Bundle: Managerial Accounting, 15th + Cengagenowv2, 1 Term Printed Access Card

15th Edition

ISBN: 9781337955386

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 1PA

The following is a list of costs that were incurred in the production and sale of large commercial airplanes:

- a. Annual bonus paid to the chief operating officer of the company

- b. Annual fee to a celebrity to promote the aircraft

- c. Cost of electronic guidance system installed in the airplane cockpit

- d. Cost of electrical wiring throughout the airplane

- e. Cost of miniature replicas of the airplane used to promote and market the airplane

- f. Cost of normal scrap from production of airplane body

- g. Cost of paving the headquarters employee parking lot

- h. Decals for cockpit door, the cost of which is immaterial to the cost of the final product

- i. Depreciation on factory equipment

- j. Hourly wages of employees that assemble the airplane

- k. Hydraulic pumps used in the airplane’s flight

control system - l. Instrument panel installed in the airplane cockpit

- m. Interior trim material used throughout the airplane cabin

- n. Masks for use by painters in painting the airplane body

- o. Metal used for producing the airplane body

- p. Oil to lubricate factory equipment

- q. Power used by painting equipment

- r. Prebuilt leather seats installed in the first-class cabin

- s. Production Quality Control Department costs for the year

- t. Salaries of Marketing Department personnel

- u. Salaries of test pilots

- v. Salary of chief financial officer

- w. Salary of plant manager

- x. Special advertising campaign in Aviation World magazine

- y. Turbo-charged airplane engine

- z. Yearly cost of the maintenance contract for robotic equipment

Instructions

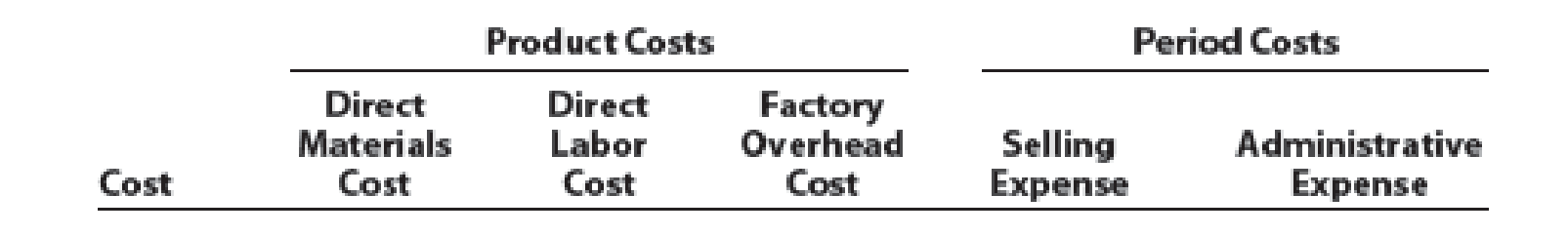

Classify each cost as either a product cost or a period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

(1) prepare the december 31 entry for bramble corporation to record amortization of intangibles. the trademark has an estimated useful life of 4 years with a residual value of $3,520

[it is not $3,460]

Please provide the solution to this general accounting question with accurate financial calculations.

I need help with this general accounting question using standard accounting techniques.

Chapter 1 Solutions

Bundle: Managerial Accounting, 15th + Cengagenowv2, 1 Term Printed Access Card

Ch. 1 - Prob. 1DQCh. 1 - Prob. 2DQCh. 1 - What manufacturing cost term is used to describe...Ch. 1 - Distinguish between prime costs and conversion...Ch. 1 - What is the difference between a product cost and...Ch. 1 - Name the three inventory accounts for a...Ch. 1 - In what order should the three inventories of a...Ch. 1 - What are the three categories of manufacturing...Ch. 1 - How do the manufacturing costs incurred during a...Ch. 1 - How does the Cost of goods sold section of the...

Ch. 1 - Management process Three phases of the management...Ch. 1 - Prob. 2BECh. 1 - Prime and conversion costs Identify the following...Ch. 1 - Product and period costs Identify the following...Ch. 1 - Cost of goods sold, cost of goods manufactured...Ch. 1 - Jakes Cabins is a small motel chain with locations...Ch. 1 - Indicate whether each of the following costs of an...Ch. 1 - Indicate whether the following costs of Procter ...Ch. 1 - Prob. 3ECh. 1 - For apparel manufacturer Abercrombie Fitch, Inc....Ch. 1 - From the choices presented in parentheses, choose...Ch. 1 - Prob. 6ECh. 1 - Classifying costs In a service company A partial...Ch. 1 - Classifying costs The following is a manufacturing...Ch. 1 - Financial statements of a manufacturing firm The...Ch. 1 - Manufacturing company balance sheet Partial...Ch. 1 - Cost of direct materials used in production for a...Ch. 1 - Prob. 12ECh. 1 - Cost of goods manufactured for a manufacturing...Ch. 1 - Income statement for a manufacturing company Two...Ch. 1 - Statement of cost of goods manufactured for a...Ch. 1 - Cost of goods sold, profit margin, and net income...Ch. 1 - Cost flow relationships The following information...Ch. 1 - The following is a list of costs that were...Ch. 1 - The following is a list of costs incurred by...Ch. 1 - A partial list of Foothills Medical Centers costs...Ch. 1 - Manufacturing income statement, statement of cost...Ch. 1 - Statement of cost of goods manufactured and income...Ch. 1 - Prob. 1PBCh. 1 - The following is a list of costs incurred by...Ch. 1 - A partial list of The Grand Hotels costs follows:...Ch. 1 - Several items are omitted from the income...Ch. 1 - Statement of cost of goods manufactured and income...Ch. 1 - Comfort Plus, Inc., has a hotel with 300 rooms in...Ch. 1 - Prob. 2MADCh. 1 - Comparing occupancy for two hotels Sunrise Suites...Ch. 1 - Prob. 4MADCh. 1 - Prob. 5MADCh. 1 - Prob. 1TIFCh. 1 - Communication Todd Johnson is the Vice President...Ch. 1 - For each of the following managers, describe how...Ch. 1 - The following situations describe scenarios that...Ch. 1 - Geek Chic Company provides computer repair...Ch. 1 - Which of the following items would not be...Ch. 1 - Prob. 2CMACh. 1 - A firm has 100,000 in direct materials costs,...Ch. 1 - In practice, items such as wood screws and glue...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardJournal entry for July 1 to record the purchase of Steve Young by Bramble Corporation: A B C D 1 01-07-2025 Cash $51,800 2 Accounts receivable $91,200 3 Inventory $125,700 4 Land $64,600 5 Buildings (net) $75,400 6 Equipment (net) $69,700 7 Trademarks $17,360 8 Goodwill $65,340 9 Accounts payable $202,500 10 Cash $256,600 11 Notes payable $102,000 12 (To record the purchase of Young Company) 13 01-07-2025 Investment in Young compan $358,600 14 Cash $256,600 15 Notes payable $102,000 16 (To record investment in Young Company) (a) prepare the december 31 entry for bramble corporation to record amortization of intangibles. the trademark has an estimated…arrow_forwardJournal entry for July 1 to record the purchase of Steve Young by Bramble Corporation: A B C D 1 01-07-2025 Cash $51,800 2 Accounts receivable $91,200 3 Inventory $125,700 4 Land $64,600 5 Buildings (net) $75,400 6 Equipment (net) $69,700 7 Trademarks $17,360 8 Goodwill $65,340 9 Accounts payable $202,500 10 Cash $256,600 11 Notes payable $102,000 12 (To record the purchase of Young Company) 13 01-07-2025 Investment in Young compan $358,600 14 Cash $256,600 15 Notes payable $102,000 16 (To record investment in Young Company) (a)arrow_forward

- I am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Relevant Costing Explained; Author: Kaplan UK;https://www.youtube.com/watch?v=hnsh3hlJAkI;License: Standard Youtube License