What is the break-even point in sales units? (see attached)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter7: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 46E: Lotts Company produces and sells one product. The selling price is 10, and the unit variable cost is...

Related questions

Question

100%

What is the break-even point in sales units? (see attached)

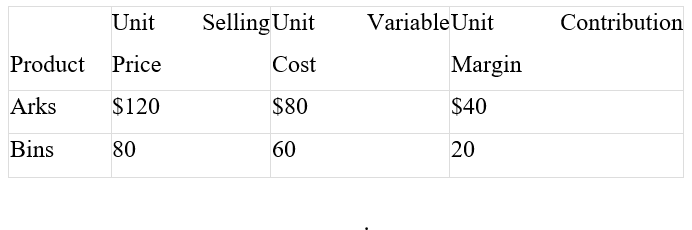

Transcribed Image Text:Carter Co. sells two products: arks and bins. Last year, Carter sold 14,000 units of arks and 56,000 units of bins. Related data are as follows:

| Product | Unit Selling Price | Unit Variable Cost | Unit Contribution Margin |

|---------|--------------------|--------------------|--------------------------|

| Arks | $120 | $80 | $40 |

| Bins | $80 | $60 | $20 |

Assuming that last year's fixed costs totaled $960,000, what was Carter Co.'s break-even point in sales units?

Options:

a. 40,000 units

b. 35,000 units

c. 12,000 units

d. 28,000 units

Expert Solution

Step 1

Given:

Step 2

Concept:

The ratio of the fixed cost and the subtraction of the variable cost with the unit price of the production is called a break-even point.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College