Working Papers, Volume 1, Chapters 1-15 for Warren/Reeve/Duchac's Corporate Financial Accounting, 13th + Financial & Managerial Accounting, 13th

13th Edition

ISBN: 9781285869582

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

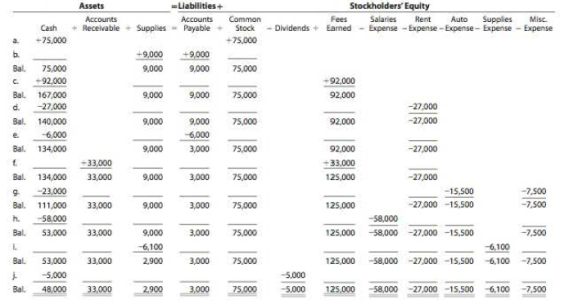

Chapter 1, Problem 1.3BPR

Financial statements

Jose Loder established Bronco Consulting on August 1, 2016. The effect of each transaction and the balances after each transaction for August follow:

Instructions

- 1. Prepare an income statement for the month ended August 31, 2016.

- 2. Prepare a

retained earnings statement for the month ended August 31, 2016. - 3. Prepare a

balance sheet as of August 31, 2016. - 4. (Optional) Prepare a statement of

cash flows for the month ending August 31, 2016.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please Solve this one with Financial Accounting method. Get Solution in time

Hello Tutor I need Answer of this Financial Accounting Question Solution with Detailed Answer

Accounting

Chapter 1 Solutions

Working Papers, Volume 1, Chapters 1-15 for Warren/Reeve/Duchac's Corporate Financial Accounting, 13th + Financial & Managerial Accounting, 13th

Ch. 1 - Name some users of accounting information.Ch. 1 - Prob. 2DQCh. 1 - Prob. 3DQCh. 1 - Prob. 4DQCh. 1 - On July 12, Reliable Repair Service extended an...Ch. 1 - Prob. 6DQCh. 1 - Describe the difference between an account...Ch. 1 - A business had revenues of 679,000 and operating...Ch. 1 - Prob. 9DQCh. 1 - The financial statements are interrelated. What...

Ch. 1 - Prob. 1.1APECh. 1 - Prob. 1.1BPECh. 1 - Accounting equation Dream-It LLC is a motivational...Ch. 1 - Prob. 1.2BPECh. 1 - Transactions Arrowhead Delivery Service is owned...Ch. 1 - Transactions Interstate Delivery Service is owned...Ch. 1 - Prob. 1.4APECh. 1 - Prob. 1.4BPECh. 1 - Prob. 1.5APECh. 1 - Prob. 1.5BPECh. 1 - Balance sheet Using the following data for Ousel...Ch. 1 - Prob. 1.6BPECh. 1 - Prob. 1.7APECh. 1 - Prob. 1.7BPECh. 1 - Prob. 1.8APECh. 1 - Prob. 1.8BPECh. 1 - Types of businesses The following is a list of...Ch. 1 - Prob. 1.2EXCh. 1 - Prob. 1.3EXCh. 1 - Prob. 1.4EXCh. 1 - Prob. 1.5EXCh. 1 - Prob. 1.6EXCh. 1 - Prob. 1.7EXCh. 1 - Asset, liability, and stockholders equity items...Ch. 1 - Effect of transactions on accounting equation What...Ch. 1 - Effect of transactions on accounting equation A. A...Ch. 1 - Effect of transactions on stockholders equity...Ch. 1 - Transactions The following selected transactions...Ch. 1 - Nature of transactions Teri West operates her own...Ch. 1 - Net income and dividends The income statement for...Ch. 1 - Prob. 1.15EXCh. 1 - Balance sheet items From the following list of...Ch. 1 - Income statement items From the following list of...Ch. 1 - Prob. 1.18EXCh. 1 - Income statement Dairy Services was organized on...Ch. 1 - Missing amounts from balance sheet and income...Ch. 1 - Prob. 1.21EXCh. 1 - Financial statements Each of the following items...Ch. 1 - Statement of cash flows Indicate whether each of...Ch. 1 - Prob. 1.24EXCh. 1 - Prob. 1.25EXCh. 1 - Ratio of liabilities to stockholders' equity The...Ch. 1 - Prob. 1.27EXCh. 1 - Transactions On April 1 of the current year,...Ch. 1 - Financial statements The amounts of the assets and...Ch. 1 - Financial statements Seth Feye established...Ch. 1 - Prob. 1.4APRCh. 1 - Transactions; financial statements DLite Dry...Ch. 1 - Prob. 1.6APRCh. 1 - Transactions Amy Austin established an insurance...Ch. 1 - Prob. 1.2BPRCh. 1 - Financial statements Jose Loder established Bronco...Ch. 1 - Prob. 1.4BPRCh. 1 - Prob. 1.5BPRCh. 1 - Missing amounts from financial statements The...Ch. 1 - Peyton Smith enjoys listening to all types of...Ch. 1 - Prob. 1.1CPCh. 1 - Prob. 1.2CPCh. 1 - Prob. 1.3CPCh. 1 - Prob. 1.6CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following errors took place in journalizing and posting transactions:a. The payment of $3,125 from a customer on account was recorded as a debit to Cash and a credit toAccounts Payable.b. Advertising expense of $1,500 paid for the current month was recorded as a debit to MiscellaneousExpense and a credit to Advertising Expense.c. The purchase of supplies of $2,690 on the account was recorded as a debit to Office Equipment anda credit to Supplies.d. The receipt of $3,750 for services rendered was recorded as a debit to Accounts Receivable and acredit to Fees Earned.Required:Prepare journal entries to correct the errors.Each error correction carries equal marks.arrow_forwardRequired:a) Journalize the following transactions using the direct write-off method of accounting foruncollectible receivables:Aug. 7. Received $175 from Roosevelt McLair and wrote off the remainder owed of $400 asuncollectible.Nov. 23. Reinstated the account of Roosevelt McLair and received $400 cash in full payment.b) Journalize the following transactions using the allowance method of accounting for uncollectiblereceivables:Feb. 12. Received $750 from Manning Wingard and wrote off the remainder owed of $2,000 asuncollectible.June 30. Reinstated the account of Manning Wingard and received $2,000 cash in full payment.Each journal carries equal marksarrow_forwardIf someone tracks, tallys and totals a current liabilities for an accounting period, and then seeks to apply this value in a calculation to assess our liquidity, what’s the difference between the current ratio and the “acid-test” (or “quick”) ratio? Does the difference between these two metrics even matter?arrow_forward

- Dear tutor. I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardno aiWhich of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forwardDon't use chatgpt Which of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understated i need help in this question quiarrow_forwardI need correct answer 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forwardNo chatgpt 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedneed anarrow_forwardNo ai 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License