This information relates to Monty Real Estate Agency. Oct. 1 2 3 6 10 27 30 Stockholders invest $30,000 in exchange for common stock of the corporation. Hires an administrative assistant at an annual salary of $31,080. Buys office furniture for $3,700, on account. Sells a house and lot for E. C. Roads; commissions due from Roads, $10,090 (not paid by Roads at this time). Receives cash of $220 as commission for acting as rental agent renting an apartment. Pays $630 on account for the office furniture purchased on October 3. Pays the administrative assistant $2,590 in salary for October.

This information relates to Monty Real Estate Agency. Oct. 1 2 3 6 10 27 30 Stockholders invest $30,000 in exchange for common stock of the corporation. Hires an administrative assistant at an annual salary of $31,080. Buys office furniture for $3,700, on account. Sells a house and lot for E. C. Roads; commissions due from Roads, $10,090 (not paid by Roads at this time). Receives cash of $220 as commission for acting as rental agent renting an apartment. Pays $630 on account for the office furniture purchased on October 3. Pays the administrative assistant $2,590 in salary for October.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

![**Title: Understanding T-Accounts and Month-End Balances**

**Objective:**

Learn how to post transactions to T-accounts and determine month-end balances.

---

**Instructions:**

Post the transactions to T-accounts and determine month-end balances. (Post entries in the order of information presented in the question.)

---

**T-Accounts:**

1. **Cash**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- [Dropdown for transaction selection]

- [Input field for amount]

2. **Accounts Receivable**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

3. **Equipment**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

4. **Accounts Payable**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

5. **Common Stock**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

6. **Service Revenue**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

7. **Salaries and Wages Expense**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

---

**Explanation:**

This table represents an interactive worksheet used to understand and analyze T-accounts for various financial accounts by filling out corresponding debit and credit transactions.

- Each row represents a financial account: Cash, Accounts Receivable, Equipment, Accounts Payable, Common Stock, Service](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F0d1f03dc-16fb-4834-9136-6d6472c9ed62%2F86d70346-3cfc-438c-9ef5-5cbc93ea06fb%2Fgg6f2ix_processed.jpeg&w=3840&q=75)

Transcribed Image Text:**Title: Understanding T-Accounts and Month-End Balances**

**Objective:**

Learn how to post transactions to T-accounts and determine month-end balances.

---

**Instructions:**

Post the transactions to T-accounts and determine month-end balances. (Post entries in the order of information presented in the question.)

---

**T-Accounts:**

1. **Cash**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- [Dropdown for transaction selection]

- [Input field for amount]

2. **Accounts Receivable**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

3. **Equipment**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

4. **Accounts Payable**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

5. **Common Stock**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

6. **Service Revenue**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

7. **Salaries and Wages Expense**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

---

**Explanation:**

This table represents an interactive worksheet used to understand and analyze T-accounts for various financial accounts by filling out corresponding debit and credit transactions.

- Each row represents a financial account: Cash, Accounts Receivable, Equipment, Accounts Payable, Common Stock, Service

Transcribed Image Text:### Monty Real Estate Agency - Transactions and Journal Entries for October

Below are the recorded financial transactions for Monty Real Estate Agency during the month of October, along with their respective journal entries.

#### October Transactions:

1. **Oct. 1**

- Stockholders invest $30,000 in exchange for common stock of the corporation.

2. **Oct. 2**

- Hired an administrative assistant at an annual salary of $31,080.

3. **Oct. 3**

- Purchased office furniture for $3,700 on account.

4. **Oct. 6**

- Sold a house and lot for E.C. Roads; commissions due from Roads, $10,090 (not paid by Roads at this time).

5. **Oct. 10**

- Received $220 as a commission for acting as rental agent renting an apartment.

6. **Oct. 27**

- Paid $630 on account for the office furniture purchased on October 3.

7. **Oct. 30**

- Paid the administrative assistant $2,590 in salary for October.

#### Journal Entries:

| Date | Account Titles and Explanation | Debit | Credit |

|-----------|-----------------------------------------|---------|---------|

| Oct. 1 | **Cash** | 30,000 | |

| | **Common Stock** | | 30,000 |

| Oct. 2 | No entry | | |

| Oct. 3 | **Equipment** | 3,700 | |

| | **Accounts Payable** | | 3,700 |

| Oct. 6 | **Accounts Receivable** | 10,090 | |

| | **Service Revenue** | | 10,090 |

| Oct. 10 | **Cash** | 220 | |

| | **Service Revenue** | | 220 |

| Oct. 27 | **Accounts Payable** | 630 | |

| | **Cash** | | 630 |

| Oct. 30 | **Salaries and Wages Expense** | 2,590 | |

| | **Cash** | | 2,590 |

### Explanation of Entries

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

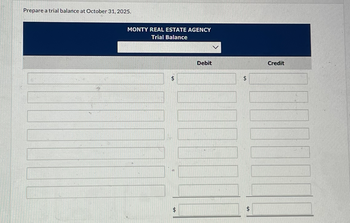

Transcribed Image Text:Prepare a trial balance at October 31, 2025.

MONTY REAL ESTATE AGENCY

Trial Balance

A

$

Debit

$

$

Credit

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education