Custom Bundle: Accounting, Loose-leaf Version, 26th + Working Papers, Chapters 1-17, 26th Edition

26th Edition

ISBN: 9781305714731

Author: Warren/Reeve/Duchac

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 1.26EX

Ratio of liabilities to stockholders’ equity

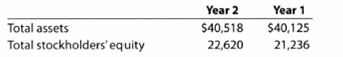

The Home Depot, Inc., is the world’s largest home improvement retailer and one of the largest retailers in the United States based on net sales volume. The Home Depot operates over 2,200 Home Depot® stores that sell a wide assortment of building materials and home improvement and lawn and garden products.

The Home Depot recently reported the following

- a. Determine the total liabilities at the end of Years 2 and 1.

- b. Determine the ratio of liabilities to stockholders’ equity for Year 2 and Year 1. Round to two decimal places.

- c. What conclusions regarding the margin of protection to the creditors can you draw from (b)?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Please explain the solution to this general accounting problem with accurate principles.

Please provide the answer to this general accounting question using the right approach.

This is almost perfect but i need the last empty cell.

Chapter 1 Solutions

Custom Bundle: Accounting, Loose-leaf Version, 26th + Working Papers, Chapters 1-17, 26th Edition

Ch. 1 - Name some users of accounting information.Ch. 1 - Prob. 2DQCh. 1 - Prob. 3DQCh. 1 - Josh Reilly is the owner of Dispatch Delivery...Ch. 1 - On July 12, Reliable Repair Service extended an...Ch. 1 - Prob. 6DQCh. 1 - Describe the difference between an account...Ch. 1 - A business had revenues of 679,000 and operating...Ch. 1 - A business had revenues of 640,000 and operating...Ch. 1 - The financial statements are interrelated. (a)...

Ch. 1 - Prob. 1.1APECh. 1 - Prob. 1.1BPECh. 1 - Accounting equation Brock Hahn is the owner and...Ch. 1 - Accounting equation Fritz Evans is the owner and...Ch. 1 - Transactions Arrowhead Delivery Service is owned...Ch. 1 - Transactions Interstate Delivery Service is owned...Ch. 1 - Income statement The revenues and expenses of...Ch. 1 - Prob. 1.4BPECh. 1 - Statement of owners equity Using the income...Ch. 1 - Prob. 1.5BPECh. 1 - Balance sheet Using the following data for Ousel...Ch. 1 - Prob. 1.6BPECh. 1 - Prob. 1.7APECh. 1 - Prob. 1.7BPECh. 1 - Ratio of liabilities to owners equity The...Ch. 1 - Prob. 1.8BPECh. 1 - Types of businesses The following is a list of...Ch. 1 - Prob. 1.2EXCh. 1 - Prob. 1.3EXCh. 1 - Prob. 1.4EXCh. 1 - Prob. 1.5EXCh. 1 - Prob. 1.6EXCh. 1 - Accounting equation Annie Rasmussen is the owner...Ch. 1 - Asset, liability, and owners equity items Indicate...Ch. 1 - Effect of transactions on accounting equation...Ch. 1 - Effect of transactions on accounting equation a.A...Ch. 1 - Effect of transactions on owner's equity Indicate...Ch. 1 - Transactions The following selected transactions...Ch. 1 - Nature of transactions Teri West operates her own...Ch. 1 - Net income and owner's withdrawals The income...Ch. 1 - Net income and owner's equity for four businesses...Ch. 1 - Balance sheet items From the following list of...Ch. 1 - Income statement items Based on the data presented...Ch. 1 - Prob. 1.18EXCh. 1 - Income statement Dairy Services was organized on...Ch. 1 - Missing amounts from balance sheet and income...Ch. 1 - Prob. 1.21EXCh. 1 - Financial statements Each of the following items...Ch. 1 - Statement of cash flows Indicate whether each of...Ch. 1 - Prob. 1.24EXCh. 1 - Financial statements We-Sell Realty, organized...Ch. 1 - Ratio of liabilities to stockholders equity The...Ch. 1 - Ratio of liabilities to stockholders equity Lowes...Ch. 1 - Transactions On April 1 of the current year,...Ch. 1 - Prob. 1.2APRCh. 1 - Financial statements Seth Feye established...Ch. 1 - Transactions; financial statements On July 1,...Ch. 1 - Transactions; financial statements DLite Dry...Ch. 1 - Prob. 1.6APRCh. 1 - Transactions Amy Austin established an insurance...Ch. 1 - Financial statements The amounts of the assets and...Ch. 1 - Financial statements Jose Loder established Bronco...Ch. 1 - Transactions; financial statements On April 1,...Ch. 1 - Transactions; financial statements Bevs Dry...Ch. 1 - Prob. 1.6BPRCh. 1 - Peyton Smith enjoys listening to all types of...Ch. 1 - Prob. 1.1CPCh. 1 - Prob. 1.2CPCh. 1 - Prob. 1.3CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello tutor please provide correct answer general accounting question with correct solution do fastarrow_forwardI want to this question answer for General accounting question not need ai solutionarrow_forwardPlease given correct answer for General accounting question I need step by step explanationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Dividend disocunt model (DDM); Author: Edspira;https://www.youtube.com/watch?v=TlH3_iOHX3s;License: Standard YouTube License, CC-BY