Concept explainers

1.

To identify: The effect of transactions on the

1.

Explanation of Solution

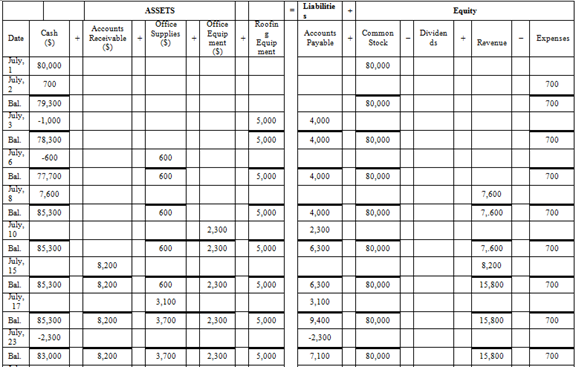

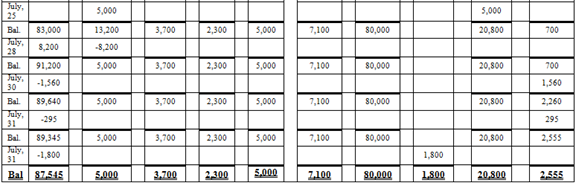

Table (1)

Hence, the cash balance is $87,545,

2.

To prepare: The income statement, statement of

2.

Explanation of Solution

Prepare income statement.

| | ||

| | ||

| | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue: | ||

| Service Revenue | 20,800 | |

| Total Revenue | 20,800 | |

| Expenses: | ||

| Rent Expenses | 700 | |

| Salary Expenses | 1,560 | |

| Utilities Expenses | 295 | |

| Total Expense | 2,555 | |

| Net income | 18,245 | |

Table(2)

Hence, net income of .R Company as on July 31, 20XX is $18,245

Prepare statement of retained earnings

| | ||

| | ||

| | ||

| Particulars | Amount ($) | |

| Opening balance | 0 | |

| Net income | 18,245 | |

| Total | 18,245 | |

| Dividends | (1,800) | |

| Retained earnings | 16,445 | |

Table(3)

Hence, the retained earnings of .R Company as on July 31, 20XX are $16,445.

Prepare balance sheet

| | ||

| | ||

| | ||

| Particulars | Amount ($) | |

| Assets | ||

| Cash | 87,545 | |

| Accounts Receivables | 5,000 | |

| Office Supplies | 3,700 | |

| Office Equipment | 2,300 | |

| Roofing Equipment | 5,000 | |

| Total Assets | 103,545 | |

| Liabilities and | ||

| Liabilities | ||

| Accounts Payable | 7,100 | |

| Stockholder’s Equity | ||

| Common Stock | 80,000 | |

| Retained earnings | 16,445 | |

| Total stockholders’ equity | 96,445 | |

| Total Liabilities and Stockholder’s equity | 103,545 | |

Table(4)

Hence, the total of the balance sheet of the R Company as on July 31, 20XX is of $103,545.

3.

To prepare: The statement of

3.

Explanation of Solution

Prepare the cash flow statement.

| | ||

| | ||

| | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flow from operating activities | ||

| Receipts: | ||

| Collections from customers | 15,800 | |

| Payments: | ||

| Supplies | (600) | |

| Rent Expenses | (700) | |

| Salary Expenses | (1,560) | |

| Utilities | (295) | (3,155) |

| Net cash from operating activities | 12,645 | |

| Cash flow from investing activities | ||

| Purchase of office equipment | (2,300) | |

| Purchase of Roofing equipment | (1,000) | |

| Net cash from investing activities | (3,300) | |

| Cash flow from financing activities | ||

| Issued common stock | 80,000 | |

| Less: Payment of cash dividends | (1,800) | |

| Net cash from financing activities | 78,200 | |

| Net increase in cash | 87,545 | |

| Cash balance, July 1,20XX | 0 | |

| Cash balance, July 31,20XX | 87,545 | |

Table(5)

Hence, the cash balance of the R Company as on July 31, 20XX is $87,545.

4.

To identify: The changes on (a) total assets, (b) total liabilities, and (c) total equity.

4.

Explanation of Solution

If the company purchase roofing equipment by owner investment instead of cash as mention in question.

- On assets- The asset of the company increases by $1,000.

- On liabilities- The liability of the company decreases by $4,000.

- On equity- The common stock is increased by $5,000 and common stock is the part of equity so equity increases by $5,000.

Thus, assets and equity will increase and liability will decrease.

Want to see more full solutions like this?

Chapter 1 Solutions

Financial and Managerial Accounting

- Reliance Enterprises has a net income of $82.3 million and pays out $14.7 million in dividends. The firm has total assets of $1,270 million and total liabilities of $720 million. What is the firm's sustainable growth rate, given this information?arrow_forwardManufacturing marginarrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education