(a)

Introduction:

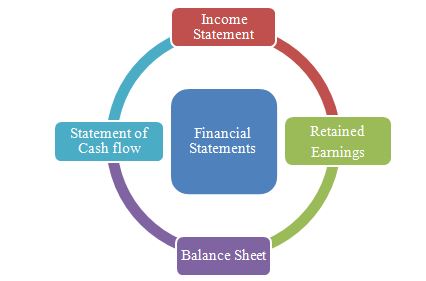

Financial statements are a complete record of the financial transactions that takes place in a company at a particular point of time. It provides important financial information like assets, liabilities, revenues and expenses of the company to its internal and external users. It helps them to know the exact financial position of the company. There are four basic financial statements as shown in the figure below:

Basic Financial Statements

Figure (1)

To Interpret: Financial facts regarding retained earnings statement.

Given: Dividends declared was $68,000 and net income was $75,000.

(b)

Introduction:

Statement of

To Interpret: Financial facts regarding cash flow statement.

Given: Cash provided by operating activities was $10,000; cash used in the investing activities was $110,000; and cash provided by financing activities was $130,000.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

Financial Accounting

- Radiant Logic Ltd. has net sales of $295,000, cost of goods sold of $190,000, selling expenses of $18,000, and non-operating expenses of $7,500. What is the company's gross profit?arrow_forwardOn August 1, 2012, Simmons Corporation loaned $40,000 to Thompson Inc. for one year at an annual interest rate of 7%. Under the terms of the promissory note, Thompson Inc. will repay the principal and pay one year's interest on August 31, 2013. What would be the total amount of receivable related to this loan on Simmons Corporation's December 31, 2012 balance sheet? (Round your answer nearest Dollar) A) $41,167 B) $26,500 C) $25,750 D) $12,875arrow_forwardCan you explain the process for solving this financial accounting problem using valid standards?arrow_forward

- Please solve this question General accounting and step by step explanationarrow_forwardAt transcend manufacturing, electricity cost starts with a minimum fixed cost, and after that, there is a perfectly variable expense.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education