Concept explainers

Using the

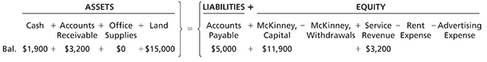

Meg McKinney opened a public relations firm called Solid Gold on August 1,2018. The following amounts summarize her business on August 31,2018:

Learning Objective 4

Cash $13,600

During September 2018, the business completed the following transactions:

a. Meg McKinney contributed $17,000 cash in exchange for capital.

b. Performed service for a client and received cash of $800.

c. Paid off the beginning balance of accounts payable.

d. Purchased office supplies from OfficeMax on account, $1,200.

e. Collected cash from a customer on account, $2,000.

f. McKinney withdrew $1,600.

g. Consulted for a new band and billed the client for services rendered, $4,500.

h. Recorded the following business expenses for the month:

Paid office rent: $1,000.

Paid advertising: $500.

Analyze the effects of the transactions on the accounting equation of Solid Gold using the format presented in Exhibit 1-5.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

Horngren's Accounting, Student Value Edition (12th Edition)

- Solve correctly without using aiarrow_forwardGive solution correctly no chatgptarrow_forwardProblem No. 1 On January 1, 2025, Manuel Cruz and Sherimae Diasalo agreed to form a partnership that will manufacture and sell biscuits. The partnership agreement specified that Cruz is to invest cash of P1,000,000 and Diasalo is to contribute land and building to serve as the office and factory of the business. The following amounts are applicable to the property of Diasalo: Acquisition Cost Fair Market Value Land Building P1,000,000 500,000 P1,500,000 850,000 During the formation, it was found out that Cruz has accounts receivable amounting to P70,000 and the partners agreed that it will be assumed by the partnership. The name of the partnership will be Fita Pan. Required: 1. Prepare journal entry to record: a. The investment of Cruz to the partnership b. The investment of Diasalo to the partnershipood relay ni 000,219 2. Prepare the statement of financial position of the partnership as of January 1, 2025 Problem No. 2 The trial balance of Cleint Lumanao Nacho Supplies on February…arrow_forward

- A company's stock price is $80, with earnings per share (EPS) of $10 and an expected growth rate of 12%.arrow_forwardKazama owns JKL Corporation stock with a basis of $20,000. He exchanges this for $24,000 of STU stock and $8,000 of STU securities as part of a tax-free reorganization. What is Kazama's basis in the STU stock?arrow_forwardKensington Textiles, Inc. manufactures customized tablecloths. An experienced worker can sew and embroider 10 tablecloths per hour. Due to the repetitive nature of the work, employees take a 10-minute break after every 10 tablecloths. Additionally, before starting each batch of 10 tablecloths, workers spend 8 minutes cleaning and setting up their sewing machines. Calculate the standard quantity of direct labor for one tablecloth.arrow_forward

- Solvearrow_forwardProblem: The bank statement balance of $7,000 does not include a check outstanding of $1,000, a deposit in transit of $275, and another company's $250 check erroneously charged against your firm's account. The reconciled bank balance is__?arrow_forwardGiven step by step explanation general accounting questionarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage