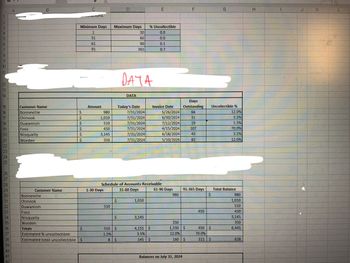

Use this table for calculations: Minimum Days Maximum days % uncollectible 1 30 1.5% 31 60 3.5% 61 90 12% 91 365 70% I need to calculate the number of days each receivable is outstanding look at image to fill in , show work when calculating or using formulas , included all work please. After that fill in the schedule accounts recievable shown in the other image for context. When filling in the schedule of accounts recievable show what the formulas w you use and all work.

Use this table for calculations:

| Minimum Days | Maximum days | % uncollectible |

| 1 | 30 | 1.5% |

| 31 | 60 | 3.5% |

| 61 | 90 | 12% |

| 91 | 365 | 70% |

I need to calculate the number of days each receivable is outstanding look at image to fill in , show work when calculating or using formulas , included all work please.

After that fill in the schedule accounts recievable shown in the other image for context.

When filling in the schedule of accounts recievable show what the formulas w you use and all work.

Accounts receivable are the amounts owed by the customers to the firm against goods or services they purchased from the firm on credit. It is quite possible that not the entire amount of accounts receivable are recovered by the firm. There may be some customers who are not able to pay the entire or some part of their outstanding balance. This uncollectible amount is estimated by the the firm on the basis of past records. These accounts are known as estimated uncollectible accounts.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

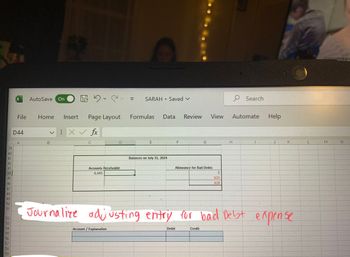

Using the imformation already about the schedule of accounts recievable help fill in the balance. -use the image to show the context

also journalize the