Concept explainers

a.

Introduction:

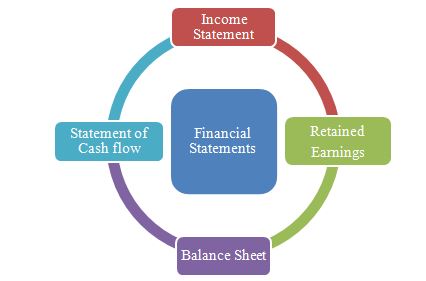

Financial statements are a complete record of the financial transactions that takes place in a company at a particular point of time. It provides important financial information like assets, liabilities, revenues and expenses of the company to its internal and external users. It helps them to know the exact financial position of the company. There are four basic financial statements as shown in the figure below:

Basic Financial Statements

Figure (1)

To Compute: Net income for the year ended December 31, 2017.

a.

Introduction:

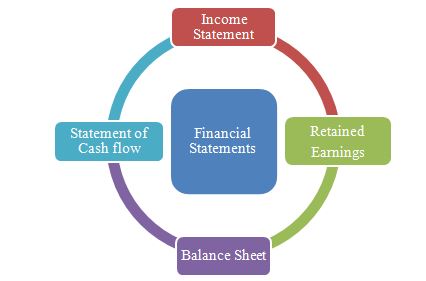

Financial statements are a complete record of the financial transactions that takes place in a company at a particular point of time. It provides important financial information like assets, liabilities, revenues and expenses of the company to its internal and external users. It helps them to know the exact financial position of the company. There are four basic financial statements as shown in the figure below:

Basic Financial Statements

Figure (1)

Answer to Problem 1.10E

Determine net income for the year 2017.

Introduction:

Income statement is a financial statement that shows the net income earned or net loss suffered by a company through reporting all the revenues earned and expenses incurred by the company over a specific period of time.

Income statement is also known as operations statement, earnings statement, revenue statement, or

Prepare the income statement of the company for the year ended December 31st , 2017 as below.

|

O Park Income Statement For the year ended December 31 st, 2017. | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues | 132,000 | |

| Service Revenue | 25,000 | 157,000 |

| Less: Expenses | 126,000 | |

| Net income | 31,000 | |

Table (1)

Explanation of Solution

Income statement is used to determine the net income / net loss of the company. It is calculated by finding out the difference between the net revenues and expenses. Net income for the year ended December 31 st, 2017 is $31,000.

Thus, the net income for the year ended December 31st, 2017 is $31,000.

b.

i.

Introduction:

Use the following formula to determine the retained earnings for the year ending December 31, 2017.

Prepare retained earnings statement for the year ending December 31, 2017.

b.

i.

Answer to Problem 1.10E

Prepare the retained earnings statement of O Park for the year ended December 31st, 2017 as below.

|

O Park Retained Earnings Statement For the year ended December 31 st, 2017. | |

| Particulars | Amount ($) |

| Retained earnings, January 1 | 5,000 |

| Add: Net income (From requirement a) | 31,000 |

| 36,000 | |

| Less: Dividends | 9,000 |

| Retained earnings, December 31 | 27,000 |

Table (2)

Explanation of Solution

Ending retained earnings is determined by adding the net income and deducting the dividends to beginning retained earnings. Thus, above table shows the determination of the retained earnings, December 31.

Thus, the ending retained earnings is $27,000.

ii.

Introduction:

Balance sheet is a financial statement that shows the available assets (owner’s equity and outsider’s equity) and owed liabilities from investing and financial activities of a company. This statement reveals the financial health of company. So, this statement is also called as

Use the formula to prepare balance sheet.

Prepare balance sheet for O Park as of December 31, 2017.

ii.

Answer to Problem 1.10E

Prepare the balance sheet for O Park as of December 31, 2017 as below.

|

O Park Balance Sheet December 31, 2017 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Cash | 8,500 | |

| Supplies | 5,500 | |

| Equipment | 114,000 | |

| Total assets | 128,000 | |

| Liabilities and Stockholders’ equity | ||

| Notes payable | 50,000 | |

| Accounts payable | 11,000 | |

| Total liabilities | 61,000 | |

| Stockholders’ equity | ||

| Common stock | 40,000 | |

| Retained earnings | 27,000 | 67,000 |

| Total liabilities and stockholders’ equity | 128,000 | |

Table (3)

Explanation of Solution

Balance sheet includes the items of assets, liabilities, and stockholders’ equity. The total assets of the company are the sum of cash, supplies, and equipment. The total liabilities are the sum of notes payable and accounts payable. The stockholders’ equity is the sum of common stock and retained earnings.

Thus, assets are equal to liabilities and stockholders’ equity.

c.

To Comment: On the company’s growth.

c.

Explanation of Solution

The income statement is prepared to determine the net income. The revenues from the G store are only 16% out of total revenues. In order to know whether the company is in more trouble than worth, it is necessary to know the expenses that are attributable to the G store.

In this income statement, expenses amount is shown in the single category instead of showing it separately for both the companies. Thus, when there is a breakdown of categories, it helps the company to generate profit or loss for the company.

Thus, there should be breakdown of the categories with respect to two companies.

Want to see more full solutions like this?

Chapter 1 Solutions

FINANCIAL ACCOUNTING>IC<

- I am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardCalculate the sustainable growth ratearrow_forwardOrville Manufacturing Company's work-in-process inventory on August 1 has a balance of $32,400, representing Job No. 527. During August, $61,500 of direct materials were requisitioned for Job No. 527, and $42,800 of direct labor cost was incurred on Job No. 527. Manufacturing overhead is allocated at 125% of direct labor cost. Actual manufacturing overhead costs incurred in August amounted to $52,500. No new jobs were started during August. Job No. 527 is completed on August 28. Is manufacturing overhead overallocated or underallocated for the month of August and by how much?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education