Managerial Accounting: Tools for Business Decision Making

7th Edition

ISBN: 9781119034681

Author: Weygandt

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 1.9BE

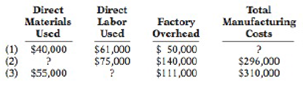

Presented below are incomplete manufacturing cost data. Determine the missing amounts for three different situations.

Determine missing amounts in computing total

(LO 3), AP

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Need help with this question solution general accounting

Please provide answer this general accounting question

Blue Wave Enterprises had revenues of $420,000, expenses of $275,000, and dividends of $60,000. When Income Summary is closed to Retained Earnings, What is the amount of the debit or credit to Retained Earnings? A. credit of $145,000 B. debit of $145,000 C. credit of $85,000 D. debit of $85,000

Chapter 1 Solutions

Managerial Accounting: Tools for Business Decision Making

Ch. 1 - Prob. 1QCh. 1 - Distinguish between managerial and financial...Ch. 1 - How do the content of reports and the verification...Ch. 1 - Prob. 4QCh. 1 - Decision-making is managements most important...Ch. 1 - Explain the primary difference between line...Ch. 1 - Prob. 7QCh. 1 - Prob. 8QCh. 1 - How are manufacturing costs classified?Ch. 1 - Mel Finney claims that the distinction between...

Ch. 1 - Tina Burke is confused about the differences...Ch. 1 - Identify the differences in the cost of goods sold...Ch. 1 - The determination of the cost of goods...Ch. 1 - Sealy Company has beginning raw materials...Ch. 1 - Tate Inc. has beginning work in process 26,000,...Ch. 1 - Using the data in Question 15, what are (a) the...Ch. 1 - In what order should manufacturing inventories be...Ch. 1 - How does the output of manufacturing operations...Ch. 1 - Discuss whether the product costing techniques...Ch. 1 - What is the value chain? Describe, in sequence,...Ch. 1 - What is an enterprise resource planning (HRP)...Ch. 1 - Why is product quality important for companies...Ch. 1 - Explain what is meant by balanced in the balanced...Ch. 1 - In what ways can the budgeting process create...Ch. 1 - What new rules were enacted under the...Ch. 1 - What is activity-based costing, and what are its...Ch. 1 - Distinguish between managerial and financial...Ch. 1 - Prob. 1.2BECh. 1 - Determine whether each of the following costs...Ch. 1 - Prob. 1.4BECh. 1 - Identify whether each of the following costs...Ch. 1 - Presented below are Rook Companys monthly...Ch. 1 - Francum Company has the following data: direct...Ch. 1 - In alphabetical order below are current asset...Ch. 1 - Presented below are incomplete manufacturing cost...Ch. 1 - Use the same data from BE1-9 above and the data...Ch. 1 - Prob. 1.11BECh. 1 - Prob. 1.1DICh. 1 - Identify managerial cost classifications. (LO 2),...Ch. 1 - The following information is available for Tomlin...Ch. 1 - Match the descriptions that follow with the...Ch. 1 - Justin Bleeber has prepared the following list of...Ch. 1 - Presented below is a list of costs and expenses...Ch. 1 - Trak Corporation incurred the following costs...Ch. 1 - Determine the total amount of various types of...Ch. 1 - Gala Company is a manufacturer of laptop...Ch. 1 - Prob. 1.6ECh. 1 - National Express reports the following costs and...Ch. 1 - Lopez Corporation incurred the following costs...Ch. 1 - An incomplete cost of goods manufactured schedule...Ch. 1 - Manufacturing cost data for Copa Company are...Ch. 1 - Incomplete manufacturing cost data for Horizon...Ch. 1 - Cepeda Corporation has the following cost records...Ch. 1 - Keisha Tombert, the bookkeeper for Washington...Ch. 1 - The following information is available for Aikman...Ch. 1 - University Company produces collegiate apparel....Ch. 1 - An analysis of the accounts of Roberts Company...Ch. 1 - McQueen Motor Company manufactures automobiles....Ch. 1 - The following is a list of terms related to...Ch. 1 - Prob. 1.1APCh. 1 - Bell Company, a manufacturer of audio systems,...Ch. 1 - Incomplete manufacturing costs, expenses, and...Ch. 1 - Prepare a cost of goods manufactured schedule, a...Ch. 1 - Empire Company is a manufacturer of smart phones....Ch. 1 - Prob. 1.1WPCh. 1 - Prob. 1.1BYPCh. 1 - Tenrack is a fairly large manufacturing company...Ch. 1 - Prob. 1.4BYPCh. 1 - The primary purpose of managerial accounting is to...Ch. 1 - As noted in this chapter, because of global...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial Accounting Questionarrow_forwardWhat is the budgeted cost of direct materials to be used this year on financial Accounting?arrow_forwardCarter Industries reported financial data for 2023, including net income of $500 million. The company s total assets at the beginning of the - year were $4,200 million, and at the end of the year, they increased to $5,000 million. What is Carter Industries' return on assets (ROA) for 2023?arrow_forward

- Provide answer this questionarrow_forwardBluewater Credit Union lends money to Oceanic Enterprises and receives a signed promissory note in return. The details of the note are as follows: Principal: $12,500 • Interest Rate: 8% • Term: 60 days Calculate the amount of interest earned by Bluewater Credit Union for the term of the note. (Assume a 360-day year for calculations.)arrow_forwardAccountingarrow_forward

- HELParrow_forwardThe total factory overhead for Delta Manufacturing is budgeted at $750,000 for the year and allocated between two departments: Processing ($500,000) and Finishing ($250,000). Delta produces two products: Desks and Chairs. Each Desk requires 4 direct labor hours in Processing and 2 direct labor hours in Finishing. Each Chair requires 3 direct labor hours in Processing and 4 direct labor hours in Finishing. The company plans to produce 5,000 units of each product during the year. Determine the total number of budgeted direct labor hours for the year in the Finishing Department. A. 30,000 dlh B. 25,000 dlh C. 20,000 dlh D. 35,000 dlharrow_forwardHello tutor please provide this question solution general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License