Concept explainers

Using the

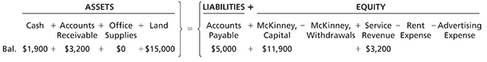

Meg McKinney opened a public relations firm called Solid Gold on August 1,2018. The following amounts summarize her business on August 31,2018:

Learning Objective 4

Cash $13,600

During September 2018, the business completed the following transactions:

a. Meg McKinney contributed $17,000 cash in exchange for capital.

b. Performed service for a client and received cash of $800.

c. Paid off the beginning balance of accounts payable.

d. Purchased office supplies from OfficeMax on account, $1,200.

e. Collected cash from a customer on account, $2,000.

f. McKinney withdrew $1,600.

g. Consulted for a new band and billed the client for services rendered, $4,500.

h. Recorded the following business expenses for the month:

Paid office rent: $1,000.

Paid advertising: $500.

Analyze the effects of the transactions on the accounting equation of Solid Gold using the format presented in Exhibit 1-5.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

ACCOUNTING PRINCIPLES V1 6/17 >C<

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning