Wiset Company completes these transactions during April of the current year (the terms of all its credit sales are 2/10, n/30). April 2 Purchased $14,700 of merchandise on credit from Noth Company, terms 2/10, n/60. April 3 (a) Sold merchandise on credit to Page Alistair, Invoice Number 760, for $8,000 (cost is $7,000). April 3 (b) Purchased $1,490 of office supplies on credit from Custer, Incorporated, terms n/30. April 4 Issued Check Number 587 to World View for advertising expense of $904. April 5 Sold merchandise on credit to Paula Kohr, Invoice Number 761, for $15,000 (cost is $13,500). April 6 Returned $90 of office supplies purchased on April 3 to Custer, Incorporated. Wiset reduces accounts payable by that amount. April 9 Purchased $12,225 of store equipment on credit from Hal’s Supply, terms n/30. April 11 Sold merchandise on credit to Nic Nelson, Invoice Number 762, for $21,600 (cost is $18,100). April 12 Issued Check Number 588 to Noth Company in payment of its April 2 purchase less the discount of $294. April 13 (a) Received payment from Page Alistair for the April 3 sale less the discount of $160. April 13 (b) Sold $11,600 of merchandise on credit to Page Alistair (cost is $10,100), Invoice Number 763. April 14 Received payment from Paula Kohr for the April 5 sale less the discount of $300. April 16 (a) Issued Check Number 589 for $10,350; payee is Payroll, in payment of sales salaries expense for the first half of the month. April 16 (b) Cash sales for the first half of the month are $52,840 (cost is $35,880). These cash sales are recorded in the cash receipts journal on April 16. April 17 Purchased $12,750 of merchandise on credit from Grant Company, terms 2/10, n/30. April 18 Borrowed $60,000 cash from First State Bank by signing a long-term note payable. April 20 (a) Received payment from Nic Nelson for the April 11 sale less the discount of $432. April 20 (b) Purchased $730 of store supplies on credit from Hal’s Supply, terms n/30. April 23 (a) Returned $650 of defective merchandise purchased on April 17 to Grant Company. Wiset reduces accounts payable by that amount. April 23 (b) Received payment from Page Alistair for the April 13 sale less the discount of $232. April 25 Purchased $11,975 of merchandise on credit from Noth Company, terms 2/10, n/60. April 26 Issued Check Number 590 to Grant Company in payment of its April 17 invoice less the return and the $242 discount. April 27 (a) Sold $7,340 of merchandise on credit to Paula Kohr, Invoice Number 764 (cost is $6,690). April 27 (b) Sold $11,700 of merchandise on credit to Nic Nelson, Invoice Number 765 (cost is $9,305). April 30 (a) Issued Check Number 591 for $10,350; payee is Payroll, in payment of the sales salaries expense for the last half of the month. April 30 (b) Cash sales for the last half of the month are $73,975 (cost is $58,900). These cash sales are recorded in the cash receipts journal on April 30. Required: 3. Enter the March 31 balances for Cash ($88,000), Inventory ($189,000), Long-Term Notes Payable ($177,000), and B. Wiset, Capital ($100,000). Post the total amounts from the journal in the respective accounts receivable subsidiary ledger accounts for Paula Kohr, Page Alistair, and Nic Nelson. 4-a. Prepare a trial balance of the general ledger accounts.

Wiset Company completes these transactions during April of the current year (the terms of all its credit sales are 2/10, n/30). April 2 Purchased $14,700 of merchandise on credit from Noth Company, terms 2/10, n/60. April 3 (a) Sold merchandise on credit to Page Alistair, Invoice Number 760, for $8,000 (cost is $7,000). April 3 (b) Purchased $1,490 of office supplies on credit from Custer, Incorporated, terms n/30. April 4 Issued Check Number 587 to World View for advertising expense of $904. April 5 Sold merchandise on credit to Paula Kohr, Invoice Number 761, for $15,000 (cost is $13,500). April 6 Returned $90 of office supplies purchased on April 3 to Custer, Incorporated. Wiset reduces accounts payable by that amount. April 9 Purchased $12,225 of store equipment on credit from Hal’s Supply, terms n/30. April 11 Sold merchandise on credit to Nic Nelson, Invoice Number 762, for $21,600 (cost is $18,100). April 12 Issued Check Number 588 to Noth Company in payment of its April 2 purchase less the discount of $294. April 13 (a) Received payment from Page Alistair for the April 3 sale less the discount of $160. April 13 (b) Sold $11,600 of merchandise on credit to Page Alistair (cost is $10,100), Invoice Number 763. April 14 Received payment from Paula Kohr for the April 5 sale less the discount of $300. April 16 (a) Issued Check Number 589 for $10,350; payee is Payroll, in payment of sales salaries expense for the first half of the month. April 16 (b) Cash sales for the first half of the month are $52,840 (cost is $35,880). These cash sales are recorded in the cash receipts journal on April 16. April 17 Purchased $12,750 of merchandise on credit from Grant Company, terms 2/10, n/30. April 18 Borrowed $60,000 cash from First State Bank by signing a long-term note payable. April 20 (a) Received payment from Nic Nelson for the April 11 sale less the discount of $432. April 20 (b) Purchased $730 of store supplies on credit from Hal’s Supply, terms n/30. April 23 (a) Returned $650 of defective merchandise purchased on April 17 to Grant Company. Wiset reduces accounts payable by that amount. April 23 (b) Received payment from Page Alistair for the April 13 sale less the discount of $232. April 25 Purchased $11,975 of merchandise on credit from Noth Company, terms 2/10, n/60. April 26 Issued Check Number 590 to Grant Company in payment of its April 17 invoice less the return and the $242 discount. April 27 (a) Sold $7,340 of merchandise on credit to Paula Kohr, Invoice Number 764 (cost is $6,690). April 27 (b) Sold $11,700 of merchandise on credit to Nic Nelson, Invoice Number 765 (cost is $9,305). April 30 (a) Issued Check Number 591 for $10,350; payee is Payroll, in payment of the sales salaries expense for the last half of the month. April 30 (b) Cash sales for the last half of the month are $73,975 (cost is $58,900). These cash sales are recorded in the cash receipts journal on April 30. Required: 3. Enter the March 31 balances for Cash ($88,000), Inventory ($189,000), Long-Term Notes Payable ($177,000), and B. Wiset, Capital ($100,000). Post the total amounts from the journal in the respective accounts receivable subsidiary ledger accounts for Paula Kohr, Page Alistair, and Nic Nelson. 4-a. Prepare a trial balance of the general ledger accounts.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter10: Accounting For Sales And Cash Receipts

Section: Chapter Questions

Problem 9SEB: SCHEDULE OF ACCOUNTS RECEIVABLE From the accounts receivable ledger shown, prepare a schedule of...

Related questions

Question

Wiset Company completes these transactions during April of the current year (the terms of all its credit sales are 2/10, n/30).

| April 2 | Purchased $14,700 of merchandise on credit from Noth Company, terms 2/10, n/60. |

|---|---|

| April 3 (a) | Sold merchandise on credit to Page Alistair, Invoice Number 760, for $8,000 (cost is $7,000). |

| April 3 (b) | Purchased $1,490 of office supplies on credit from Custer, Incorporated, terms n/30. |

| April 4 | Issued Check Number 587 to World View for advertising expense of $904. |

| April 5 | Sold merchandise on credit to Paula Kohr, Invoice Number 761, for $15,000 (cost is $13,500). |

| April 6 | Returned $90 of office supplies purchased on April 3 to Custer, Incorporated. Wiset reduces accounts payable by that amount. |

| April 9 | Purchased $12,225 of store equipment on credit from Hal’s Supply, terms n/30. |

| April 11 | Sold merchandise on credit to Nic Nelson, Invoice Number 762, for $21,600 (cost is $18,100). |

| April 12 | Issued Check Number 588 to Noth Company in payment of its April 2 purchase less the discount of $294. |

| April 13 (a) | Received payment from Page Alistair for the April 3 sale less the discount of $160. |

| April 13 (b) | Sold $11,600 of merchandise on credit to Page Alistair (cost is $10,100), Invoice Number 763. |

| April 14 | Received payment from Paula Kohr for the April 5 sale less the discount of $300. |

| April 16 (a) | Issued Check Number 589 for $10,350; payee is Payroll, in payment of sales salaries expense for the first half of the month. |

| April 16 (b) | Cash sales for the first half of the month are $52,840 (cost is $35,880). These cash sales are recorded in the cash receipts journal on April 16. |

| April 17 | Purchased $12,750 of merchandise on credit from Grant Company, terms 2/10, n/30. |

| April 18 | Borrowed $60,000 cash from First State Bank by signing a long-term note payable. |

| April 20 (a) | Received payment from Nic Nelson for the April 11 sale less the discount of $432. |

| April 20 (b) | Purchased $730 of store supplies on credit from Hal’s Supply, terms n/30. |

| April 23 (a) | Returned $650 of defective merchandise purchased on April 17 to Grant Company. Wiset reduces accounts payable by that amount. |

| April 23 (b) | Received payment from Page Alistair for the April 13 sale less the discount of $232. |

| April 25 | Purchased $11,975 of merchandise on credit from Noth Company, terms 2/10, n/60. |

| April 26 | Issued Check Number 590 to Grant Company in payment of its April 17 invoice less the return and the $242 discount. |

| April 27 (a) | Sold $7,340 of merchandise on credit to Paula Kohr, Invoice Number 764 (cost is $6,690). |

| April 27 (b) | Sold $11,700 of merchandise on credit to Nic Nelson, Invoice Number 765 (cost is $9,305). |

| April 30 (a) | Issued Check Number 591 for $10,350; payee is Payroll, in payment of the sales salaries expense for the last half of the month. |

| April 30 (b) | Cash sales for the last half of the month are $73,975 (cost is $58,900). These cash sales are recorded in the cash receipts journal on April 30. |

Required:

3. Enter the March 31 balances for Cash ($88,000), Inventory ($189,000), Long-Term Notes Payable ($177,000), and B. Wiset, Capital ($100,000). Post the total amounts from the journal in the respective

4-a. Prepare a

Transcribed Image Text:Enter the March 31 balances for Cash ($88,000), Inventory ($189,000), Long-Term Notes Payable ($177,000), and B. Wiset, Capital ($100,000). Post the total amounts from the

journal in the respective accounts receivable subsidiary ledger accounts for Paula Kohr, Page Alistair, and Nic Nelson.

Date

Date

Page Alistair

Debit

Nic Nelson

Debit

Credit

Credit

ACCOUNTS RECEIVABLE LEDGER

Balance

Balance

Date

Paula Kohr

Debit

Credit

Balance

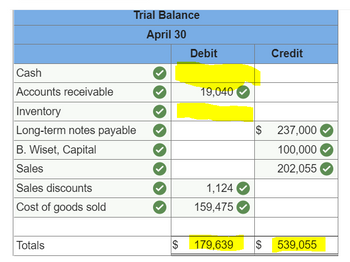

Transcribed Image Text:Prepare a trial balance of the general ledger accounts.

WISET COMPANY

Trial Balance

April 30

Cash

Accounts receivable

Inventory

Long-term notes payable

B. Wiset, Capital

Sales

Sales discounts

Cost of goods sold

Totals

$

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

On the

Transcribed Image Text:**Trial Balance as of April 30**

| **Account** | **Debit** | **Credit** |

|-------------------------------|------------|------------|

| **Cash** | 160,000 | |

| **Accounts Receivable** | 19,040 | |

| **Inventory** | 0 | |

| **Long-term Notes Payable** | | 237,000 |

| **B. Wiset, Capital** | | 100,000 |

| **Sales** | | 202,055 |

| **Sales Discounts** | 1,124 | |

| **Cost of Goods Sold** | 159,475 | |

| **Totals** | 179,639 | 539,055 |

**Analysis:**

- **Debit Entries**: The total debits amount to $179,639, which includes cash, accounts receivable, sales discounts, and cost of goods sold.

- **Credit Entries**: The total credits amount to $539,055. These include long-term notes payable, capital, and sales.

- The Trial Balance indicates a discrepancy as the totals of debit and credit columns do not match. This could suggest errors in journalizing or posting transactions. Further investigation is needed to ensure accuracy and correct financial reporting.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,