore, debit premium on bonds payable for $11,838.

- Interest payable is a current liability, and increased. Therefore, credit interest payable account for $140,000.

(b)

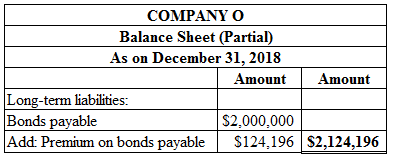

To Prepare: The proper long-term liabilities section balance sheet presentation for the liability of bonds payable on 31st December 2018 of Company O.

(b)

Answer to Problem 10.11AP

Prepare the proper long-term liabilities section balance sheet presentation for the liability of bonds payable on 31st December 2018 of Company O as shown below:

Figure (1)

Explanation of Solution

Premium on bonds payable for the year 2018 is $124,196 which is calculated by deducting from premium on amortize of bond for the year 2017 ($11,168) and 2018 ($11,838) from premium on bonds payable on January 1, 2017 is $147,202.

(c-1)

To Prepare: The interest expenses amount shows in the year 2018 of Company O.

(c-1)

Answer to Problem 10.11AP

Prepare the interest expenses amount shows in the year 2018 of Company O as shown below:

Therefore, an Interest expense amount show in the year 2018 of Company O is $128,162.

Explanation of Solution

Interest expense is calculated by multiplying carrying

(c-2)

To Ascertain: If the bond interest expense reported in the year 2018 is greater than the amount reported, lesser than the amount reported or same amount reported, if the Company used the straight-line method of amortization.

(c-2)

Explanation of Solution

The interest expense under straight-line method of amortization is $125,280

Want to see more full solutions like this?

Chapter 10 Solutions

Bundle: Financial Accounting: Tools for Business Decision Making 8e Binder Ready Version + WileyPLUS Registration Code

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning  Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,