three checks outstanding on October 31: no. 1417 for $110.00, no. 1420 for $144.35, and no. 1422 for $151.00. Check no. 1417 and no. 1422 were returned with the November bank statement; however, check no. 1420 was not returned. Check no. 1500 for $160.00, no. 1517 for $147.00, no. 1518 for $243.00, and no. 1519 for $146.15 were written during November and have not been returned by the bank. A deposit of $935 was placed in the night depository on November 30 and did not appear on the bank statement. The canceled checks were compared with the entries in the checkbook, and it was observed that check no. 1487, for $24, was written correctly, payable to M. A. Golden, the owner, for

three checks outstanding on October 31: no. 1417 for $110.00, no. 1420 for $144.35, and no. 1422 for $151.00. Check no. 1417 and no. 1422 were returned with the November bank statement; however, check no. 1420 was not returned. Check no. 1500 for $160.00, no. 1517 for $147.00, no. 1518 for $243.00, and no. 1519 for $146.15 were written during November and have not been returned by the bank. A deposit of $935 was placed in the night depository on November 30 and did not appear on the bank statement. The canceled checks were compared with the entries in the checkbook, and it was observed that check no. 1487, for $24, was written correctly, payable to M. A. Golden, the owner, for

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

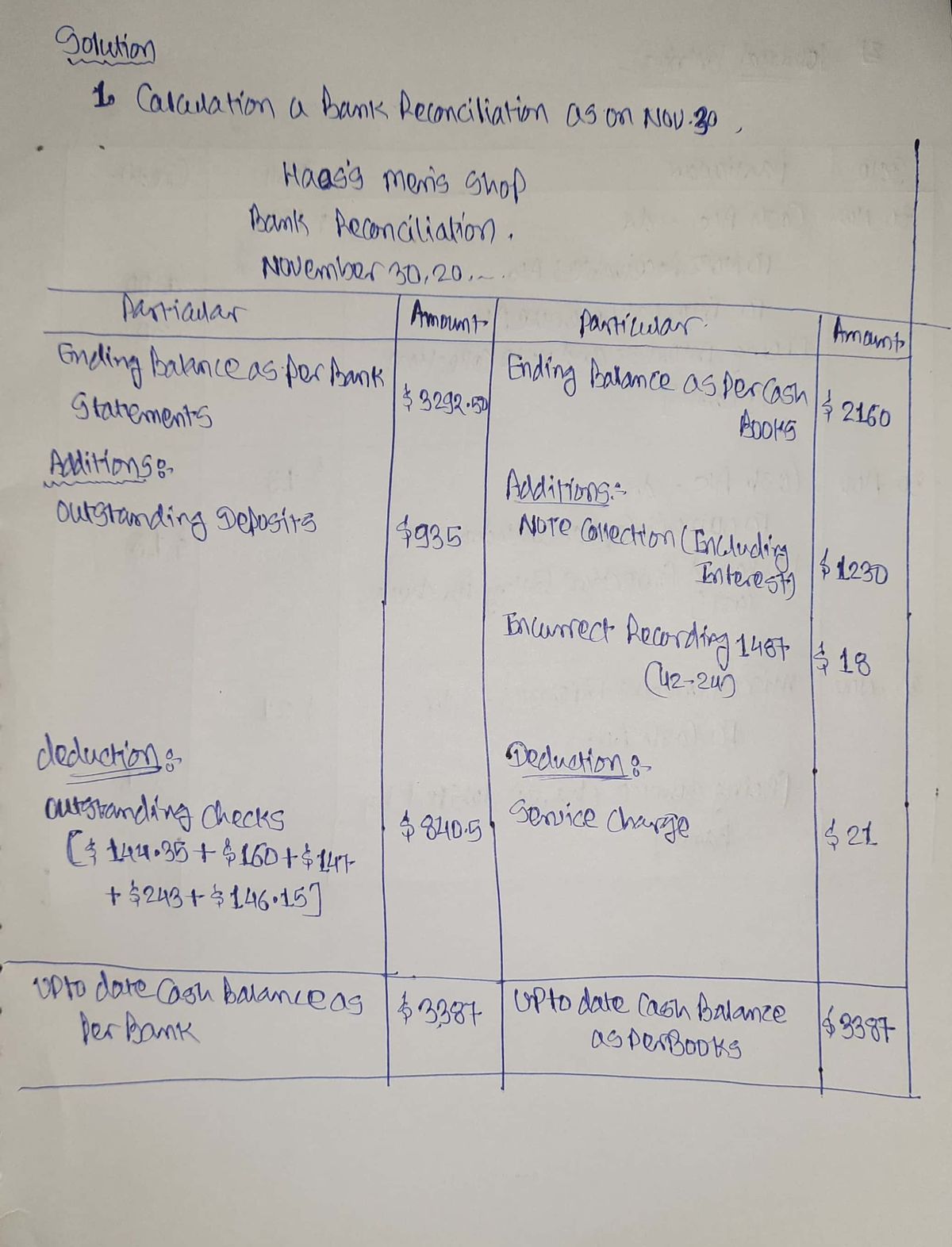

Haas's Men's Shop deposits all receipts in the bank each evening and makes all payments by check. On November 30, its ledger balance of cash is $2,160.00. The bank statement balance of cash as of November 30 is $3,292.50. Use the following information to reconcile the bank statement:

- The reconciliation for October, the previous month, showed three checks outstanding on October 31: no. 1417 for $110.00, no. 1420 for $144.35, and no. 1422 for $151.00. Check no. 1417 and no. 1422 were returned with the November bank statement; however, check no. 1420 was not returned.

- Check no. 1500 for $160.00, no. 1517 for $147.00, no. 1518 for $243.00, and no. 1519 for $146.15 were written during November and have not been returned by the bank.

- A deposit of $935 was placed in the night depository on November 30 and did not appear on the bank statement.

- The canceled checks were compared with the entries in the checkbook, and it was observed that check no. 1487, for $24, was written correctly, payable to M. A. Golden, the owner, for personal use, but was recorded in the checkbook as $42.

- Included in the bank statement was a bank debit memo for service charges, $21.

- A bank credit memo was also enclosed for the collection of a note signed by C.G. Tolson, $1,230.00, including $1,200 principal and $30.00 interest.

Transcribed Image Text:# General Journal Entry Template

## Overview

This section provides a template for recording general journal entries in accounting. It includes fields for dates, descriptions, post references, debits, and credits. Always ensure accuracy in record-keeping to maintain financial integrity.

## Journal Entry Fields

### 1. Date

- Year: 20--

- Entries provided for November 30th.

### 2. Description

- Line 1: Error in recording Check No. 1487.

- Line 2: Bank collected note signed by C. G. Tolson.

### 3. Post Reference (POST. REF.)

- Space for indicating reference numbers or details.

### 4. Debit and Credit Columns

- Spaces for recording debit and credit amounts are provided with options to leave blanks if not applicable.

- Ensure amounts are rounded to two decimal places for precision.

## Instructions

- Record the necessary entries clearly and accurately.

- If an amount box does not require an entry, leave it blank.

- Review all entries to verify correctness.

This template is crucial for ensuring clear and accurate financial documentation, facilitating effective bookkeeping practices.

Transcribed Image Text:**Bank Reconciliation Educational Example**

1. **Task**: Prepare a bank reconciliation as of November 30, assuming the debit and credit memos have not been recorded. Round your answers to two decimal places.

**Haas's Men's Shop**

**Bank Reconciliation**

**November 30, 20--**

**Bank Statement Balance**

- Input fields for amounts.

**Subsections:**

- Lines are provided to list specific transaction adjustments such as checks numbered 1420, 1500, 1517, 1518, and 1519. Each line has an associated input field for dollar amounts.

**Adjusted Bank Statement Balance**

- Input field to calculate and enter the adjusted balance after considering the checks and transactions listed.

**Ledger Balance of Cash**

- Input fields are provided to enter details and the final adjusted cash balance in the ledger.

This setup guides students in reconciling bank statements by factoring in outstanding checks and deposits to match the ledger balance of cash with the bank statement after adjustments.

Expert Solution

Step 1

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education