Concept explainers

OBJECTIVE 6 Exercise 1-46 Income Statement

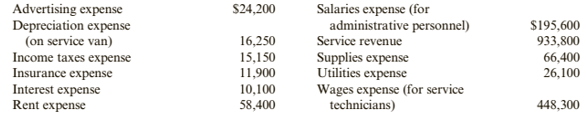

ERS Inc. maintains and repairs office equipment. ERS had an average of 10,000 shares of common stock outstanding for the year. The following income statement account balances are available for ERS at the end of 2019.

Required:

1. Prepare a single-step income statement for ERS for 2019.

2. CONCEPTUAL CONNECTION Compute net profit margin for ERS. If ERS is able to increase its service revenue by $100,000, what should be the effect on future income?

3. CONCEPTUAL CONNECTION Assume that ERS net profit margin was 8.5% for 2018. As an investor, what conclusions might you draw about ERS’ future profitability?

Concept Introduction:

Income Statement:

Income Statement is the part of the financial statement which is prepared to calculate the net income earned by the organization. In the income statement, all expenses are subtracted from the revenues to calculate the net income. It is prepared for a particular period.

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items.

Requirement-1:

To Prepare:

The Single step income statement.

Answer to Problem 46E

The Single step income statement is as follows:

| ERS Inc. | ||

| Single Step Income Statement | ||

| For the month of January 2019 | ||

| Revenue: | ||

| Service revenue | $ 933,800 | |

| Total Revenue | $ 933,800 | |

| Expenses: | ||

| Cost of Goods Sold | ||

| Utilities Expense | $ 26,100 | |

| Wages Expense | $ 448,300 | |

| Salaries Expense | $ 195,600 | |

| Rent Expense | $ 58,400 | |

| Depreciation expense | $ 16,250 | |

| Advertising expense | $ 24,200 | |

| Income tax Expense | $ 15,150 | |

| Insurance Expense | $ 10,100 | |

| Supplies Expense | $ 66,400 | |

| Interest Expense | $ 10,100 | |

| Total Expense | $ 870,600 | |

| Net Income | $ 63,200 | |

Explanation of Solution

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items.

The Single step income statement is prepared as follows:

| ERS Inc. | ||

| Single Step Income Statement | ||

| For the month of January 2019 | ||

| Revenue: | ||

| Service revenue | $ 933,800 | |

| Total Revenue | $ 933,800 | |

| Expenses: | ||

| Cost of Goods Sold | ||

| Utilities Expense | $ 26,100 | |

| Wages Expense | $ 448,300 | |

| Salaries Expense | $ 195,600 | |

| Rent Expense | $ 58,400 | |

| Depreciation expense | $ 16,250 | |

| Advertising expense | $ 24,200 | |

| Income tax Expense | $ 15,150 | |

| Insurance Expense | $ 10,100 | |

| Supplies Expense | $ 66,400 | |

| Interest Expense | $ 10,100 | |

| Total Expense | $ 870,600 | |

| Net Income | $ 63,200 | |

Concept Introduction:

Income Statement:

Income Statement is the part of the financial statement which is prepared to calculate the net income earned by the organization. In the income statement, all expenses are subtracted from the revenues to calculate the net income. It is prepared for a particular period.

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items.

Requirement-2:

To Prepare:

The Net profit margin and effect on net income if sales revenue increases by $100,000.

Answer to Problem 46E

The Net profit margin is 6.77%. The Net income shall increase by $6,770 if sales revenue increases by $100,000.

Explanation of Solution

The Net profit margin is calculated as follows;

Net profit margin= Net profit / Sales = 63200/933800 =0.0677 = 6.77%

The Net income shall increase by 100000*6.77% = $6,770 if sales revenue increases by $100,000.

Concept Introduction:

Income Statement:

Income Statement is the part of the financial statement which is prepared to calculate the net income earned by the organization. In the income statement, all expenses are subtracted from the revenues to calculate the net income. It is prepared for a particular period.

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items.

Requirement-3:

To Discuss:

The future profitability of the company.

Answer to Problem 46E

The profit of the company is declining and it may decline in future also.

Explanation of Solution

The Net profit margin is 6.77% in the year 2019 and it was 8.5% for 2018 it means the profit of the company is declining and it may decline in future also.

Want to see more full solutions like this?

Chapter 1 Solutions

Cornerstones of Financial Accounting - With CengageNow

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardCan you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning