1.

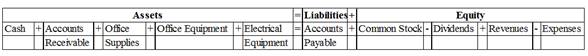

Arrange the asset, liability and equity titles in a table.

1.

Explanation of Solution

The arrangement of asset, liability and equity titles in a table is as follows:

Figure (1)

2.

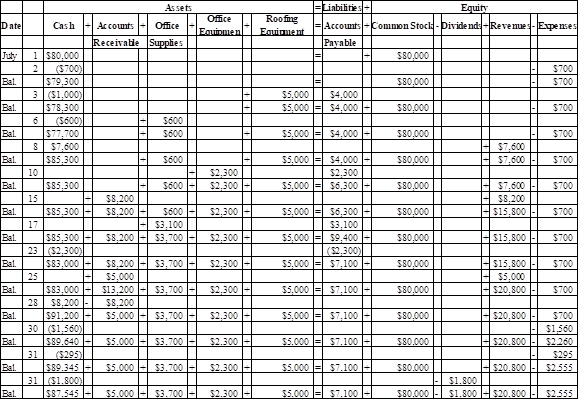

Create the table showing the effects of each transaction using

2.

Explanation of Solution

The effects of each transaction on the accounts of accounting equation are given bellow:

Figure (2)

3.

Prepare the income statement, statement of

3.

Explanation of Solution

Income statement: Income statement is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

Statement of retained earnings: Statement of retained earnings is an equity statement which shows the changes in the

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities. Operating activities include cash inflows and outflows from business operations. Investing activities includes cash inflows and

Prepare income statement:

| Company R | ||

| Income Statement | ||

| For Month Ended December 31 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues | ||

| Roofing fees earned | 20,800 | |

| Expenses | ||

| Rent expense | 700 | |

| Salaries expense | 1,560 | |

| Utilities expense | 295 | |

| Total expenses | 2,555 | |

| Net income | 18,245 | |

Table (1)

Prepare statement of retained earnings:

| Company R | |

| Statement of Retained Earnings | |

| For Month Ended December 31 | |

| Particulars | Amount ($) |

| Retained earnings, December 1 | 0 |

| Add: | |

| Net income | 18,245 |

| Less: | |

| Dividends | 1,800 |

| Retained earnings, December 31 | 16,445 |

Table (2)

Prepare balance sheet:

| Company R | |||

| Balance Sheet | |||

| For the year ended December 31,2017 | |||

| Assets | Amount ($) | Liabilities | Amount ($) |

| Cash | 87,545 | Accounts payable | 7,100 |

| 5,000 | Equity | ||

| Office supplies | 3,700 | Common stock | 80,000 |

| Office equipment | 2,300 | Retained earnings | 16,445 |

| Roofing equipment | 5,000 | Total equity | 96,445 |

| Total assets | 103,545 | Total liabilities and equity | 103,545 |

Table (3)

Prepare statement of cash flows:

| Company R | ||

| Statement of Cash Flows | ||

| For Month Ended July 31 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flows from operating activities | ||

| Cash received from customers (1) | 15,800 | |

| Cash paid for rent | (700) | |

| Cash paid for supplies | (600) | |

| Cash paid for utilities | (295) | |

| Cash paid to employees | (1,560) | |

| Net cash provided by operating activities | 12,645 | |

| Cash flows from investing activities | ||

| Cash paid for roofing equipment | (1,000) | |

| Cash paid for office equipment | (2,300) | |

| Net cash used by investing activities | (3,300) | |

| Cash flows from financing activities | ||

| Cash investment from shareholder | 80,000 | |

| Cash dividend to shareholder | (1,800) | |

| Net cash provided by financing activities | 78,200 | |

| Net increase in cash | 87,545 | |

| Cash balance, July 1 | 0 | |

| 87,545 | ||

Table (4)

Working note:

Calculate the cash received from customers:

4.

Explain the effect of change on total assets, total liabilities and total equity.

4.

Explanation of Solution

If the purchase of roofing equipment on July 3 for $5,000 is acquired through an additional investment of cash by owner, then following is the effect of this change:

(a) Total assets will be greater by $1,000.

(b) Total liabilities will be lesser by $4,000.

(c) Total equity will be $5,000 greater.

Want to see more full solutions like this?

Chapter 1 Solutions

Financial Accounting Fundamentals:

- Oakridge Manufacturing applies overhead to jobs using a predetermined rate of 125% of direct labor cost. At year-end, the company had actual overhead costs of $487,500, while applied overhead totaled $512,500. The company's unadjusted cost of goods sold was $1,250,000. If the company closes any over- or underapplied overhead to cost of goods sold, what is the adjusted cost of goods sold? Answer thisarrow_forwardUpon completing an aging analysis of accounts receivable, the accountant for Riverside Manufacturing prepared an aging of accounts receivable and estimated that $9,300 of the $142,500 accounts receivable balance would be uncollectible. The allowance for doubtful accounts had a $850 credit balance at year-end prior to adjustment. How much is the bad debt expense? a. $8,450 b. $6,580 c. $7,820 d. $7,200arrow_forwardDuring the current year, August Corporation began operations with $150,000 cash contributed by shareholders. The company purchased equipment for $80,000 cash and inventory for $45,000 on account. By year-end, they had collected $120,000 in service revenue, paid $32,000 for operating expenses, and made payments of $38,000 to suppliers. If the ending inventory balance was $12,000, what is the total stockholders' equity at year-end? Helparrow_forward

- Can you help me solve this general accounting problem with the correct methodology?arrow_forwardHarmony Outdoors plans to sell 6,300 camping tents at $95 each in the coming year. The unit variable cost is $56.05 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Fixed factory overhead is $28,500, and fixed selling and administrative expenses are $41,200. Calculate the variable cost ratio. Calculate the contribution margin ratio.arrow_forwardI need assistance with this financial accounting question using appropriate principles.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education