Wagner

Q: The following transactions apply to Walnut Enterprises for Year 1, its first year of operations:…

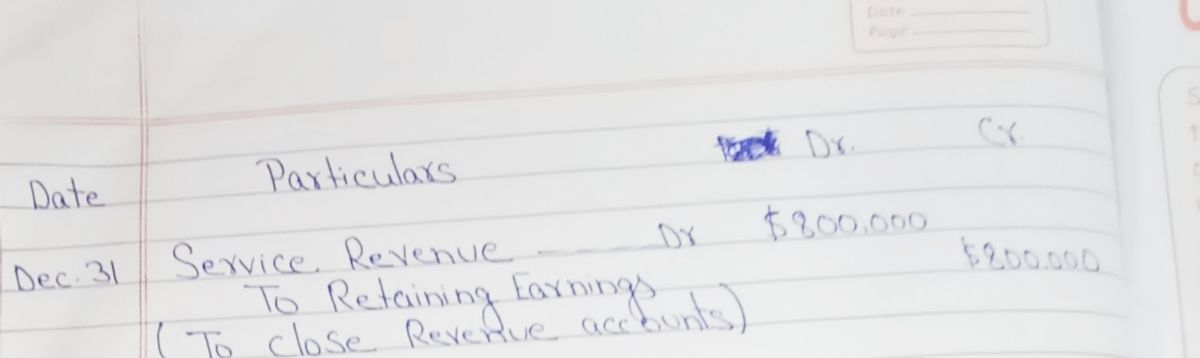

A: Closing Entries - Closing entries are required to close the temporary accounts after making…

Q: You are provided with the following amounts for Janet Mattera for the current year: • Net…

A: Taxable income is the net income earned by an individual on which the tax is payable. It is…

Q: Trombone deducts employment taxes from its employees' wages on a monthly basis and pays these to the…

A: Auditors employ audit procedures to assess the accuracy of financial reports produced by their…

Q: Journalize the transactions shown

A: Calculate Salary expense = Gross salary - Tax payables - Insurance premium payables.

Q: Ralph Henwood was paid a salary of $83,600 during 20-- by Odesto Company. In addition, during the…

A: a.

Q: The following monthly

A: FICA stands for the Federal Insurance Contributions Act and is deducted from each paycheck.…

Q: Mike Inc. is switching from a cash to an accrual method for tax purposes effective 1/1/X2. Mike…

A: Taxable income: It can be defined as an income that is used or considered while calculating the tax…

Q: Grotto Ltd has already sent $19,600 to the ATO in respect to PAYG, and this figure shown as a debit…

A: PAYG stands for "Pay as you Go", it is a installment method of paying income tax to…

Q: The following transactions apply to Walnut Enterprises for Year 1, its first year of operations:…

A: Statement of Cash Flow - Statement of Cash Flow is a financial statement. That includes inflow and…

Q: Required prepare a post-closing trial balance.

A: Post-closing trial balance is the trial balance that is prepared after closure and transfer of all…

Q: For the first year of operations, Fidelity Engineering reported pretax accounting income of…

A: Deferred tax asset: The deferred tax asset is created when the taxes to be paid as per income tax…

Q: As part of its accounting process, estimated incon ed each month for 28% of the current month's net…

A: Companies estimates the uncertain amount for the benefits of employees like pension, vacation pay,…

Q: Spritzer Inc. summarized the following pretax amounts from its accounting records for the year:…

A: Comprehensive Income is a statement where income that is not earned is considered. Unearned income…

Q: August, $15,000; September and October, $10,000; and November, $5,000. How much should the…

A: The property tax revenue is the revenue which is the source of revenue to the government and for…

Q: The names of the employees of Hogan Thrift Shop are listed on the following payroll register.…

A: HOGAN THRIFT SHOP PAYROLL REGISTER FOR PERIOD YEAR ENDING Employee name Marital status No.…

Q: How much is the input tax? How much is the value added tax payable?

A: VAT is Value Added Tax paid during purchases & collected while making sales the difference to be…

Q: A hospitality corporation is preparing its annual reports. The accounting records show sales of…

A: Compute the income before income taxes on the financial statements:

Q: The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December…

A: GIVEN Account No. Account Name Balance 211 Salaries Payable — 212 Social Security…

Q: The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $380,000;…

A: Journal Entries are used to record all the financial transactions in a business. It helps to know…

Q: The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $320,000;…

A: A payroll register is maintained to record expenses related to wages and salary payments. Payroll…

Q: The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $200,000;…

A: Requirement 1:Calculation of the amount of premium paid by the employee& employer

Q: Complete Accounting Services has the following payroll information for the week ended December 7.…

A: Wages: Wages are the earnings of the employees for their work to the company they serve. These are…

Q: Cougar’s Accounting Services provides low-cost tax advice and preparation to those with financial…

A: The net income or loss is calculated as difference between total revenue and total expenses. The…

Q: EFG, a calendar year, accrual basis corporation, reported $479,900 net income after tax on its…

A: In order to calculate the taxable income from the book income, all the exempt income and deductible…

Q: Cougar’s Accounting Services provides low-cost tax advice and preparation to those with financial…

A: The Accounting Equation Is The Basic Element Of The Balance Sheet. It Shows The Total Assets Equals…

Q: On September 30, Cody Company's selected account balances are as follows: Employees' Federal Income…

A: Journal entries are the basic foundation of financial statements in which at least two accounts are…

Q: Using the above information, complete the below table and prepare the journal entries to record…

A: “Since you have posted a question with multiple sub parts, we will provide the solution only to the…

Q: Bonita Corporation operates on a calendar year basis. The company is in its first year of operations…

A: Property Tax: It refers to a tax that is levied on the owner in relation to the property owed by…

Q: For each of the following situations, indicate the amount shown as current or long-term liability on…

A: The current liability is the liability which is to be paid off within one year.

Q: The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $700,000;…

A: Ramirez Company's July payroll process involves several key components, including recording accrued…

Q: . If a company has a pre - tax accounting income of $1, 000, with interest revenue from municipal…

A: Given :Pre-tax accounting income = $1,000Interest revenue from municipal bonds = $500Tax rate =…

Q: Sheffield Corporation rings up cash sales and sales taxes separately on its cash register. On April…

A: Journal entries are used to document financial transactions. To generate a journal entry, you insert…

Q: The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $380,000;…

A: The question is based on the concept of Financial Accounting.

Q: An accountant needs to withhold 18% of income for taxes if the income is below $40,000, and 21% of…

A: Data given: Withhold 18% of income for taxes if the income is below $40,000. Withhold 21% of income…

Q: Wages paid for the second quarter for Ivanhoe Law Firm were $59,000.00. All wages were subject to…

A: Social Security tax = Gross Earnings x Social Security tax rate = $59000*6.20% = $3,658 Medicare…

Q: The following transactions apply to Walnut Enterprises for Year 1, its first year of operations:…

A: Accounting Equation: The equation that proves the double-entry accounting system by showing equal…

Wagner Accounting & Tax Services provides accounting and tax services in Tampa, Florida.The following account balances appear on the year-end adjusted

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

- Romie Ltd is preparing accounts for the year ended 31 December 20X5. The company has an estimated tax charge of $35,000 for the year ended December 20X5. The trial balance includes an entry of $2,000 relating to an over provision of tax in the previous financial year. What is the charge for tax in the statement of profit or loss for the year ended December 20X5?The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $360,000; Office salaries, $72,000; Federal income taxes withheld, $108,000; State income taxes withheld, $24,000; Social security taxes withheld, $26,784; Medicare taxes withheld, $6,264; Medical insurance premiums, $8,500; Life insurance premiums, $5,500; Union dues deducted, $2,500; and Salaries subject to unemployment taxes, $53,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%. 1. & 2. Using the above information, complete the below table and prepare the journal entries to record accrued payroll, including employee deductions, and cash payment of the net payroll (salaries payable) for July. 3. Using the above information, complete the below table. 4. Record the accrued employer payroll taxes and other related employment expenses and the cash payment of all…The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $380,000; Office salaries, $76,000; Federal income taxes withheld, $114,000; State income taxes withheld, $25,500; Social security taxes withheld, $28,272; Medicare taxes withheld, $6,612; Medical insurance premiums, $9,000; Life insurance premiums, $6,000; Union dues deducted, $3,000; and Salaries subject to unemployment taxes, $54,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%. 1. & 2. Using the above information, complete the below table and prepare the journal entries to record accrued payroll, including employee deductions, and cash payment of the net payroll (salaries payable) for July. 3. Using the above information, complete the below table. 4. Record the accrued employer payroll taxes and other related employment expenses and the cash payment of all liabilities…

- The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: 211 Salaries Payable — 212 Social Security Tax Payable $16,302 213 Medicare Tax Payable 4,290 214 Employees Federal Income Tax Payable 26,455 215 Employees State Income Tax Payable 25,740 216 State Unemployment Tax Payable 2,717 217 Federal Unemployment Tax Payable 858 218 U.S. Saving Bond Deductions Payable 6,000 219 Medical Insurance Payable 49,800 411 Operations Salaries Expense 1,732,000 511 Officers Salaries Expense 1,130,000 512 Office Salaries Expense 287,000 519 Payroll Tax Expense 245,960 The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Dec. 2 Issued Check No. 410 for $6,000 to Jay Bank to purchase U.S. savings bonds for employees. Dec. 2 Issued Check No. 411 to Jay Bank for $47,047 in payment of $16,302 of social security tax, $4,290 of Medicare tax, and…An exempt organization, reports unrelated business income of $290,000 and unrelated business expenses of $45,000. In addition, the organization has positive adjustments of $88,000. Assume a 21% corporate income tax rate. Calculate the amount of unrelated business income tax. (Is 1,000 standard deduction applicable?)A summary of the transactions of Ramstage Co, which is registered for sales tax at 15% showed the following for the month of August 20X9. Outputs $60000(exclusive of sales tax) Inputs $46000(inclusive of sales tax) At the beginning of the period Ramstage Co owed $3400 to the government tax authority,and during the period $2600 was paid to the tax authority. What was the amount owed to the government tax authorities at the end of the accounting period?

- The following transactions apply to Walnut Enterprises for Year 1, its first year of operations: Received $50,000 cash from the issue of a short-term note with a 6 percent interest rate and a one-year maturity. The note was made on April 1, Year 1. Received $130,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 6 percent. Paid $62,000 cash for other operating expenses during the year. Paid the sales tax due on $110,000 of the service revenue for the year. Sales tax on the balance of the revenue is not due until Year 2. Recognized the accrued interest at December 31, Year 1. The following transactions apply to Walnut Enterprises for Year 2: Paid the balance of the sales tax due for Year 1. Received $201,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 6 percent. Repaid the principal of the note and applicable interest on April 1, Year 2. Paid $102,500 of other…After making four quaterly estimated payments of $3,500, a corporation's actual income tax liability for the year is $17,200. The year-end adjusting entry would require: