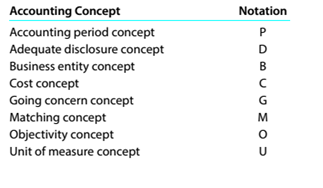

Accounting concepts

Match each of the following statements with the appropriate accounting concept. Sonic concepts may he used more than once, while others may not be used at all. Use the notat ions shown to indicate the appropriate accounting concept.

Statements

1. Assume that a business will continue forever.

2. Material litigation involving the corporation is described in a note.

3. Monthly utilities costs are reported as expenses along with the monthly revenues.

4. Personal transactions of owners are kept separate from the business.

5. This concept supports relying on an independent actuary (statistician), rather than the chief operating officer of the coq)ration, to estimate a pension liability.

6. Changes in the use of accounting methods from one period to the next are described in the notes to the financial statements.

7. Land worth $800,000 is reported at its original purchase price of $220,000.

8. This concept justifies recording only transactions that are expressed in dollars.

9. If this concept was ignored, the confidence of users in the financial statements could not be maintained.

10. The changes in financial condition are reported at the end of the month.

Trending nowThis is a popular solution!

Chapter 1 Solutions

SURVEY OF ACCOUNTING W/ACCESS >BI<

Additional Business Textbook Solutions

Essentials of MIS (13th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Financial Accounting, Student Value Edition (5th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Horngren's Accounting (12th Edition)

- Give solution correctly no chatgptarrow_forwardProblem No. 1 On January 1, 2025, Manuel Cruz and Sherimae Diasalo agreed to form a partnership that will manufacture and sell biscuits. The partnership agreement specified that Cruz is to invest cash of P1,000,000 and Diasalo is to contribute land and building to serve as the office and factory of the business. The following amounts are applicable to the property of Diasalo: Acquisition Cost Fair Market Value Land Building P1,000,000 500,000 P1,500,000 850,000 During the formation, it was found out that Cruz has accounts receivable amounting to P70,000 and the partners agreed that it will be assumed by the partnership. The name of the partnership will be Fita Pan. Required: 1. Prepare journal entry to record: a. The investment of Cruz to the partnership b. The investment of Diasalo to the partnershipood relay ni 000,219 2. Prepare the statement of financial position of the partnership as of January 1, 2025 Problem No. 2 The trial balance of Cleint Lumanao Nacho Supplies on February…arrow_forwardA company's stock price is $80, with earnings per share (EPS) of $10 and an expected growth rate of 12%.arrow_forward

- Kazama owns JKL Corporation stock with a basis of $20,000. He exchanges this for $24,000 of STU stock and $8,000 of STU securities as part of a tax-free reorganization. What is Kazama's basis in the STU stock?arrow_forwardKensington Textiles, Inc. manufactures customized tablecloths. An experienced worker can sew and embroider 10 tablecloths per hour. Due to the repetitive nature of the work, employees take a 10-minute break after every 10 tablecloths. Additionally, before starting each batch of 10 tablecloths, workers spend 8 minutes cleaning and setting up their sewing machines. Calculate the standard quantity of direct labor for one tablecloth.arrow_forwardSolvearrow_forward

- Problem: The bank statement balance of $7,000 does not include a check outstanding of $1,000, a deposit in transit of $275, and another company's $250 check erroneously charged against your firm's account. The reconciled bank balance is__?arrow_forwardGiven step by step explanation general accounting questionarrow_forwardQuick answer of this accounting questionsarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning