Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 4PEB

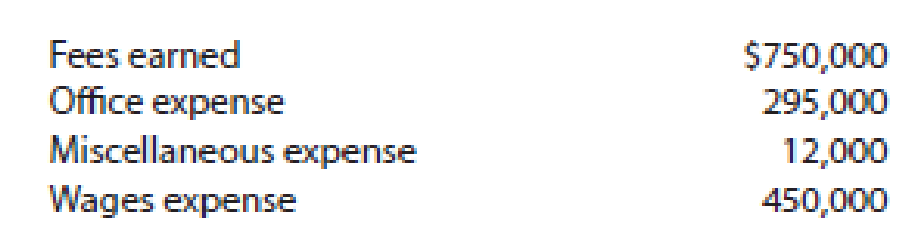

The revenues and expenses of Sentinel Travel Service for the year ended August 31, 2016, follow:

Prepare an income statement for the year ended August 31, 2016.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Please explain the solution to this general accounting problem with accurate explanations.

I am searching for the accurate solution to this financial accounting problem with the right approach.

Please explain the correct approach for solving this general accounting question.

Chapter 1 Solutions

Financial Accounting

Ch. 1 - Prob. 1DQCh. 1 - Prob. 2DQCh. 1 - Prob. 3DQCh. 1 - Josh Reilly is the owner of Dispatch Delivery...Ch. 1 - On July 12, Reliable Repair Service extended an...Ch. 1 - Prob. 6DQCh. 1 - Describe the difference between an account...Ch. 1 - A business had revenues of 679,000 and operating...Ch. 1 - A business had revenues of 640,000 and operating...Ch. 1 - The financial statements are interrelated. (a)...

Ch. 1 - On February 22, Kountry Repair Service extended an...Ch. 1 - On March 31, Higgins Repair Service extended an...Ch. 1 - Brock Hahn is the owner and operator of Dream-It...Ch. 1 - Fritz Evans is the owner and operator of...Ch. 1 - Arrowhead Delivery Service is owned and operated...Ch. 1 - Interstate Delivery Service is owned and operated...Ch. 1 - Prob. 4PEACh. 1 - The revenues and expenses of Sentinel Travel...Ch. 1 - Using the income statement for Ousel Travel...Ch. 1 - Using the income statement for Sentinel Travel...Ch. 1 - Using the following data for Ousel Travel Service...Ch. 1 - Using the following data for Sentinel Travel...Ch. 1 - A summary of cash flows for Ousel Travel Service...Ch. 1 - A summary of cash flows for Sentinel Travel...Ch. 1 - Prob. 8PEACh. 1 - Prob. 8PEBCh. 1 - The following is a list of well-known companies:...Ch. 1 - Prob. 2ECh. 1 - Ozark Sports sells hunting and fishing equipment...Ch. 1 - Prob. 4ECh. 1 - Prob. 5ECh. 1 - Prob. 6ECh. 1 - Annie Rasmussen is the owner and operator of Go44,...Ch. 1 - Indicate whether each of the following is...Ch. 1 - Describe how the following business transactions...Ch. 1 - Prob. 10ECh. 1 - Indicate whether each of the following types of...Ch. 1 - The following selected transactions were completed...Ch. 1 - Teri West operates her own catering service....Ch. 1 - The income statement of a proprietorship for the...Ch. 1 - Four different proprietorships, Jupiter, Mars,...Ch. 1 - From the following list of selected items taken...Ch. 1 - Based on the data presented in Exercise 1-16,...Ch. 1 - Financial information related to Udder Products...Ch. 1 - Dairy Services was organized on August 1, 2016. A...Ch. 1 - One item is omitted in each of the following...Ch. 1 - Prob. 21ECh. 1 - Prob. 22ECh. 1 - Indicate whether each of the following activities...Ch. 1 - A summary of cash flows for Ethos Consulting Group...Ch. 1 - Prob. 25ECh. 1 - Prob. 26ECh. 1 - Lowes Companies Inc., a major competitor of The...Ch. 1 - On April 1 of the current year, Andrea Byrd...Ch. 1 - The amounts of the assets and liabilities of...Ch. 1 - Seth Feye established Reliance Financial Services...Ch. 1 - On July 1, 2016, Pat Glenn established Half Moon...Ch. 1 - DLite Dry Cleaners is owned and operated by Joel...Ch. 1 - The financial statements at the end of Wolverine...Ch. 1 - Amy Austin established an insurance agency on...Ch. 1 - The amounts of the assets and liabilities of...Ch. 1 - Jose Loder established Bronco Consulting on August...Ch. 1 - On April 1, 2016, Maria Adams established Custom...Ch. 1 - Bevs Dry Cleaners is owned and operated by Beverly...Ch. 1 - The financial statements at the end of Atlas...Ch. 1 - Prob. 1COPCh. 1 - Colleen Fernandez, president of Rhino Enterprises,...Ch. 1 - Prob. 2CPCh. 1 - Prob. 3CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Zebrix Ltd. has an inventory period of 55 days, an accounts receivable period of 10 days, and an accounts payable period of 6 days. The company's annual sales are $208,400. How many times per year does the company turn over its accounts receivable?arrow_forwardLika company issues 2,000 shares of $10 par value common stock for $25 per share. What amount should be credited to the Common Stock account and to the Additional Paid-in Capital account?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forward

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardPlease provide the answer to this financial accounting question using the right approach.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

- Can you solve this financial accounting problem using accurate calculation methods?arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardI am looking for a reliable way to solve this financial accounting problem using accurate principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning - Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License