Concept explainers

a)

To Determine: The

a)

Explanation of Solution

Calculate the retained earnings for BD Cleaners as on November 1, 2016.

The retained earnings, for BD Cleaners as on November 1, 2016 are $98,500.

b)

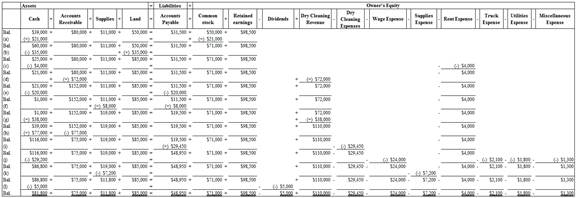

To Indicate: The effect of each given transaction of BD Cleaners on the

b)

Explanation of Solution

Business transaction: Business transaction is a record of any economic activity, resulting in the change in the value of the assets, the liabilities, and the Shareholder’s equities, of a business. Business transaction is also referred to as financial transaction.

Indicate the effect of the given transactions of BD Cleaners.

(Figure – 1)

c)

To Prepare: The financial statements for BD Cleaners for the month ended November 30, 2016.

c)

Explanation of Solution

Financial statements: Financial statements refer to those statements, which are prepared by the Company according to particular formats in accounting to show its financial position.

Financial statements include the following statements:

Income statement: Income statement is a financial statement that shows the net income or net loss by deducting the expenses from the revenues and vice versa.

Prepare the income statement of BD Cleaners for the month ended November 30, 2016.

| BD Cleaners | ||

| Income Statement | ||

| For the month ended November 30 , 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues | ||

| Dry cleaning revenue | $110,000 | |

| Expenses | ||

| Dry Cleaning expense | $29,450 | |

| Wages expense | $24,000 | |

| Supplies expense | $7,200 | |

| Rent expense | $4,000 | |

| Truck expense | $2,100 | |

| Utilities expense | $1,800 | |

| Miscellaneous expense | $1,300 | |

| Total expenses | $69,850 | |

| Net income | $40,150 | |

Table (1)

Hence, the net income of BD Cleaners for the month ended November 30, 2016 is $40,150.

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Prepare the statement of Retained earnings for BD Cleaners for the month ended November 30, 2016.

| BD Cleaners | ||

| Statement of Retained Earnings | ||

| For the month ended November 30 , 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, November 1, 2016 | $98,500 | |

| Net income for the month | $40,150 | |

| Deduct - Dividends | $5,000 | |

| Increase in Retained earnings | $35,150 | |

| Retained earnings, November 30, 2016 | $133,650 | |

Table (2)

Hence, the retained earnings of BD Cleaners for the month ended November 30, 2016 are $133,650.

Prepare the balance sheet of BD Cleaners for the month ended November 30, 2016.

| BD Cleaners | ||

| Balance Sheet | ||

| November 30 , 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Current Assets | ||

| Cash | $81,800 | |

| |

$75,000 | |

| Supplies | $11,800 | |

| Land | $85,000 | |

| Total current assets | $253,600 | |

| Liabilities and |

||

| Liabilities | ||

| Accounts payable | $48,950 | |

| Owner's equity | ||

| Common Stock | $71,000 | |

| Retained earnings | $133,650 | |

| Total stockholders’ equity | 204,650 | |

| Total liabilities and stockholders’ equity | $253,600 | |

Table (3)

The balance sheet of BD Cleaners shows asset balance of $253,600 which is same as the balance of liabilities and owner's equity.

d)

To Prepare: The statement of

d)

Explanation of Solution

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period.

Prepare the statement of cash flows for BD Cleaners for the month ended November 30, 2016.

| DD Cleaners | ||

| Statement of Cash Flows | ||

| For the month ended November 30, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Cash receipts from customers | $115,000 | |

| Cash payments for expenses (1) | $33,200 | |

| Payments to creditors | $20,000 | $53,200 |

| Net cash flow used for operating activities | $61,800 | |

| Cash flows from investing activities: | ||

| Cash payment for purchase of land | (-) $35,000 | |

| Cash flows from financing activities: | ||

| Cash receipt of owner’s investment | $21,000 | |

| Deduct - Withdrawals | (-) $5,000 | |

| Net cash flow from financing activities | $16,000 | |

| Net Increase in cash during November | $42,800 | |

| Cash Balance on November 1, 2019 | $39,000 | |

| Cash Balance on November 30 , 2019 | $81,800 | |

Table (4)

The statement of cash flows for BD Cleaners for the month ended November 30, 2016, shows cash balance of $81,800 on November 30, 2016

Working Note:

Calculate the expenses made through cash payments.

Want to see more full solutions like this?

Chapter 1 Solutions

Financial & Managerial Accounting

- Sierra Tech Industries purchased an asset costing $80,000 that is expected to produce 600,000 units and have a salvage value of $8,000. In the first year, 100,000 units are produced; in the second year, 95,000 units are produced; and in the third year, 88,000 units are produced. Using the units-of-production method, what is the book value of the asset at the end of year 3?arrow_forwardWaka Company had cash sales of $78,275, credit sales of $97,450, sales returns and allowances of $1,500, and sales discounts of $4,875. Calculate Waka's net sales for this period.arrow_forwardProvide answerarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education