Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 5Q

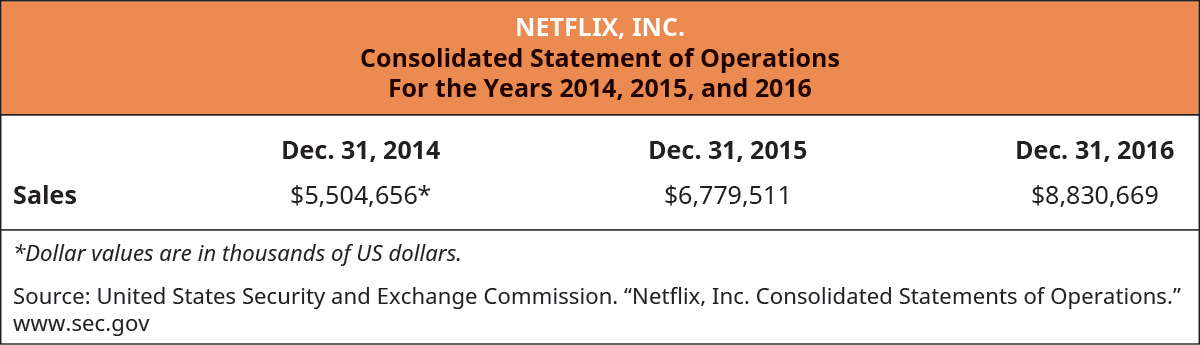

The following information was taken from the Netflix financial statements.

For Netflix, sales is the product of the number of subscribers and the price charged for each subscription. What observations can you make about the previous three years of Netflix’s sales? Given this data, provide any predictions you can make about the future financial performance of Netflix. What nonfinancial factors influenced that prediction?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Please provide the answer to this general accounting question using the right approach.

Please provide the answer to this general accounting question with proper steps.

I need help with this general accounting problem using proper accounting guidelines.

Chapter 1 Solutions

Principles of Accounting Volume 1

Ch. 1 - Accounting is sometimes called the language of...Ch. 1 - Financial accounting information ________. A....Ch. 1 - External users of financial accounting information...Ch. 1 - Which of the following groups would have access to...Ch. 1 - All of the following are examples of managerial...Ch. 1 - Which of the following is not true? A....Ch. 1 - The primary purpose of what type of business is to...Ch. 1 - Which of the following is not an example of a...Ch. 1 - A governmental agency can best be described by...Ch. 1 - Which of the following is likely not a type of...

Ch. 1 - Which of the following is not considered a...Ch. 1 - Stockholders can best be defined as which of the...Ch. 1 - Which of the following sell stock on an organized...Ch. 1 - All of the following are sustainable methods...Ch. 1 - The accounting information of a privately held...Ch. 1 - Which of the following skills/attributes is not a...Ch. 1 - Which of the following is typically required for...Ch. 1 - Typical accounting tasks include all of the...Ch. 1 - What type of organization primarily offers tax...Ch. 1 - Most states require 150 semester hours of college...Ch. 1 - Research your top five career choices. Identify...Ch. 1 - Using the same top five career choices, identify...Ch. 1 - Think about a recent purchase you made. Describe...Ch. 1 - Computerized accounting systems help businesses...Ch. 1 - The following information was taken from the...Ch. 1 - The following chart shows the price of Netflix...Ch. 1 - Use the internet to research one for-profit, one...Ch. 1 - Use the internet to research one manufacturing,...Ch. 1 - Assume you are considering opening a retail...Ch. 1 - Uber and Lyft are two popular ride-sharing...Ch. 1 - How would you categorize or classify a company...Ch. 1 - Charity Navigator...Ch. 1 - Use the internet to visit the Securities and...Ch. 1 - Imagine that you have just been elected president...Ch. 1 - According to a company press release, on January...Ch. 1 - The Dow Jones Industrial Average (DJIA) is often...Ch. 1 - Many professional certifications now have...Ch. 1 - The Certified Public Accountant (CPA) exam is a...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Small Business Analysis Purpose: To help you understand the importance of cash flows in the operation of a smal...

Financial Accounting, Student Value Edition (5th Edition)

How is inventory tracked under a perpetual inventory system?

Intermediate Accounting (2nd Edition)

(Record inventory transactions in the periodic system) Wexton Technologies began the year with inventory of 560...

Financial Accounting (12th Edition) (What's New in Accounting)

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (5th Edition)

Define cost pool, cost tracing, cost allocation, and cost-allocation base.

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Similar questions

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

- Please provide the solution to this general accounting question with accurate financial calculations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning