Your company completed the following merchandise transactions during year 6: 1. On January 1, Year 6, your company had merchandise which cost $18,000 and had a net realizable value of S17,900. 2. Purchased $23,000 of merchandise for cash 3. Sold $19,000 of the merchandise for $36,400 on account. 4. Purchased $10,000 of merchandise on account, terms 2/10, n/30. 5. Paid for the merchandise in #3 on the eighth day after the purchase. 6. There were other purchases and sales throughout the year, but you do not need to record them, so no entry here. 7. Ended the year with merchandise which cost $26,000 (according to your calculations) and had a net realizable value of $25,400. INSTRUCTIONS: a. Prepare the entries for the transactions above assuming a Periodic inventory system, the allowance method for LCNRV, and the net method for purchase discounts. b. Prepare the entries for the transactions above assuming a Perpetual inventory system, the direct inventory reduction method for LCNRV, and the gross method for purchase discounts.

Your company completed the following merchandise transactions during year 6: 1. On January 1, Year 6, your company had merchandise which cost $18,000 and had a net realizable value of S17,900. 2. Purchased $23,000 of merchandise for cash 3. Sold $19,000 of the merchandise for $36,400 on account. 4. Purchased $10,000 of merchandise on account, terms 2/10, n/30. 5. Paid for the merchandise in #3 on the eighth day after the purchase. 6. There were other purchases and sales throughout the year, but you do not need to record them, so no entry here. 7. Ended the year with merchandise which cost $26,000 (according to your calculations) and had a net realizable value of $25,400. INSTRUCTIONS: a. Prepare the entries for the transactions above assuming a Periodic inventory system, the allowance method for LCNRV, and the net method for purchase discounts. b. Prepare the entries for the transactions above assuming a Perpetual inventory system, the direct inventory reduction method for LCNRV, and the gross method for purchase discounts.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Your company completed the following merchandise transactions during year 6:

1. On January 1, Year 6, your company had merchandise which cost $18,000 and had a net

realizable value of $17,900.

2. Purchased $23,000 of merchandise for cash

3. Sold $19,000 of the merchandise for $36,400 on account.

4. Purchased $10,000 of merchandise on account, terms 2/10, n/30.

5. Paid for the merchandise in #3 on the eighth day after the purchase.

6. There were other purchases and sales throughout the year, but you do not need to record

them, so no entry here.

7. Ended the year with merchandise which cost $26,000 (according to your calculations) and

had a net realizable value of $25,400.

INSTRUCTIONS:

a. Prepare the entries for the transactions above assuming a Periodic inventory system, the

allowance method for LCNRV, and the net method for purchase discounts.

b. Prepare the entries for the transactions above assuming a Perpetual inventory system, the

direct inventory reduction method for LCNRV, and the grosS method for purchase

discounts.

Expert Solution

Step 1: Introduction

Concepts covered in the solution:-

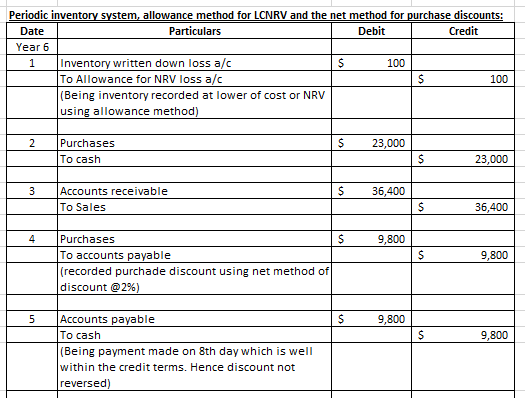

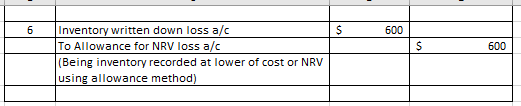

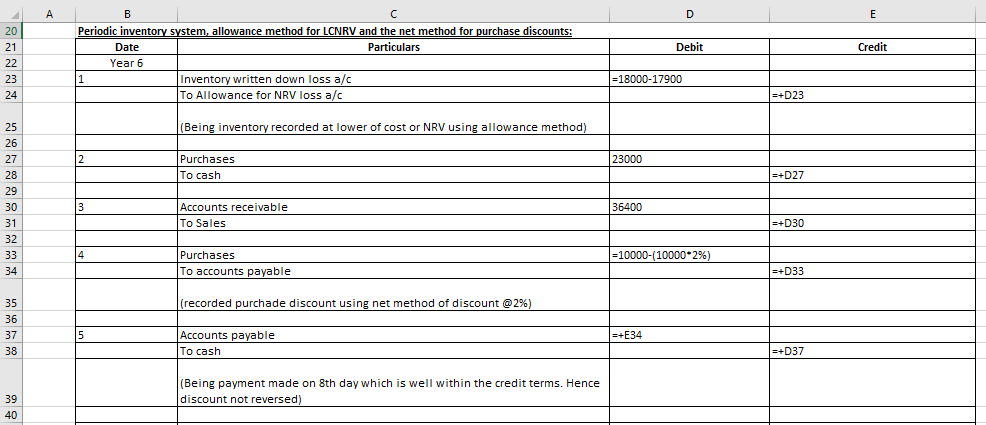

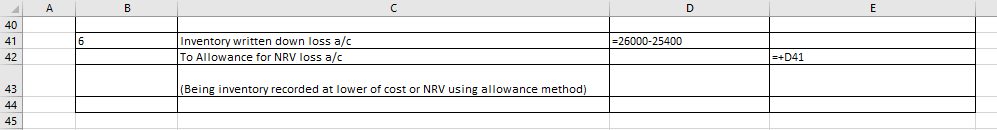

- Periodic inventory system:- Under periodic inventory system, updates to the inventory records are made on a periodic basis. Entries are recorded directly to the purchase, sales accounts.

- Perpetual inventory system:- Under perpetual inventory system, transactions are recorded directly to the inventory account on a continuous basis (real time) as and when they occur.

- Allowance method for LCNRV:- Here, inventory loss is shown as a separate contra asset account to merchandise inventory such that the actual cost of the inventory remains intact.

- Direct inventory reduction method:- Here, Merchandise inventory account is directly credited to record for recording a reduction in inventory balance.

- Net method for purchase discount:- Purchases are originally recorded at discounted price.

- Gross method for purchase discount:- Discounts are recorded only at the time of making the payment.

Step 2: Part a

Step by step

Solved in 3 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education