Concept explainers

(a)

Introduction:

Forms of Organization

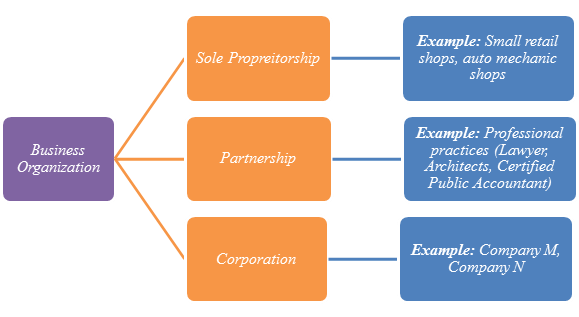

There are different types of business organization as per their nature of the formation. The following are the different types of organization:

Forms of Business Organization

Figure (1)

To identify: The form of business organization as per the given situations.

(b)

Sole Proprietorship: An entity which is completely owned by a single person and that person is running the business solely is called sole proprietorship organization. Each and every decision of the organization is taken by the owner and is also responsible for all types of business risks.

To identify: The form of business organization as per the given situations.

(c)

Corporation: A business concern where there is a separate legal entity and are owned by shareholders are classified as corporation. Transfer of ownership and raising funds are easy in this form of organization. The liabilities of the corporation to its creditors is limited up to its available resources.

To identify: The form of business organization as per the given situations.

(d)

To identify: The form of business organization as per the given situations.

(e)

Corporation: A business concern where there is a separate legal entity and are owned by shareholders are classified as corporation. Transfer of ownership and raising funds are easy in this form of organization. The liabilities of the corporation to its creditors is limited up to its available resources.

To identify: The form of business organization as per the given situations.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

FIN.ACCT-TOOLS F/DECI.MAKERS-TEXT+WILEY+

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forward

- I need help solving this financial accounting question with the proper methodology.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help with this financial accounting problem using accurate calculation methods.arrow_forward

- Please explain the solution to this general accounting problem with accurate principles.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardCan you provide the valid approach to solving this financial accounting question with suitable standards?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage