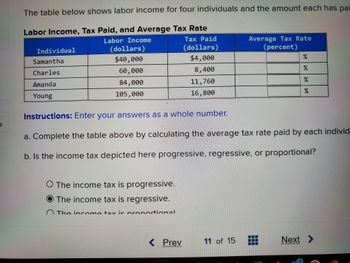

The table below shows labor income for four individuals and the amount each has paid in income taxes. Labor Income, Tax Paid, and Average Tax Rate Individual Labor Income (dollars) Tax Paid (dollars) Average Tax Rate (percent) Samantha $45,000 $3,600 ________% Charles 65,000 6,500 ________% Amanda 82,000 13,120 ________% Young 110,000 119,800 ________% Instructions: Enter your answers as a whole number. Complete the table above by calculating the average tax rate paid by each individual. Is the income tax depicted here progressive, regressive, or proportional? ____ The income tax is progressive. ____ The income tax is proportional. ____ The income tax is regressive.

The table below shows labor income for four individuals and the amount each has paid in income taxes.

Labor Income, Tax Paid, and Average Tax Rate

Individual Labor Income (dollars) Tax Paid (dollars) Average Tax Rate (percent)

Samantha $45,000 $3,600 ________%

Charles 65,000 6,500 ________%

Amanda 82,000 13,120 ________%

Young 110,000 119,800 ________%

Instructions: Enter your answers as a whole number.

- Complete the table above by calculating the average tax rate paid by each individual.

- Is the income tax depicted here progressive, regressive, or proportional?

____ The income tax is progressive.

____ The income tax is proportional.

____ The income tax is regressive.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps