Concept explainers

a.

Introduction:

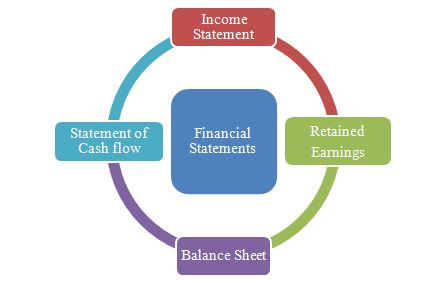

Financial statements are a complete record of the financial transactions that takes place in a company at a particular point of time. It provides important financial information like assets, liabilities, revenues and expenses of the company to its internal and external users. It helps them to know the exact financial position of the company. There are four basic financial statements as shown in the figure below:

Basic Financial Statements

Figure (1)

Figure (1)

Introduction:

To Interpret: Financial facts regarding retained earnings statement.

b.

Introduction:

Statement of

To Interpret: Financial facts regarding cash flow statement.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

FINANCIAL ACCOUNTING: TOOLS LL W/ ACCES

- Obama Enterprises had a beginning inventory of $32,000. During the year, the company recorded inventory purchases of $67,000 and a cost of goods sold of $63,000. What is the ending inventory? a. $28,000 b. $27,000 c. $24,000 d. $36,000arrow_forwardAuburn Inc. is preparing its cash budget for the month of September. The company estimated credit sales for September at $300,000. Actual credit sales for August were $210,000. Estimated collections in September for credit sales in September are 30%. Estimated collections in September for credit sales in August are 55%. Estimated collections in September for credit sales prior to August are $18,000. Estimated write-offs in September for uncollectible credit sales are $12,000. The estimated provision for bad debts in September for credit sales in September is $10,000. What are the estimated cash receipts from accounts receivable collections in September?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

- When should accountants apply cross-sequential analysis methods? (a) Multiple time periods require simultaneous comparison (b) Single period analysis works better (c) Sequential reviews provide more accuracy (d) Time periods remain isolated MCQarrow_forwardEdison Ventures reported its financial results for the year ended December 31, 2023. The company generated $450,000 in sales revenue, while the cost of goods sold amounted to $210,000. The company also incurred operating expenses of $105,000 and reported a net income of $135,000. Additionally, the company's net cash provided by operating activities was $160,000. Based on this information, what was Edison Ventures' profit margin ratio? Right answerarrow_forwardWhich circumstances prompt modified attribution analysis? a) Attribution never needs modification b) Standard attribution works universally c) Complex ownership structures require specialized allocation methods d) Ownership always follows simple patterns Need answerarrow_forward

- Cadillac Industries estimates direct labor costs and manufacturing overhead costs for the upcoming year to be $920,000 and $725,000, respectively. Cadillac allocates overhead costs based on machine hours. The estimated total labor hours and machine hours for the coming year are 21,000 hours and 8,500 hours, respectively. What is the predetermined overhead allocation rate? (Round your answer to the nearest cent.)arrow_forwardComplete solution wanted. Each step clear calculation want.arrow_forwardSubject. GENERAL ACCOUNT.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning