Managerial Accounting

7th Edition

ISBN: 9781260247886

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 3AA

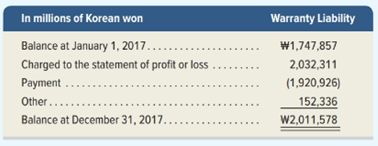

Samsung’s 2017 annual report discloses the warranty information below. Like Apple, Samsung offers warranties on its products.

Required

1. What amount of warranty expense did Samsung record in 2017? What amount of warranty claims did Samsung pay in 2017?

2. Access Apple’s report in Appendix A and locate “Accrued Warranty and Indemnification” on page A-9 of its notes. What amount of warranty expense did Apple record during 2017? What amount of warranty claims did Apple pay in 2017?

3. Using answers from parts 1 and 2, which company was more accurate in estimating warranty claims for 2017?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I am looking for the correct answer to this general accounting problem using valid accounting standards.

I am looking for help with this general accounting question using proper accounting standards.

Please provide the answer to this general accounting question with proper steps.

Chapter 1 Solutions

Managerial Accounting

Ch. 1 - Prob. 1MCQCh. 1 - What is Ella Company’s current ratio? a.0.69...Ch. 1 - What is Ella Company’s acid-test ratio? a.2.39...Ch. 1 - What is Ella Company’s debt ratio? a. 25.78% b....Ch. 1 - What is Ella Company’s equity ratio? a.25.78%...Ch. 1 - Describe the managerial accountant’s role in...Ch. 1 - Distinguish between managerial and financial...Ch. 1 - Prob. 3DQCh. 1 - Prob. 4DQCh. 1 - Distinguish between (a) factory overhead and (b)...

Ch. 1 - Prob. 6DQCh. 1 - What product cost is both a prime cost and a...Ch. 1 - APPLE Assume that we tour Apple’s factory where it...Ch. 1 - Prob. 9DQCh. 1 - Prob. 10DQCh. 1 - Prob. 11DQCh. 1 - Prob. 12DQCh. 1 - Prob. 13DQCh. 1 - Prob. 14DQCh. 1 - Prob. 15DQCh. 1 - Prob. 16DQCh. 1 - Prob. 17DQCh. 1 - What are the three categories of manufacturing...Ch. 1 - List several examples of factory overhead.Ch. 1 - Prob. 20DQCh. 1 - GOOGLE Prepare a proper title for the annual...Ch. 1 - Prob. 22DQCh. 1 - Prob. 23DQCh. 1 - Prob. 24DQCh. 1 - Prob. 25DQCh. 1 - Prob. 1QSCh. 1 - Prob. 2QSCh. 1 - Fixed and variable costs C2 Listed below are...Ch. 1 - QS 14-4 Direct and indirect costs C2

Diez Company...Ch. 1 - Classifying product costs C2 Identify each of the...Ch. 1 - QS 14-6 Product and period costs C3

Identify each...Ch. 1 - Prob. 7QSCh. 1 - Prob. 8QSCh. 1 - Prob. 9QSCh. 1 - Prob. 10QSCh. 1 - Prob. 11QSCh. 1 - Prob. 12QSCh. 1 - Prob. 13QSCh. 1 - Prob. 14QSCh. 1 - Prob. 15QSCh. 1 - Prob. 16QSCh. 1 - Raw materials inventory management A1 Nestlé...Ch. 1 - Exercise 14-1 Sources of accounting information C1...Ch. 1 - Prob. 2ECh. 1 - Exercise 14-3 Cost classifications for a service...Ch. 1 - Exercise 14-4 Cost classifications for a service...Ch. 1 - Prob. 5ECh. 1 - Prob. 6ECh. 1 - Prob. 7ECh. 1 - Prob. 8ECh. 1 - Exercise 14-9 Preparing financial statements for a...Ch. 1 - Prob. 10ECh. 1 - Prob. 11ECh. 1 - Prob. 12ECh. 1 - Prob. 13ECh. 1 - Prob. 14ECh. 1 - Prob. 15ECh. 1 - Prob. 16ECh. 1 - Exercise 14-17 Lean business practice C6 Many...Ch. 1 - Prob. 18ECh. 1 - Prob. 19ECh. 1 - Prob. 1PSACh. 1 - Prob. 2PSACh. 1 - Prob. 3PSACh. 1 - Prob. 4PSACh. 1 - Prob. 5PSACh. 1 - Prob. 1PSBCh. 1 - Prob. 2PSBCh. 1 - Problem 14-3B Schedule of cost of goods...Ch. 1 - Problem 14-4B Ending inventory computation and...Ch. 1 - Prob. 5PSBCh. 1 - Prob. 1SPCh. 1 - Prob. 1AACh. 1 - Both Apple and Google (Alphabet) invest in...Ch. 1 - Samsung’s 2017 annual report discloses the...Ch. 1 - Prob. 1BTNCh. 1 - Prob. 2BTNCh. 1 - Prob. 3BTNCh. 1 - Prob. 4BTNCh. 1 - Prob. 5BTNCh. 1 - Prob. 6BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this general accounting problem using accurate calculation methods?arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

- Please provide the solution to this general accounting question with accurate financial calculations.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardCan you solve this financial accounting problem using accurate calculation methods?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Revenue recognition explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=816Q6pOaGv4;License: Standard Youtube License