Concept explainers

1.

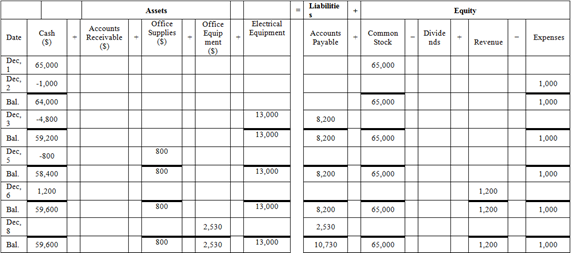

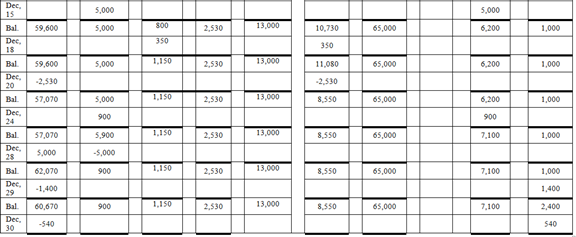

To identify: The effect of transactions on the

1.

Explanation of Solution

Table (1)

Hence, the cash balance is $59,180,

2.

To prepare: The income statement, statement of

2.

Explanation of Solution

Prepare income statement.

| S. Electric | ||

| Income Statement | ||

| For the month ended December 31,20XX | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue: | ||

| Service Revenue | 7,100 | |

| Total Revenue | 7,100 | |

| Expenses: | ||

| Rent Expenses | 1000 | |

| Salary Expenses | 1,400 | |

| Utilities Expenses | 540 | |

| Total Expense | 2,940 | |

| Net income | 4,160 | |

Table(2)

Hence, net income of .S Electric as on December 31, 20XX is $4,160.

Prepare statement of retained earnings.

| S. Electric | |

| Retained Earnings Statement | |

| For the month ended December 31,20XX | |

| Particulars | Amount ($) |

| Opening balance | 0 |

| Net income | 4,160 |

| Total | 4,160 |

| Dividends | (950) |

| Retained earnings | 3,210 |

Table(3)

Hence, the retained earnings of S Electric as on December 31, 20XX are $3,210.

Prepare balance sheet.

| S. Electric | ||

| Balance sheet | ||

| As on December 31, 20XX | ||

| Particulars |

| Amount ($) |

| Assets | ||

| Cash | 59,180 | |

| Accounts Receivables | 900 | |

| Office Supplies | 1,150 | |

| Office Equipment | 2,530 | |

| Electric Equipment | 13,000 | |

| Total Assets |

| 76,760 |

| Liabilities and | ||

| Liabilities | ||

| Accounts Payable | 8,550 | |

| Stockholder’s Equity | ||

| Common Stock | 65,000 | |

| Retained earnings | 3,210 | |

| Total stockholders’ equity |

| 68,210 |

| Total Liabilities and Stockholder’s equity |

| 76,760 |

Table(4)

Hence, the total of the balance sheet of the S Electric as on December 31, 20XX is of $76,760.

3.

To prepare: The statement of

3.

Explanation of Solution

Prepare the cash flow statement.

| S. Electric | ||

| Statement of Cash Flows | ||

| Month Ended December 31, 20XX | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flow from operating activities | ||

| Receipts: | ||

| Collections from customers |

| 6,200 |

| Payments: |

| |

| Supplies | (800) | |

| Rent Expenses | (1,000) | |

| Salary Expenses | (1,400) | |

| Utilities | (540) | (3,740) |

| Net cash from operating activities |

| 2,460 |

| Cash flow from investing activities |

| |

| Purchase of office equipment | (2,530) | |

| Purchase of electric equipment | (4,800) | |

| Net cash from investing activities |

| (7,330) |

| Cash flow from financing activities |

| |

| Issued common stock | 65,000 | |

| Less: Payment of cash dividends | (950) | |

| Net cash from financing activities |

| 64,050 |

| Net increase in cash |

| 59,180 |

| Cash balance, December 1,20XX |

| 0 |

| Cash balance, December 31,20XX |

| 59,180 |

Table(5)

Hence, the cash balance of the S Electric as on December 31, 20XX is $59,180.

4.

To identify: The changes in (a) total assets, (b) total liabilities, and (c) total equity.

4.

Explanation of Solution

If the owner of the company invests $49,000 cash instead of $65,000 for common stock and borrows $16,000 from the bank, then the effect on assets, liabilities and equity is,

- On assets- There is no change in assets, as in both the cases cash balance increases.

- On liabilities- There is an increase of $16,000 in accounts payable account and liability of S electric will increase.

- On equity- The common stock is decreased by $16,000 and common stock are the part of equity so equity decreases by $16,000.

Want to see more full solutions like this?

Chapter 1 Solutions

FINANCIAL & MANAGERIAL ACCOUNTING

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education