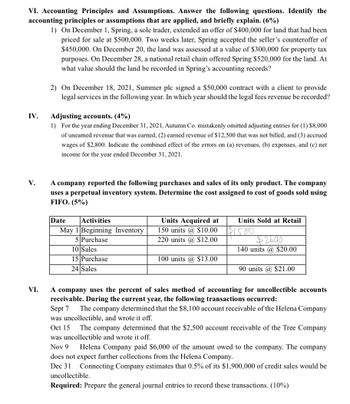

VI. Accounting Principles and Assumptions. Answer the following questions. Identify the accounting principles or assumptions that are applied, and briefly explain. (6%) 1) On December 1, Spring, a sole trader, extended an offer of $400,000 for land that had been priced for sale at $500,000. Two weeks later, Spring accepted the seller's counteroffer of $450,000. On December 20, the land was assessed at a value of $300,000 for property tax purposes. On December 28, a national retail chain offered Spring $520,000 for the land. At what value should the land be recorded in Spring's accounting records? IV. V. VI. 2) On December 18, 2021, Summer plc signed a $50,000 contract with a client to provide legal services in the following year. In which year should the legal fees revenue be recorded? Adjusting accounts. (4%) 1) For the year ending December 31, 2021, Autumn Co. mistakenly omitted adjusting entries for (1) $8,000 of unearned revenue that was earned, (2) earned revenue of $12,500 that was not billed, and (3) accrued wages of $2,800. Indicate the combined effect of the errors on (a) revenues, (b) expenses, and (c) net income for the year ended December 31, 2021. A company reported the following purchases and sales of its only product. The company uses a perpetual inventory system. Determine the cost assigned to cost of goods sold using FIFO. (5%) Date Activities May 1 Beginning Inventory 5 Purchase 10 Sales 15 Purchase 24 Sales Units Acquired at 150 units @ $10.00 220 units @ $12.00 100 units @ $13.00 Units Sold at Retail $1500 $2640 140 units @ $20.00 90 units @ $21.00 A company uses the percent of sales method of accounting for uncollectible accounts. receivable. During the current year, the following transactions occurred: Sept 7 The company determined that the $8,100 account receivable of the Helena Company was uncollectible, and wrote it off. Oct 15 The company determined that the $2,500 account receivable of the Tree Company was uncollectible and wrote it off. Nov 9 Helena Company paid $6,000 of the amount owed to the company. The company does not expect further collections from the Helena Company. Dec 31 Connecting Company estimates that 0.5% of its $1,900,000 of credit sales would be uncollectible. Required: Prepare the general journal entries to record these transactions. (10%)

VI. Accounting Principles and Assumptions. Answer the following questions. Identify the accounting principles or assumptions that are applied, and briefly explain. (6%) 1) On December 1, Spring, a sole trader, extended an offer of $400,000 for land that had been priced for sale at $500,000. Two weeks later, Spring accepted the seller's counteroffer of $450,000. On December 20, the land was assessed at a value of $300,000 for property tax purposes. On December 28, a national retail chain offered Spring $520,000 for the land. At what value should the land be recorded in Spring's accounting records? IV. V. VI. 2) On December 18, 2021, Summer plc signed a $50,000 contract with a client to provide legal services in the following year. In which year should the legal fees revenue be recorded? Adjusting accounts. (4%) 1) For the year ending December 31, 2021, Autumn Co. mistakenly omitted adjusting entries for (1) $8,000 of unearned revenue that was earned, (2) earned revenue of $12,500 that was not billed, and (3) accrued wages of $2,800. Indicate the combined effect of the errors on (a) revenues, (b) expenses, and (c) net income for the year ended December 31, 2021. A company reported the following purchases and sales of its only product. The company uses a perpetual inventory system. Determine the cost assigned to cost of goods sold using FIFO. (5%) Date Activities May 1 Beginning Inventory 5 Purchase 10 Sales 15 Purchase 24 Sales Units Acquired at 150 units @ $10.00 220 units @ $12.00 100 units @ $13.00 Units Sold at Retail $1500 $2640 140 units @ $20.00 90 units @ $21.00 A company uses the percent of sales method of accounting for uncollectible accounts. receivable. During the current year, the following transactions occurred: Sept 7 The company determined that the $8,100 account receivable of the Helena Company was uncollectible, and wrote it off. Oct 15 The company determined that the $2,500 account receivable of the Tree Company was uncollectible and wrote it off. Nov 9 Helena Company paid $6,000 of the amount owed to the company. The company does not expect further collections from the Helena Company. Dec 31 Connecting Company estimates that 0.5% of its $1,900,000 of credit sales would be uncollectible. Required: Prepare the general journal entries to record these transactions. (10%)

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

It looks like you may have submitted a graded question that, per our Honor Code, experts cannot answer. We've credited a question to your account.

Your Question:

Transcribed Image Text:VI. Accounting Principles and Assumptions. Answer the following questions. Identify the

accounting principles or assumptions that are applied, and briefly explain. (6%)

1) On December 1, Spring, a sole trader, extended an offer of $400,000 for land that had been

priced for sale at $500,000. Two weeks later, Spring accepted the seller's counteroffer of

$450,000. On December 20, the land was assessed at a value of $300,000 for property tax

purposes. On December 28, a national retail chain offered Spring $520,000 for the land. At

what value should the land be recorded in Spring's accounting records?

IV.

V.

VI.

2) On December 18, 2021, Summer plc signed a $50,000 contract with a client to provide

legal services in the following year. In which year should the legal fees revenue be recorded?

Adjusting accounts. (4%)

1) For the year ending December 31, 2021, Autumn Co. mistakenly omitted adjusting entries for (1) $8,000

of unearned revenue that was earned, (2) earned revenue of $12,500 that was not billed, and (3) accrued

wages of $2,800. Indicate the combined effect of the errors on (a) revenues, (b) expenses, and (c) net

income for the year ended December 31, 2021.

A company reported the following purchases and sales of its only product. The company

uses a perpetual inventory system. Determine the cost assigned to cost of goods sold using

FIFO. (5%)

Date

Activities

May 1 Beginning Inventory

5 Purchase

10 Sales

15 Purchase

24 Sales

Units Acquired at

150 units @ $10.00

220 units @ $12.00

100 units @ $13.00

Units Sold at Retail

$1500

$2640

140 units @ $20.00

90 units @ $21.00

A company uses the percent of sales method of accounting for uncollectible accounts.

receivable. During the current year, the following transactions occurred:

Sept 7

The company determined that the $8,100 account receivable of the Helena Company

was uncollectible, and wrote it off.

Oct 15 The company determined that the $2,500 account receivable of the Tree Company

was uncollectible and wrote it off.

Nov 9 Helena Company paid $6,000 of the amount owed to the company. The company

does not expect further collections from the Helena Company.

Dec 31 Connecting Company estimates that 0.5% of its $1,900,000 of credit sales would be

uncollectible.

Required: Prepare the general journal entries to record these transactions. (10%)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT