The Lyns live in their own home at 40 Cavin Ave, on which they have a mortgage balance of $2,000,000. This property has been appraised at $8,500,000 and is now up for sale at its current market value. A purchaser has been identified but the proceeds from the sale is not due to be paid to the Lyns until November 30, 2020. In the meantime the Lyns have contracted to purchase a new home at Wex Haven for $17,000, 000, although this property is valued at only $16,000,000. The sale agreement on this property requires a deposit of 20% on signing which will take place on June 1, 2020, with the balance which will not be covered by a mortgage, payable in 30 days after signing. Based on their high salaries, North Caribbean Building Society have pre-approved the Lyns for a 25-year mortgage of 75% of purchase price or value, whichever is less,up to a maximum of $20,000,000. This will attract an interest rate of 5.50% per annum with monthly compounding and will be disbursed on September 30, 2020. New World Bank Ltd, a commercial bank , is offering a bridging loan of up to $17,000,000 for 120 days at an interest rate of 8.50% per annum on the reducing balance and the Lyns will only use the minimum amount needed of this loan. A closing cost of $450,000, which must be paid on signing of the sale agreement, will be associated with purhase of the new home. The Lyns also have savings of $ 1,450,000 which will be available for use in their new home transactions. Final payment for the new property, possession of both properties and disbursement of the bridging loan will take place on August 1, 2020. The Lyns also have a bond with a face value of $10,000,000 that will mature on September 29, 2030. In the event that the Lyns decide to use proceeds from the bond immediately it matures to pay off their mortgage, will they have sufficient funds to do so? How much interest will they have paid over the period? This question must be manually calculated showing all workings

The Lyns live in their own home at 40 Cavin Ave, on which they have a mortgage balance of $2,000,000. This property has been appraised at $8,500,000 and is now up for sale at its current market value. A purchaser has been identified but the proceeds from the sale is not due to be paid to the Lyns until November 30, 2020.

In the meantime the Lyns have contracted to purchase a new home at Wex Haven for $17,000, 000, although this property is valued at only $16,000,000. The sale agreement on this property requires a deposit of 20% on signing which will take place on June 1, 2020, with the balance which will not be covered by a mortgage, payable in 30 days after signing.

Based on their high salaries, North Caribbean Building Society have pre-approved the Lyns for a 25-year mortgage of 75% of purchase price or value, whichever is less,up to a maximum of $20,000,000. This will attract an interest rate of 5.50% per annum with monthly compounding and will be disbursed on September 30, 2020.

New World Bank Ltd, a commercial bank , is offering a bridging loan of up to $17,000,000 for 120 days at an interest rate of 8.50% per annum on the reducing balance and the Lyns will only use the minimum amount needed of this loan.

A closing cost of $450,000, which must be paid on signing of the sale agreement, will be associated with purhase of the new home.

The Lyns also have savings of $ 1,450,000 which will be available for use in their new home transactions.

Final payment for the new property, possession of both properties and disbursement of the bridging loan will take place on August 1, 2020.

The Lyns also have a bond with a face value of $10,000,000 that will mature on September 29, 2030.

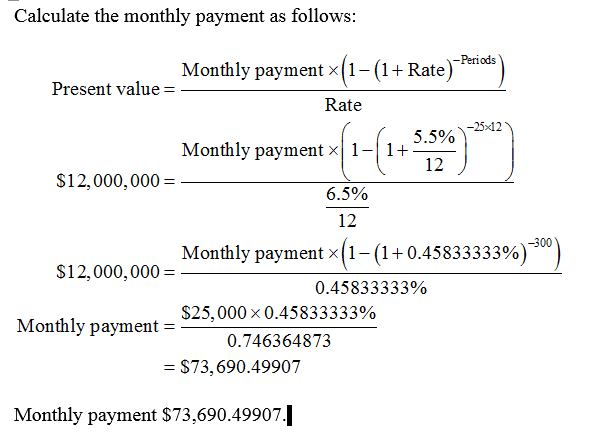

In the event that the Lyns decide to use proceeds from the bond immediately it matures to pay off their mortgage, will they have sufficient funds to do so? How much interest will they have paid over the period? This question must be manually calculated showing all workings

Loan amount is 75% of purchase price or property value which ever is lower maximum up to $20,000,000

75% of price = $17,000,000 *75% = $12,750,000

75% of value = $16,000,000 *75% = $12,000,000

Loan borrowed is $12,000,000

Step by step

Solved in 4 steps with 2 images