Business Combination

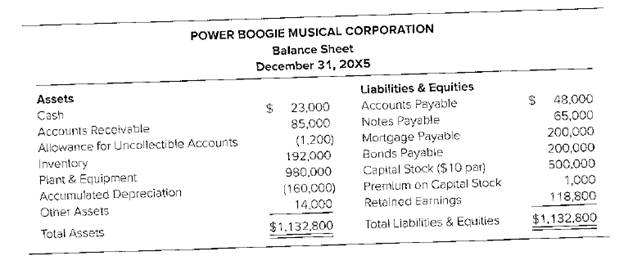

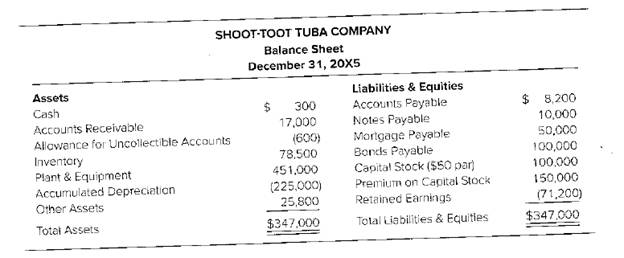

Following are the balance sheets of Power Boogie Musical Corporation and Shoot-Toot TubaCompany as of December 31, 20X5.

In preparation for a possible business combination, a team of experts from Power BoogieMusical made a thorough examination and audit of Shoot-Toot Tuba. They found that Shoot-Toot’s assets and liabilities were correctly stated except that they estimated uncollectibleaccounts at $1,400. The experts also estimated the market value of the inventory at $35,000and the market value of the plant and equipment at $500,000. The business combination tookplace on January 1, 20X6, and on that date Power Boogie’s Musical acquired all the assets andliabilities of Shoot-Toot Tuba. On that date, Power Boogie’s common stock was selling for$55 per share.

Required

Record the combination on Power Boogie’s books assuming that Power Boogie issued 9,000 of its

$10 par common shares in exchange for Shoot-Toot’s assets and liabilities.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

EBK ADVANCED FINANCIAL ACCOUNTING

- I need help with this General accounting question using the proper accounting approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forward

- I am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardI am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNo chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage