Concept explainers

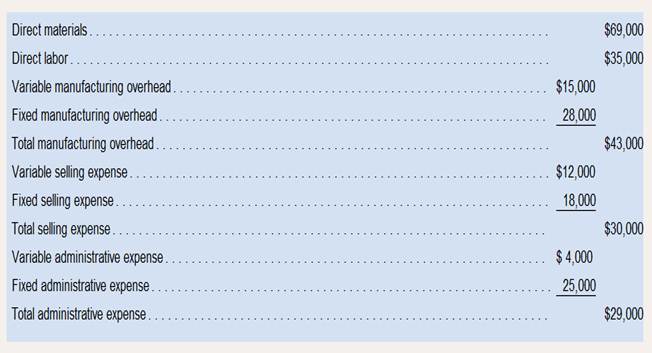

Different Cost Classifications for Different PurposesDozier Company produced and sold 1,000 units during its first month of operations. It reported the following costs and expenses for the month:

Required:

1. With respect to cost classifications for preparing financial statements:

a. What is the total product cost?

b. What is the total period cost?

2. With respect to cost classifications for assigning costs to cost objects:

a. What is total direct

b. What is the total indirect manufacturing cost?

3. With respect to cost classifications for manufacturers:

a. What is the total manufacturing cost?

b. What is the total nonmanufacturing cost?

c. What is the total conversion cost and prime cost?

4. With respect to cost classifications for predicting cost behaviour:

a. What is the total variable manufacturing cost?

b. What is the total fixed cost for the company as a whole?

c. What is the variable cost per unit produced and sold?

5. With respect to cost classifications for decision making:

a. If Dozier had produced 1,001 units instead of 1,000 units, how much incremental manufacturing cost would it have incurred to make the additional unit?

1.

(a)

To identify: The total product cost.

Product Cost: Product Cost is the total cost incurred to produce a product which includes cost of material used, labor cost and overhead.

Answer to Problem 24P

Solution:

Total product cost is $147,000.

Explanation of Solution

Given,

Direct material is $69,000.

Direct labor is $35,000.

Total manufacturing overhead is $43,000.

Formula to calculate total product cost,

Substitute $69,000 for direct material, $35,000 for direct labor and $43,000 for total manufacturing overhead.

Hence, total product cost is $147,000.

(b)

To identify: The total period cost.

Period Costs: Period Costs is the cost incurred by the business except the cost of goods sold. Period costs are the expense of the same period in which it is incurred.

Answer to Problem 24P

Solution:

Total period cost is $59,000.

Explanation of Solution

Given,

Total selling expense is $30,000.

Total administrative expense is $29,000.

Formula to calculate total period cost,

Substitute $30,000 for total selling expense and $29,000 for total administrative expense.

Hence, total period cost is $59,000.

2.

(a)

To identify: The total direct manufacturing cost.

Direct manufacturing: Direct manufacturing cost is the total cost incurred to manufacture a product which includes cost of material used, labor cost and direct expenses.

Answer to Problem 24P

Solution:

Total direct manufacturing cost is $119,000.

Explanation of Solution

Given,

Direct material is $69,000.

Direct labor is $35,000.

Variable manufacturing overhead is $15,000.

Formula to calculate total direct manufacturing cost,

Substitute $69,000 for direct material, $35,000 for direct labor and $15,000 for total variable manufacturing overhead.

Hence, total direct manufacturing cost is $119,000.

(b)

To identify: The total indirect manufacturing cost.

Indirect manufacturing: Indirect manufacturing cost is the total cost incurred to manufacture a product which includes cost of material used, labor cost and indirect expenses.

Answer to Problem 24P

Solution:

Total indirect manufacturing cost is $132,000.

Explanation of Solution

Given,

Direct material is $69,000.

Direct labor is $35,000.

Fixed manufacturing overhead is $28,000.

Formula to calculate total indirect manufacturing cost,

Substitute $69,000 for direct material, $35,000 for direct labor and $28,000 for total fixed manufacturing overhead.

Hence, total indirect manufacturing cost is $132,000.

3.

(a)

To identify: The total manufacturing cost.

Manufacturing Cost: Manufacturing cost is the total cost incurred to manufacture a product which includes cost of material used, labor cost and manufacturing overheads.

Answer to Problem 24P

Solution:

Total manufacturing cost is $147,000.

Explanation of Solution

Given,

Direct material is $69,000.

Direct labor is $35,000.

Total manufacturing overhead is $43,000.

Formula to calculate total manufacturing cost,

Substitute $69,000 for direct material, $35,000 for direct labor and $43,000 for total manufacturing overhead.

Hence, total manufacturing cost is $147,000.

(b)

To identify: The total nonmanufacturing cost.

Nonmanufacturing: Nonmanufacturing cost is the cost which is not directly linked with the manufacturing of a product but it includes selling and administration expense.

Answer to Problem 24P

Solution:

Total nonmanufacturing cost is $59,000.

Explanation of Solution

Given,

Total selling expense is $30,000.

Total administrative expense is $29,000.

Formula to calculate total nonmanufacturing cost,

Substitute $30,000 for total selling expense and $29,000 for total administrative expense.

Hence, total nonmanufacturing cost is $59,000.

(c)

To identify: The total conversion cost and prime cost.

Prime Costs: Prime cost is the primary cost incurred to produce product, it is a sum total of direct material costs and direct manufacturing labor costs.

Conversion Costs: Conversion cost is the cost of transferring the raw material into finished product, it is sum total of direct manufacturing labor costs and manufacturing overhead costs.

Answer to Problem 24P

Solution:

Total conversion cost is $78,000 and prime cost is $104,000.

Explanation of Solution

Given,

Direct material is $69,000.

Direct labor is $35,000.

Total manufacturing overhead is $43,000.

Formula to calculate total conversion cost,

Substitute $35,000 for direct labor and $43,000 for total manufacturing overhead.

Formula to calculate total prime cost,

Substitute $35,000 for direct labor and $69,000 for direct material.

Hence, conversion cost is $78,000 and prime cost is $104,000.

4.

(a)

To identify: The total variable manufacturing cost.

Variable manufacturing cost: Variable manufacturing cost is the total cost incurred to manufacture a product which includes cost of material used, labor cost and variable overheads.

Answer to Problem 24P

Solution:

Total variable manufacturing cost is $119,000.

Explanation of Solution

Given,

Direct material is $69,000.

Direct labor is $35,000.

Variable manufacturing overhead is $15,000.

Formula to calculate total variable manufacturing cost,

Substitute $69,000 for direct material, $35,000 for direct labor and $15,000 for total variable manufacturing overhead.

Hence, total variable manufacturing cost is $119,000.

(b)

To identify: The total fixed cost.

Fixed Cost: Fixed cost refers the cost which remains constant for particular time duration and there is no effect of the level of production on it.

Answer to Problem 24P

Solution:

Total fixed cost is $71,000.

Explanation of Solution

Given,

Fixed selling expense is $18,000.

Fixed administrative expense is $25,000.

Fixed manufacturing overhead is $28,000.

Formula to calculate total fixed cost,

Substitute $18,000 for fixed selling expense, $25,000 for fixed administrative expense and $28,000 for total fixed manufacturing overhead.

Hence, total fixed cost is $71,000.

(c)

To identify: The variable cost per unit.

Variable Cost: Variable cost refers the cost which varies due to the change in the level of production. Higher the production level, higher is the variable cost, and lowers the production level, lower is the variable cost.

Answer to Problem 24P

Solution:

Variable cost per unit produced and sold is $135.

Explanation of Solution

Given,

Direct material is $69,000.

Direct labor is $35,000.

Variable manufacturing overhead is $15,000.

Variable selling expense is $12,000.

Variable administrative expense is $4,000.

Units produced and sold are $1,000.

Formula to calculate variable cost per unit,

Substitute $69,000 for direct material, $35,000 for direct labor, $15,000 for total variable manufacturing overhead, $12,000 for variable selling expense, $4,000 for variable administrative expense and 1,000 for units produced and sold.

Hence, variable cost per unit produced and sold is $135.

5.

To identify: The incremental manufacturing cost.

Incremental Manufacturing cost: Incremental manufacturing cost is the increase in the total cost incurred to manufacture a product which includes the cost of material used, labor cost and manufacturing overheads.

Answer to Problem 24P

Solution: Total incremental manufacturing cost is $119.

Explanation of Solution

Given,

Direct material is $69,000.

Fixed manufacturing overhead is $28,000.

Direct labor is $35,000.

Variable manufacturing overhead is $15.

Formula to calculate per unit variable manufacturing cost,

Substitute $69,000 for direct material, $35,000 for direct labor, $15,000 for total variable manufacturing overhead and 1,000 for units produced and sold.

Only variable manufacturing cost will increase as fixed cost remains constant irrespective of units sold, therefore incremental manufacturing cost is equal to the variable cost per unit.

Hence, total incremental manufacturing cost is $119.

Want to see more full solutions like this?

Chapter 1 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

- I am trying to find the accurate solution to this financial accounting problem with the correct explanation.arrow_forward19. What does a classified balance sheet show?A. Net cash from operationsB. Revenue by categoryC. Assets and liabilities in current and long-term sectionsD. Owners' drawingsarrow_forwardPlease explain the correct approach for solving this financial accounting question.arrow_forward

- Book value of an asset equals:A. Market valueB. Cost minus accumulated depreciationC. Net incomeD. Sale pricearrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forwardBook value of an asset equals:A. Market valueB. Cost minus accumulated depreciationC. Net incomeD. Sale pricearrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning