Concept explainers

1.

To prepare:

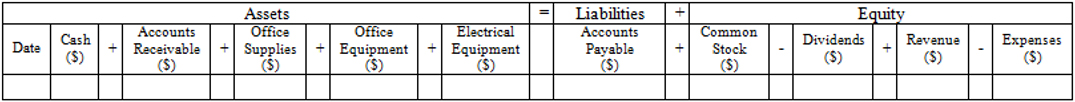

The table showing accounts given related to assets, liabilities, and equity.

1.

Explanation of Solution

Show the classification of the accounts under assets, liabilities, and equity as follow:

Table (1)

Hence, Cash, Accounts receivable, Office Supplies, Office Equipment, and Electrical Equipment accounts will come under assets, Accounts Payable account will be treated as liability and the Common Stock, Dividends, Revenue and Expenses accounts will come under equity.

2.

To identify:

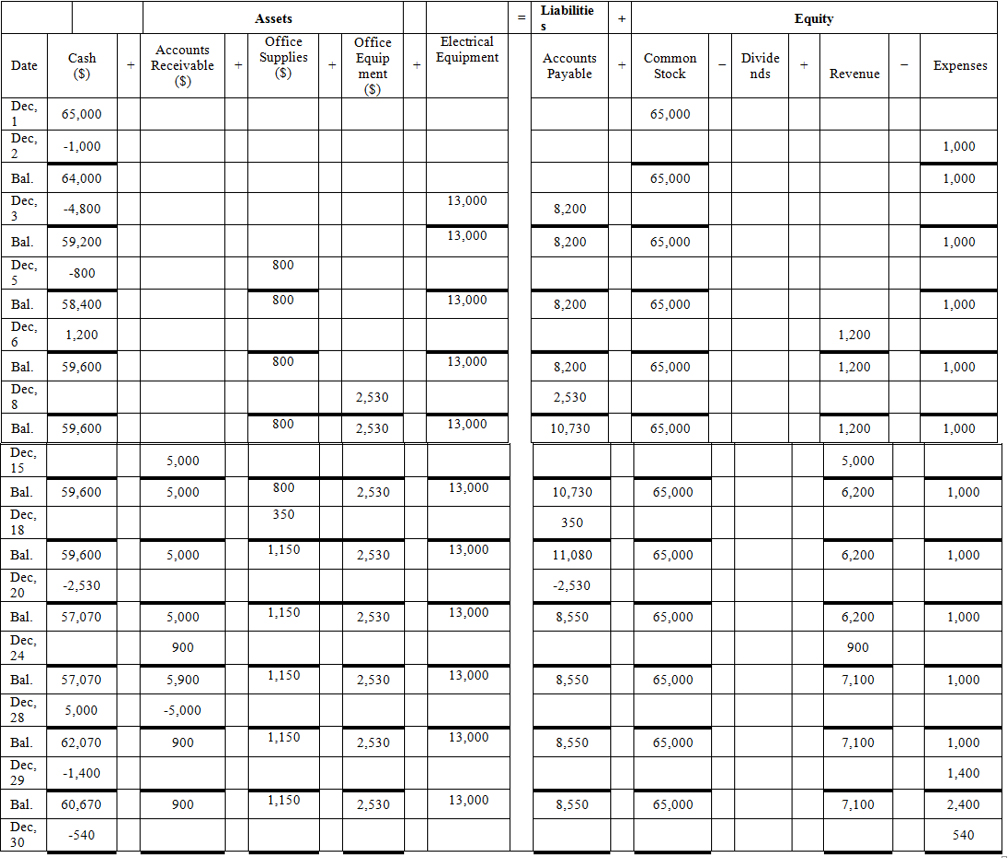

The effect of transactions on the

2.

Explanation of Solution

Table (2)

Hence, the cash balance is $59,180, accounts receivables is $900, office supplies is $1,150, office equipment is $2,530, electrical equipment is$13,000, accounts payable is $8,550, common stock is $65,000, dividend is $950, revenue is $7,100 and expenses is $2,940.

3.

To prepare:

The income statement, statement of

3.

Explanation of Solution

Prepare income statement.

| S Company | ||

|---|---|---|

| Income Statement | ||

| For the month ended December 31, 20XX | ||

| Particulars | Amount ($) |

Amount ($) |

| Revenue: | ||

| Service Revenue | 7,100 | |

| Total Revenue | 7,100 | |

| Expenses: | ||

| Rent Expenses | 1000 | |

| Salary Expenses | 1,400 | |

| Utilities Expenses | 540 | |

| Total Expense | 2,940 | |

| Net income | 4,160 | |

Table (3)

Hence, net income of .S Company as on December 31, 20XX is $4,160.

Prepare statement of retained earnings.

| S Company | |

|---|---|

| Retained Earnings Statement | |

| For the Month Ended December 31, 20XX | |

| Particulars | Amount ($) |

| Opening balance of retained earnings | 0 |

| Net income | 4,160 |

| Total | 4,160 |

| Dividends | (950) |

| Ending balance of retained earnings | 3,210 |

Table (4)

Hence, the retained earnings of S Company as on December 31, 20XX are $3,210.

Prepare the cash flow statement.

| S Company | ||

|---|---|---|

| Statement of Cash Flows | ||

| Month Ended December 31, 20XX | ||

| Particulars | Amount ($) |

Amount ($) |

| Cash flow from operating activities | ||

| Receipts: | ||

| Collections from customers | 6,200 | |

| Payments: | ||

| Supplies | (800) | |

| Rent Expenses | (1,000) | |

| Salary Expenses | (1,400) | |

| Utilities | (540) | (3,740) |

| Net cash from operating activities | 2,460 | |

| Cash flow from investing activities | ||

| Purchase of office equipment | (2,530) | |

| Purchase of electric equipment | (4,800) | |

| Net cash from investing activities | (7,330) | |

| Cash flow from financing activities | ||

| Issued common stock | 65,000 | |

| Less: Payment of cash dividends | (950) | |

| Net cash from financing activities | 64,050 | |

| Net increase in cash | 59,180 | |

| Cash balance, December 1,20XX | 0 | |

| Cash balance, December 31,20XX | 59,180 | |

Table (5)

Hence, the cash balance of the S Company as on December 31, 20XX is $59,180.

Prepare balance sheet.

| S Company | ||

|---|---|---|

| Balance sheet | ||

| As on December 31, 20XX | ||

| Particulars | Amount ($) |

Amount ($) |

| Assets | ||

| Cash | 59,180 | |

| Accounts Receivables | 900 | |

| Office Supplies | 1,150 | |

| Office Equipment | 2,530 | |

| Electric Equipment | 13,000 | |

| Total Assets | 76,760 | |

| Liabilities and |

||

| Liabilities | ||

| Accounts Payable | 8,550 | |

| Stockholder’s Equity | ||

| Common Stock | 65,000 | |

| Retained earnings | 3,210 | |

| Total stockholders’ equity | 68,210 | |

| Total Liabilities and Stockholder’s equity | 76,760 | |

Table (6)

Hence, the total of the balance sheet of the S Company as on December 31, 20XX is of $76,760.

4.

To identify:

The changes in (a) total assets, (b) total liabilities, and (c) total equity.

4.

Explanation of Solution

If the owner of the company invests $49,000 cash instead of $65,000 for common stock and borrows $16,000 from the bank, then the effect on assets, liabilities and equity is,

• On assets- There is no change in assets, as in both the cases cash balance increases.

• On liabilities- There is an increase of $16,000 in accounts payable account and liability of S electric will increase.

• On equity- The common stock is decreased by $16,000 and common stock is the part of equity so equity decreases by $16,000.

Hence, the liability will increase by $16,000 and common stock will decrease by $16,000.

Want to see more full solutions like this?

Chapter 1 Solutions

Connect 2 Semester Access Card for Financial and Managerial Accounting

- Question: 23 Torrence Corporation has the following data: Accounts Receivable: . December 31, 2010: $105,000.00 January 31, 2011: $135,000.00 Sales During: . December 2010: x January 2011: y Sales Collections: . During the month of sales: 45% Next month of sales: 55% . No bad debts (all sales are collected). Find the sales made during December.arrow_forwardI need guidance on solving this financial accounting problem with appropriate financial standards.arrow_forwardA company currently has a 45-day cash cycle. Assume that the company makes operational changes that reduce its receivables period by 5 days, increase its inventory period by 3 days, and reduce its payables period by 2 days. What will the new length of the cash cycle be after these changes? How did you calculate it?arrow_forward

- Please provide the answer to this general accounting question with proper steps.arrow_forwardI need the correct answer to this financial accounting problem using the standard accounting approach.arrow_forwardI need help with this financial accounting problem using accurate calculation methods.arrow_forward

- Use the information below to answer the following question Rita Franklin is employed at Mighty Ltd. in Jamaica. For the month of June, 2017, she received a gross salary of $60,000. She contributes 5% or her gross salary towards an approved pension scheme. As an employee, her statutory deductions include NIS, NHT and education tax. What is Rita’s statutory income? A.$53,875 B.$55,500 C.$57,000 D.$63,000arrow_forwardUse the information provided to answer following question Larry Ltd. is a registered VAT taxpayer. His business transactions for the months of January to March are included below. The VAT rate is 12.5%. All the amounts given are VAT inclusive. Months Sales Purchases Imports January $50,625 $30,375 $17,662.50 February $63,337.50 $38,475 $25,087.50 March $67,500 $52,312.50 $22,612.50 What is the Larry Ltd. VAT payable/refund for the 3 months period? A.$13,125 payable B.$1,562.50 refund C.$562.50 refund D.$20,143.50 payablearrow_forwardGeneral accounting questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education