with the help of the statement of income attached please answer the below: explain the trend in the net borrowing (proceeds from borrowing less payments of short- and long-term debt) of the firm? explain the trend in working capital accounts? Critically evaluate the financial strength of each of the companie based on the evidence presented in the Statement of Cash Flow.

with the help of the statement of income attached please answer the below: explain the trend in the net borrowing (proceeds from borrowing less payments of short- and long-term debt) of the firm? explain the trend in working capital accounts? Critically evaluate the financial strength of each of the companie based on the evidence presented in the Statement of Cash Flow.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

with the help of the statement of income attached please answer the below:

- explain the trend in the net borrowing (proceeds from borrowing less payments of short- and long-term debt) of the firm?

- explain the trend in

working capital accounts? - Critically evaluate the financial strength of each of the companie based on the evidence presented in the Statement of

Cash Flow .

Expert Solution

Step 1

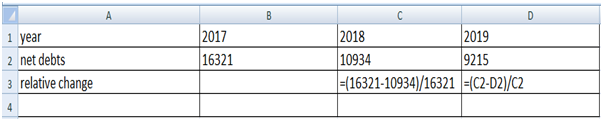

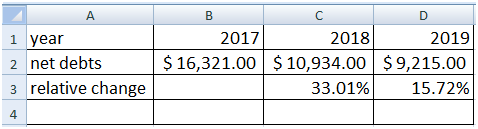

Net debts is the amount that shows the capability of the entity that whether it can pay off its due debts on time using its cash and other liquid assets or not. A negative debt shows that it can pay off the liability with the cash and the company is stable. But if the debt is positive it implies that its debt is more than company’s liquid assets. As in the above statement, Net debts for three consecutive years are given which shows the following trend:

Result for the above table is shown below:

As per the above table, the trend shows that net debts of the company are decreasing by the years.

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education