Vernon Deltvery Is a small company that transports business packages between New York and Chicago. It operates a fleet of small vans that moves packages to and from a central depot within each city and uses a common carrler to deliver the packages between the depots In the two citles. Vernon Dellvery recently acquired approximately $5.2 million of cash capital from Its owners, and Its president, George Hay, Is trying to Identify the most profitable way to Invest these funds. Todd Payne, the company's operations manager, belleves that the money should be used to expand the fleet of city vans at a cost of $800,000. He argues that more vans would enable the company to expand Its services Into new markets, thereby Increasing the revenue base. More specifically, he expects cash Inflows to Increase by $310,000 per year. The additional vans are expected to have an average useful life of four years and a combined salvage value of $107,000. Operating the vans will require additional working capital of $47,000, which will be recovered at the end of the fourth year. In contrast, Oscar Vance, the company's chlef accountant, belleves that the funds should be used to purchase large trucks to deliver the packages between the depots In the two citles. The converslon process would produce continuing Improvement Iin operating savings and reduce cash outflows as follows. Year 1 $168, 800 Year 2 Year 3 Year 4 $317,000 $406, 000 $431, eee The large trucks are expected to cost $880,000 and to have a four-year useful life and a $82,000 salvage value. In addition to the purchase price of the trucks, up-front training costs are expected to amount to $19,000. Vernon Delvery's management has established a 10 percent desired rate of return. (PV of $1 and PVA of $1) (Use approprlate factor(s) from the tables provlded.) Regulred a.&b. Determine the net present value and present value Index for each Investment alternative. (Round your Intermedlate calculations and final answers to 2 decimal places. Enter your answer In whole dollars and not In mllons.) Purchase of City Vans Purchase of Trucks a. Net Present Value (NPV) b. Present Value Index (PVI)

Vernon Deltvery Is a small company that transports business packages between New York and Chicago. It operates a fleet of small vans that moves packages to and from a central depot within each city and uses a common carrler to deliver the packages between the depots In the two citles. Vernon Dellvery recently acquired approximately $5.2 million of cash capital from Its owners, and Its president, George Hay, Is trying to Identify the most profitable way to Invest these funds. Todd Payne, the company's operations manager, belleves that the money should be used to expand the fleet of city vans at a cost of $800,000. He argues that more vans would enable the company to expand Its services Into new markets, thereby Increasing the revenue base. More specifically, he expects cash Inflows to Increase by $310,000 per year. The additional vans are expected to have an average useful life of four years and a combined salvage value of $107,000. Operating the vans will require additional working capital of $47,000, which will be recovered at the end of the fourth year. In contrast, Oscar Vance, the company's chlef accountant, belleves that the funds should be used to purchase large trucks to deliver the packages between the depots In the two citles. The converslon process would produce continuing Improvement Iin operating savings and reduce cash outflows as follows. Year 1 $168, 800 Year 2 Year 3 Year 4 $317,000 $406, 000 $431, eee The large trucks are expected to cost $880,000 and to have a four-year useful life and a $82,000 salvage value. In addition to the purchase price of the trucks, up-front training costs are expected to amount to $19,000. Vernon Delvery's management has established a 10 percent desired rate of return. (PV of $1 and PVA of $1) (Use approprlate factor(s) from the tables provlded.) Regulred a.&b. Determine the net present value and present value Index for each Investment alternative. (Round your Intermedlate calculations and final answers to 2 decimal places. Enter your answer In whole dollars and not In mllons.) Purchase of City Vans Purchase of Trucks a. Net Present Value (NPV) b. Present Value Index (PVI)

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:Vernon Delivery is a small company that transports business packages between New York and Chicago. It operates a fleet of small vans that move packages to and from a central depot within each city and uses a common carrier to deliver the packages between the depots in the two cities. Vernon Delivery recently acquired approximately $5.2 million of cash capital from its owners, and its president, George Hay, is trying to identify the most profitable way to invest these funds.

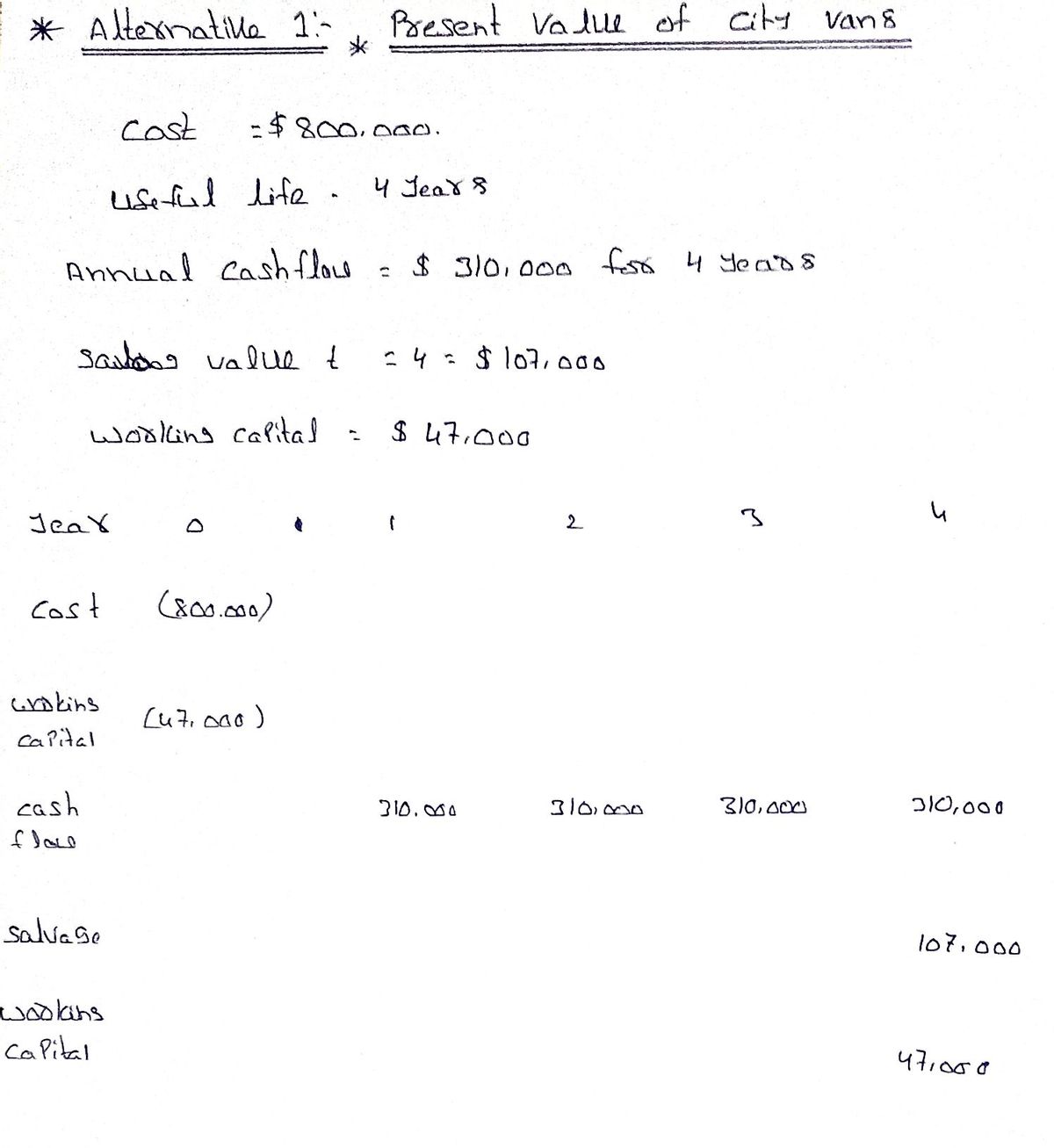

Todd Payne, the company’s operations manager, believes that the money should be used to expand the fleet of city vans at a cost of $800,000. He argues that more vans would enable the company to expand its services into new markets, thereby increasing the revenue base. More specifically, he expects cash inflows to increase by $310,000 per year. The additional vans are expected to have an average useful life of four years and a combined salvage value of $107,000. Operating the vans will require additional working capital of $47,000, which will be recovered at the end of the fourth year.

In contrast, Oscar Vance, the company’s chief accountant, believes that the funds should be used to purchase large trucks to deliver the packages between the depots in the two cities. The conversion process would produce continuing improvement in operating savings and reduce cash outflows as follows:

| Year 1 | Year 2 | Year 3 | Year 4 |

|--------|--------|--------|--------|

| $168,000 | $317,000 | $406,000 | $431,000 |

The large trucks are expected to cost $880,000 and to have a four-year useful life and an $82,000 salvage value. In addition to the purchase price of the trucks, up-front training costs are expected to amount to $19,000. Vernon Delivery’s management has established a 10 percent desired rate of return. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.)

**Required**

a & b. Determine the net present value and present value index for each investment alternative. (Round your intermediate calculations and final answers to 2 decimal places. Enter your answer in whole dollars and not in millions.)

| | Purchase of City Vans | Purchase of Trucks |

|------------------------|-----------------------|--------------------|

| a. Net Present Value (NPV) | | |

| b. Present Value Index (PVI

Expert Solution

Step 1

*Answer:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman