Concept explainers

a.

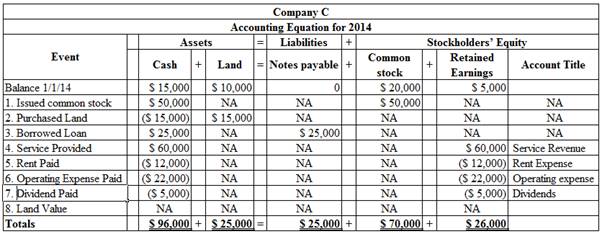

Record the eight events in the

a.

Explanation of Solution

The eight events are recorded using

Table (1)

b.

Prepare an income statement, statement of changes in equity, year-end

b.

Explanation of Solution

Income statement: Income statement is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

Income statement for the 2014 is prepared as follows:

| Company C | |

| Income Statement | |

| For the Year Ended December 31, 2014 | |

| Particulars | Amount ($) |

| Service Revenue | 60,000 |

| Utilities Expense | (12,000) |

| Operating Expense | (22,000) |

| Net Income | $26,000 |

Table (2)

Statement of changes in stockholders' equity: Statement of changes in stockholders' equity records the changes in the owners’ equity during the end of an accounting period by explaining about the increase or decrease in the capital reserves of shares.

Statement of changes in equity for the 2014 is prepared is as follows:

| Company C | ||

| Statement of Changes in | ||

| For the Year Ended December 31, 2014 | ||

| Particulars | Amount ($) | Amount ($) |

| Beginning Common Stock | 20,000 | |

| Add: Common Stock Issued | 50,000 | |

| Ending Common Stock | 70,000 | |

| Beginning | 5,000 | |

| Add: Net Income | 26,000 | |

| Less: Dividends | (5,000) | |

| Ending Retained Earnings | 26,000 | |

| Total Stockholders’ Equity | $96,000 | |

Table (3)

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Balance sheet for the 2014 is prepared as follows:

| Company C | ||

| Balance Sheet | ||

| As of December 31, 2014 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets: | ||

| Cash | 96,000 | |

| Land | 25,000 | |

| Total Assets | $121,000 | |

| Liabilities: | ||

| Notes Payable | 25,000 | |

| Total Liabilities | 25,000 | |

| Stockholders’ Equity: | ||

| Common Stock | 70,000 | |

| Retained Earnings | 26,000 | |

| Total Stockholders’ Equity | 96,000 | |

| Total Liabilities and Stockholders’ Equity | $121,000 | |

Table (4)

Statement of cash flows: Statement of cash flows is one among the financial statement of a Company statement that shows aggregate data of all

Statement of cash flows for the 2014 is prepared as follows:

| Company C | ||

| Statement of Cash Flows | ||

| For the Year Ended December 31, 2014 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash Flows From Operating Activities: | ||

| Cash Receipts from Customers | 60,000 | |

| Cash Payment for Utilities Expense | (12,000) | |

| Cash Payments for Other Operating Expense | (22,000) | |

| Net Cash Flow from Operating Activities | 26,000 | |

| Cash Flows From Investing Activities: | ||

| Cash Paid to Purchase Land | (15,000) | |

| Net Cash Flow from Investing Activities | (15,000) | |

| Cash Flows From Financing Activities: | ||

| Cash Receipts from Stock Issue | 50,000 | |

| Cash Receipts from Loan | 25,000 | |

| Cash Payments for Dividends | (5,000) | |

| Net Cash Flow from Financing Activities | 70,000 | |

| Net Increase in Cash | 81,000 | |

| Add: Beginning Cash Balance | 15,000 | |

| Ending Cash Balance | $96,000 | |

Table (5)

c.

Ascertain the percentage of assets provided by the retained earnings and find out the amount of cash in the retained earnings account.

c.

Explanation of Solution

Retained earnings:

Retained earnings are the portion of earnings kept by the business for the purpose of reinvestments, payment of debts, or for future growth.

Calculate the percentage of assets provided by retained earnings:

Retained earnings are used to purchase assets or to pay liabilities. Therefore, the amount of cash in the retained earnings accounts cannot be determined directly.

Therefore, the percentage of assets provided by retained earnings is 21.5%.

Want to see more full solutions like this?

Chapter 1 Solutions

Survey Of Accounting

- Calculate the employer's total FUTA and SUTA taxes. As TCLH Industries operates in North Carolina, assume a SUTA tax rate of 1.2% and a taxable earnings threshold of $29,600. Current period taxable earnings for FUTA and SUTA taxes are the same as those for FICA taxes. Year-to-date taxable earnings for FUTA and SUTA taxes, prior to the current pay period, are as follows: Determine the FUTA AND SUTA of each person. Zachary Fox: $0 Calvin Bell: $20,478.57 David Alexander: $198,450 Michael Sierra: $117,600arrow_forwardAnswer? General accounting questionarrow_forward????arrow_forward

- Petron Pet Supplies sells on terms of 3/10, net 60. What is the effective annual cost of trade credit under these terms? Use a 365-day year.arrow_forwardwhat is managerial accounting? explain its partarrow_forwardAssuming no safety stock, what is the re-order point (R) given an average daily demand of 65 units, a lead time of 8 days, and 720 units on hand?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education