a.

Prepare horizontal analysis to show the affect of each event in the

a.

Explanation of Solution

Accounting event:

An accounting event is a cost-effective event that affects assets, liabilities, or

Income statement:

Income statement is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance is the financial statement that reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Statement of cash flows:

Statement of cash flows is one among the financial statement of a Company statement that

Shows aggregate data of all

Operating activities:

Operating activities refer to the normal activities of a company to carry out the business. The examples for operating activities are purchase of inventory, payment of salary, sales, and others.

Investing activities:

Investing activities refer to the activities carried out by a company for acquisition of long term assets. The examples for investing activities are purchase of equipment, long term investment, sale of land, and others.

Financing activities:

Financing activities refer to the activities carried out by a company to mobilize funds to carry out the business activities. The examples for financing activities are purchase of bonds, issuance of common shares, and others.

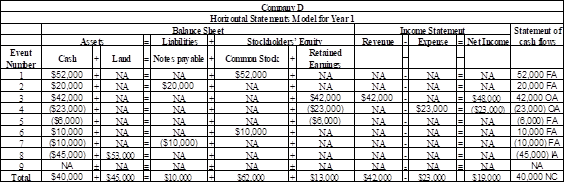

Prepare horizontal analysis:

Figure (1)

Note: FA represents financing activity, OA represents operating activity, IA represents investing activity and NA represents no affect.

b.

Report the amount of total assets that is reported on the December 31, Year 1, balance sheet.

b.

Explanation of Solution

Balance sheet:

Balance is the financial statement that reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Calculate the total amount of assets:

Therefore, the total amount of cash reported on the balance sheet is $85,000.

c.

Identify the asset source transactions and related amounts for Year 1.

c.

Explanation of Solution

Assets source transaction:

Transaction that acquires the assets from primary sources of the business is called as assets source transaction. Assets source transactions increase the value of assets account, and increase the corresponding liabilities or stockholder’s equity account. The increased assets account is recorded with the debit entry, and increased liabilities or stockholder’s equity account is recorded with credit entry

The asset source transaction are identifed as follows along with the related amounts:

| Sources of Assets | Amount ($) |

| 1. Issue of stock | 52,000 |

| 2. Cash from loan | 20,000 |

| 3. Cash from revenue | 42,000 |

| 6. Issue of stock | 10,000 |

| Total Sources of Assets | 124,000 |

Table (1)

d.

Calculate the net income that is reported on the income statement for the year 1 and Explain the reason for the non appearance of dividends in the income statement.

d.

Explanation of Solution

The amount of net income reported is $19,000 (refer figure (1)). But dividend does not appear in the income statement because it is not considered as an expense.

e.

Calculate the net cash flows from operating activities, financing activities, and investing activities.

e.

Explanation of Solution

Operating activities:

Operating activities refer to the normal activities of a company to carry out the business. The examples for operating activities are purchase of inventory, payment of salary, sales, and others.

Investing activities:

Investing activities refer to the activities carried out by a company for acquisition of long term assets. The examples for investing activities are purchase of equipment, long term investment, sale of land, and others.

Financing activities:

Financing activities refer to the activities carried out by a company to mobilize funds to carry out the business activities. The examples for financing activities are purchase of bonds, issuance of common shares, and others.

The net cash flows from operating activities, financing activities, and investing activities are calculated as follows:

| Operating Activities: | |

| Particulars | Amount ($) |

| Cash from revenue | 42,000 |

| Cash paid for expenses | (23,000) |

| Net Cash Flow from Operating Activities | 19,000 |

Table (2)

| Investing Activities: | |

| Particulars | Amount ($) |

| Cash paid to purchase land | (45,000) |

| Net Cash Flow from Investing Activities | (45,000) |

Table (3)

| Financing Activities: | |

| Particulars | Amount ($) |

| Cash from stock issue ($52,000 + $10,000) | 62,000 |

| Cash from loan | 20,000 |

| Paid cash dividend | (6,000) |

| Cash paid on loan principal | (10,000) |

| Net Cash Flow from Financing Activities | 66,000 |

Table (4)

f.

Calculate the percentage of assets that were provided by investors, creditors and earnings.

f.

Explanation of Solution

Stockholders’ equity to asset ratio:

Stockholders ‘equity to asset ratio is the ratio that measures the difference between total asset and stockholders ‘equity of the company. Stockholders’ equity ratio reflects the amount of assets that can be claimed by the stockholders in proportion to the value of shares owned by them.

Percentage of total assets acquired from investors is calculated as follows:

Note: Total

Debt to Asset Ratio:

Debt to asset ratio is the ratio that measures the difference between total asset and total liability of the company. Debt ratio reflects the finance strategy of the company. It is used to evaluate company’s ability to pay its debts. Higher debt ratio implies the higher financial risk.

Percentage of assets acquired from creditors is calculated as follows:

Note: Total

Return on assets:

Return on assets is the financial ratio which determines the amount of net income earned by the business with the use of total assets owned by it. It indicates the magnitude of the company’s earnings with relative to its total assets.

Percentage of total assets acquired from

Note: Total

Therefore the percentage of total assets acquired from investors is 72.94%, the percentage of total assets acquired from creditors is 11.77% and the percentage of total assets from retained earnings is 15.29%.

g.

Calculate the balance in the retained accounts

g.

Explanation of Solution

Retained earnings:

Retained earnings are the portion of earnings kept by the business for the purpose of reinvestments, payment of debts, or for future growth.

Balance in the retained earnings account is as follows:

The balance in the account of retained earnings is zero. The revenue earned is recorded in the revenue accounts and not recorded in the retained earnings account.

Want to see more full solutions like this?

Chapter 1 Solutions

Fundamental Financial Accounting Concepts

- Delta Tools estimated its manufacturing overhead for the year to be $875,500. At the end of the year, actual direct labor hours were 49,600 hours, and the actual manufacturing overhead was $948,000. Manufacturing overhead for the year was overapplied by $81,400. If the predetermined overhead rate is based on direct labor hours, then the estimated direct labor hours at the beginning of the year used in the predetermined overhead rate must have been _.arrow_forwardWhat is the depreciation expense for 2022arrow_forwardCan you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forward

- Julius provided consulting services amounting to P420, 000. His total expenses were 25%. His net income is: A. P105,000 B. P300,000 C. P315,000 D. P120,000arrow_forwardWhat is the cost of goods soldarrow_forwardSnapGallery Inc. sells one digital poster frame. The sales price per unit is $12. The variable cost per unit is $7. Fixed costs per annum are $13,500 and having a sales volume of 5,000 digital poster frames would result in: 1. a profit of $11,500 2. a loss of $2,500 3. breaking even 4. a profit of $8,000arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education