Use the dataset ORG_QEarnings and perform the following regression: QE QEt-4 = a + ß* (QEt-1- QEt-5) + Et where QE denotes quarterly earnings of Origin Energy Ltd in quarter t. a is the constant term (i.e., the intercept) and & is the error term. The regression should be performed using 20 quarters of earnings data. Report your regression estimates in the table below:

Use the dataset ORG_QEarnings and perform the following regression: QE QEt-4 = a + ß* (QEt-1- QEt-5) + Et where QE denotes quarterly earnings of Origin Energy Ltd in quarter t. a is the constant term (i.e., the intercept) and & is the error term. The regression should be performed using 20 quarters of earnings data. Report your regression estimates in the table below:

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:Company Legal Name

ASX Code

ORIGIN ENERGY LTD

ORG

ORIGIN ENERGY LTD ORG

ORG

ORG

ORG

ORIGIN ENERGY LTD

ORIGIN ENERGY LTD

ORIGIN ENERGY LTD

ORIGIN ENERGY LTD ORG

ORIGIN ENERGY LTD ORG

ORIGIN ENERGY LTD ORG

ORIGIN ENERGY LTD ORG

ORIGIN ENERGY LTD

ORIGIN ENERGY LTD

ORIGIN ENERGY LTD ORG

ORIGIN ENERGY LTD ORG

ORIGIN ENERGY LTD ORG

ORIGIN ENERGY LTD ORG

ORIGIN ENERGY LTD ORG

ORIGIN ENERGY LTD ORG

ORIGIN ENERGY LTD ORG

ORIGIN ENERGY LTD ORG

ORIGIN ENERGY LTD ORG

ORG QEarnings

1 Date

2 2019/4/1

3 2019/4/2

4

2019/4/3

5

2019/4/4

6

2019/4/5

7

2019/4/8

8

2019/4/9

9

2019/4/10

10

2019/4/11

11

2019/4/12

12

2019/4/15

13

2019/4/16

14

2019/4/17

15 2019/4/18

16 2019/4/23

17 2019/4/24

18 2019/4/26

19

2019/4/29

20

2019/4/30

21

2019/5/1

22

2019/5/2

2019/5/3

23

24 2019/5/6

25

2019/5/7

26

2019/5/8

27

2019/5/9

28

2019/5/10

29

2019/5/13

30

2019/5/14

31

2019/5/15

32 2019/5/16

33 2019/5/17

34

2019/5/20

2019/5/21

35

36

2019/5/22

37 2019/5/23

38 2019/5/24

39

40

2019/5/27

2019/5/28

41 2019/5/29

42

2019/5/30

1 Date

23

45

ORG

ORG

5

2 2019/4/1

2019/4/2

4 2019/4/3

2019/4/4

6

2019/4/5

7

2019/4/8

8

2019/4/9

9 2019/4/10

10

2019/4/11

11 2019/4/12

12

2019/4/15

13

2019/4/16

14

2019/4/17

15 2019/4/18

16

2019/4/23

17

2019/4/24

18

2019/4/26

19

2019/4/29

20

2019/4/30

21

2019/5/1

22

2019/5/2

23

2019/5/3

24

2019/5/6

25

2019/5/7

26

2019/5/8

27

2019/5/9

28 2019/5/10

29 2019/5/13

30 2019/5/14

31

2019/5/15

32

2019/5/16

33

2019/5/17

34

2019/5/20

35

2019/5/21

36

2019/5/22

37

2019/5/23

38

2019/5/24

39

40

2019/5/27

2019/5/28

2019/5/29

41

43

44

42 2019/5/30

2019/5/31

2019/6/3

Data Date

2014/6/30

2014Q2

2014/9/30 201403

2014/12/31 201404

2015/3/31 201501

2015/6/30 201502

2015/9/30 201503

2015/12/31 201504

Data Calendar Year_Quarter

2016/3/31 2016Q1

2016/6/30

2016Q2

2016/9/30 2016Q3

43 2019/5/31

ASX Daily Returns (%)

44 2019/6/3

45 2019/6/4

0.5873

0.4086

0.6824

-0.8305

46 2019/6/5

47 2019/6/6

48 2019/6/7

49 2019/6/11

-0.8263

0.6487

0.0064

50 2019/6/12

2019/6/13

51

52 2019/6/14

0.0273

-0.3985

0.8486

53 2019/6/17

2019/6/18

0.0016 54

0.4159 55

2019/6/19

-0.3345 56

2019/6/20

2019/6/21

58 2019/6/24

0.0543 57

0.9521

0.9922 59 2019/6/25

0.0548 60 2019/6/26

-0.4087 61 2019/6/27

-0.5346 62

2019/6/28

0.7968 63

2019/7/1

-0.5882 64

2019/7/2

-0.0410 65 2019/7/3

-0.8223 66

0.1910 67

-0.4225 68

2016/12/31 201604

2017/3/31 2017Q1

2017/6/30 2017Q2

2017/9/30 201703

2017/12/31 201704

2018/3/31 2018Q1

2018/6/30 201802

2018/9/30 2018Q3

2018/12/31 201804

2019/3/31 2019Q1

2019/7/4

2019/7/5

2019/7/8

0.4179 69 2019/7/9

0.2478 70

2019/7/10

-0.2107 71 2019/7/11

-0.9162 72 2019/7/12

0.7099 73

2019/7/15

0.6938 74 2019/7/16

0.5926 75 2019/7/17

1.7407 76

2019/7/18

0.3706 77 2019/7/19

0.1631 78 2019/7/22

-0.2903 79 2019/7/23

-0.5515 80

2019/7/24

-0.0635 81

2019/7/25

0.5099 82

2019/7/26

-0.6908 83

2019/7/29

-0.7438 84 2019/7/30

0.0751

-1.1943

0.1883 83

0.4122

0.3853

84

0.9541 85

1.5891 86

-0.0397

-0.0199

87

0.1773 88

-0.3525

89

0.5987

1.1887 90

0.5911

91

-0.5473

0.2195 92

-0.1110

93

-0.2628

0.3885 94

-0.7125

95

0.4427

0.0767 96

0.4855 97

0.4861

0.4957 98

-1.1716

-0.0974

0.3616 100

0.3931 101

-0.2918

-0.6496

-0.1804 103

0.4864

IORD Close

7.15 45

7.14 46

7.18 47

7.11 48

QE(t)

104.0

-35.5

-12.5

0.0

0.0

-141.0

-141.0

-167.5

-167.5

-689.0

-748.0

OO

2019/7/29

2019/7/30

2019/7/31

2019/8/1

2019/8/2

2019/8/5

2019/8/6

2019/8/7

2019/8/8

2019/8/9

2019/8/12

2019/8/13

2019/8/14

2019/8/15

2019/8/16

2019/8/19

99 2019/8/20

2019/8/21

2019/8/22

102 2019/8/23

2019/8/26

104

2019/8/27

-0.3626

0.7700 105 2019/8/28

-0.1358

106

2019/8/29

0.4992

0.7748 107

2019/8/30

0.6094

-0.3608

0.4769

0.2828

0.0

0.0

-68.0

-68.0

208.0

208.0

398.0

398.0

207.5

QE(t-1)

2019/7/10

2019/7/11

2019/7/12

2019/7/15

2019/7/16

2019/7/17

2019/7/18

2019/7/19

2019/7/22

2019/7/23

2019/7/24

2019/7/25

2019/7/26

104.0

104.0

-35.5

-12.5

2019/6/4

2019/6/5

2019/6/6

2019/6/7

7.1 49

2019/6/11

7.25 50

2019/6/12

7.31 51

2019/6/13

7.23 52

2019/6/14

7.2 53

2019/6/17

7.25 54

2019/6/18

7.29 55

2019/6/19

7.29

56

2019/6/20

7.3 57

2019/6/21

7.32 58

2019/6/24

7.57

59

2019/6/25

7.57

60 2019/6/26

7.48

61 2019/6/27

7.45

62 2019/6/28

7.37

63

2019/7/1

7.66

64

2019/7/2

7.66

65

2019/7/3

7.52

66

2019/7/4

7.41

67

2019/7/5

7.52

68

2019/7/8

7.4

69

2019/7/9

7.44

70

7.51

7.45 71

7.26 72

7.44 73

7.74 74

7.89 75

7.97 76

7.85 77

7.86 78

7.72 79

7.51 80

7.59 81

7.69 82

7.5 83

7.34 84

7.18

85

7.1

2019/7/29

2019/7/30

2019/7/31

OO

0.0

0.0

QE(t-4) QE(t-5)

-73.0

161.0

161.0

104.0

104.0

-35.5

-12.5

-141.0

-141.0

-167.5

-167.5 -141.0

-689.0

-141.0

-141.0

-748.0

-167.5

-141.0

0.0 -167.5 -167.5

0.0

-689.0 -167.5

-68.0

-748.0

-68.0

-689.0

-748.0

0.0

208.0

208.0

0.0

398.0

398.0

0.0

0.0

000

-73.0

-73.0

161.0

161.0

104.0

104.0

-35.5

-12.5

0.0

0.0

-68.0

-68.0

208.0

-68.0

-68.0

0.0

0.0

0.4769

0.2828

-0.4748

-0.3479

-0.2990

-1.8955

-2.4427

0.6391

0.7455

0.2482

0.0896

-0.3308

0.4171

-2.8472

-0.0406

966

1.1999

-0.9427

0.2853

0.3276

-1.2724

0.4829

0.4543

0.1046

1.4875

7.11

7.08

7.06

7.08

7.19

7.15

6.95

7.02

6.91

6.91

7.04

7.26

7.35

7.34

7.32

7.34

7.46

7.31

7.39

7.41

7.43

7.47

7.65

7.58

7.42

7.45

7.52

7.53

7.43

7.42

7.43

7.36

7.51

7.58

7.69

7.75

7.76

7.85

7.86

7.86

7.94

Transcribed Image Text:Use the dataset ORG_QEarnings

and perform the following regression:

QE QEt-4 = a + ß* (QEt-1 - QEt-5) + Et

where QE denotes quarterly earnings of Origin Energy Ltd in quarter t. a is the

constant term (i.e., the intercept) and & is the error term. The regression should be

performed using 20 quarters of earnings data.

Report your regression estimates in the table below:

α =

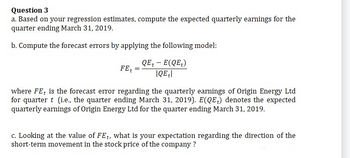

Question 3

a. Based on your regression estimates, compute the expected quarterly earnings for the

quarter ending March 31, 2019.

b. Compute the forecast errors by applying the following model:

QE+ - E(QE₂)

|QE|

FEt

B =

=

where FE is the forecast error regarding the quarterly earnings of Origin Energy Ltd

for quarter t (i.e., the quarter ending March 31, 2019). E(QE) denotes the expected

quarterly earnings of Origin Energy Ltd for the quarter ending March 31, 2019.

c. Looking at the value of FEt, what is your expectation regarding the direction of the

short-term movement in the stock price of the company?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Q3

Transcribed Image Text:Question 3

a. Based on your regression estimates, compute the expected quarterly earnings for the

quarter ending March 31, 2019.

b. Compute the forecast errors by applying the following model:

QE+ - E(QE₂)

|QE|

FE

=

where FE is the forecast error regarding the quarterly earnings of Origin Energy Ltd

for quarter t (i.e., the quarter ending March 31, 2019). E(QE) denotes the expected

quarterly earnings of Origin Energy Ltd for the quarter ending March 31, 2019.

c. Looking at the value of FEt, what is your expectation regarding the direction of the

short-term movement in the stock price of the company?

Solution

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman