FINANCIAL ACCOUNTINGLL W/CONNECT >IC<

4th Edition

ISBN: 9781259934773

Author: SPICELAND

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 1.12E

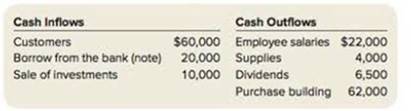

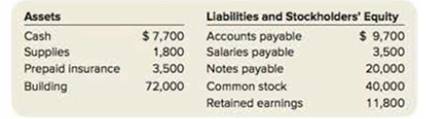

Squirrel Tree Services reports the following amounts on December 31.

In addition, the company reported the following

Required:

1. Prepare a

2. Prepare a statement of cash flows.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need help with this general accounting problem using proper accounting guidelines.

I am trying to find the accurate solution to this general accounting problem with appropriate explanations.

I am searching for the correct answer to this general accounting problem with proper accounting rules.

Chapter 1 Solutions

FINANCIAL ACCOUNTINGLL W/CONNECT >IC<

Ch. 1 - Explain what it means to say that an accounting...Ch. 1 - Identify some of the people interested in making...Ch. 1 - What is the basic difference between financial...Ch. 1 - What are the two primary functions of financial...Ch. 1 - What are line three basic business activities that...Ch. 1 - Prob. 6RQCh. 1 - What are a few of the typical investing activities...Ch. 1 - Prob. 8RQCh. 1 - Prob. 9RQCh. 1 - Provide the basic definition for each of the...

Ch. 1 - Prob. 11RQCh. 1 - What are the four primary financial statements?...Ch. 1 - What does it mean to say that the income...Ch. 1 - Prob. 14RQCh. 1 - What is the accounting equation? Which financial...Ch. 1 - Prob. 16RQCh. 1 - The retained earnings account is a link between...Ch. 1 - Prob. 18RQCh. 1 - Prob. 19RQCh. 1 - Prob. 20RQCh. 1 - Prob. 21RQCh. 1 - Prob. 22RQCh. 1 - Prob. 23RQCh. 1 - Prob. 24RQCh. 1 - Prob. 25RQCh. 1 - What are the three primary objectives of financial...Ch. 1 - Prob. 27RQCh. 1 - Prob. 28RQCh. 1 - Prob. 29RQCh. 1 - What is meant by the term cost effectiveness in...Ch. 1 - Prob. 31RQCh. 1 - Prob. 1.1BECh. 1 - Match each business activity with its description....Ch. 1 - Prob. 1.3BECh. 1 - Match each account type with its description....Ch. 1 - For each transaction, indicate whether each...Ch. 1 - For each transaction, indicate whether each...Ch. 1 - Describe each financial statement (LO13) Match...Ch. 1 - Determine the location of items in financial...Ch. 1 - Prob. 1.9BECh. 1 - Indicate which of the following are objectives of...Ch. 1 - Prob. 1.11BECh. 1 - Prob. 1.12BECh. 1 - Prob. 1.13BECh. 1 - The following provides a list of transactions and...Ch. 1 - Falcon Incorporated has the following transactions...Ch. 1 - Prob. 1.3ECh. 1 - Eagle Corp. operates magnetic resonance imaging...Ch. 1 - Prob. 1.5ECh. 1 - Below are the account balances for Cowboy Law Firm...Ch. 1 - At the beginning of the year (January 1), Buffalo...Ch. 1 - Wolfpack Construction has the following account...Ch. 1 - Tiger Trade has the following cash transactions...Ch. 1 - Prob. 1.10ECh. 1 - At the beginning of 2018, Artichoke Academy...Ch. 1 - Squirrel Tree Services reports the following...Ch. 1 - Prob. 1.13ECh. 1 - During its first five years of operations, Red...Ch. 1 - Below are approximate amounts related to retained...Ch. 1 - Below are approximate amounts related to balance...Ch. 1 - Below are approximate amounts related to cash flow...Ch. 1 - Prob. 1.18ECh. 1 - Prob. 1.19ECh. 1 - Prob. 1.20ECh. 1 - A Below are typical transactions for...Ch. 1 - Account classifications include assets,...Ch. 1 - Longhorn Corporation provides low-cost food...Ch. 1 - Below are-incomplete financial statements for...Ch. 1 - Cornhusker Company provides the following...Ch. 1 - Prob. 1.6APCh. 1 - Listed below are nine terms and definitions...Ch. 1 - Below are typical transactions for Caterpillar...Ch. 1 - Prob. 1.2BPCh. 1 - Prob. 1.3BPCh. 1 - Prob. 1.4BPCh. 1 - Tar Heel Corporation provides the following...Ch. 1 - Prob. 1.6BPCh. 1 - Prob. 1.7BPCh. 1 - Great Adventures (The Great Adventures problem...Ch. 1 - Financial Analysis American Eagle Outfitters, Inc....Ch. 1 - The Buckle, Inc. Financial Analysis Financial...Ch. 1 - Prob. 1.4APCACh. 1 - Prob. 1.5APECh. 1 - Prob. 1.7APWC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forward

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardCurrent Attempt in Progress The following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1. 2. Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3. 4. 5. 6. In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining…arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License