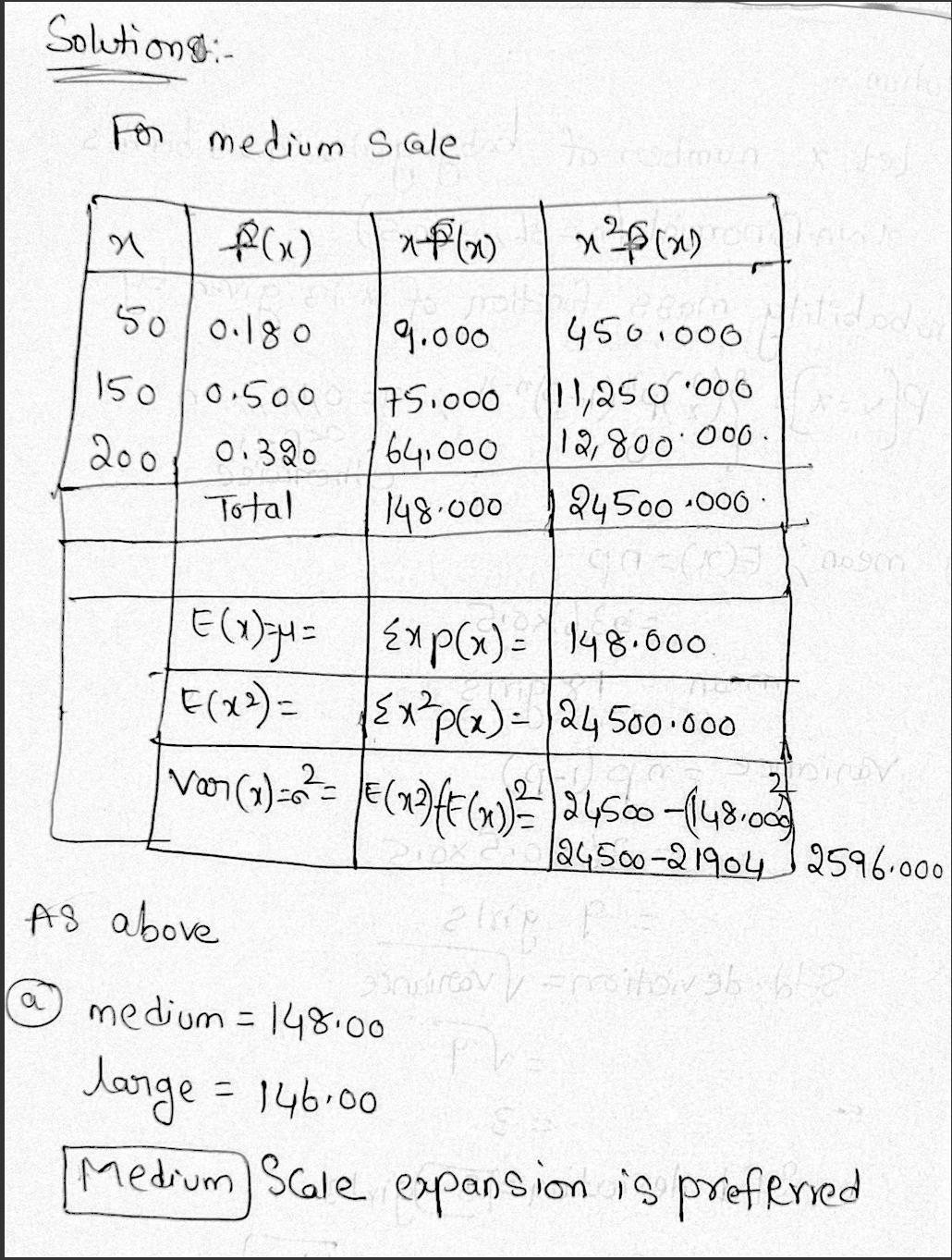

The J. R. Ryland Computer Company is considering a plant expansion to enable the company to begin production of a new computer product. The company's president must determine whether to make the expansion a medium- or large-scale project. Demand for the new product is uncertain, which for planning purposes may be low demand, medium demand, or high demand. The probability estimates for demand are 0.18, 0.50, and 0.32, respectively. Letting x and Y indicate the annual profit in thousands of dollars, the firm's planners developed the following profit forecasts for the medium- and large-scale expansion projects. Medium-Scale Large-Scale Expansion Profit Expansion Profit f(x) f(y) Low 50 0.18 0.18 Demand Medium 150 0.50 100 0.50 High 200 0.32 300 0.32 a. Compute the expected value (to 2 decimals) for the profit associated with the two expansion alternatives. thousand Medium $ 148 thousand $ 146 Large Which decision is preferred for the objective of maximizing the expected profit? Medium preferred. b. Compute the variance (to 2 decimals) for the profit associated with the two expansion alternatives. Medium Large Which decision is preferred for the objective of minimizing the risk or uncertainty? Medium preferred. Hide Feedback Partially Correct

The J. R. Ryland Computer Company is considering a plant expansion to enable the company to begin production of a new computer product. The company's president must determine whether to make the expansion a medium- or large-scale project. Demand for the new product is uncertain, which for planning purposes may be low demand, medium demand, or high demand. The probability estimates for demand are 0.18, 0.50, and 0.32, respectively. Letting x and Y indicate the annual profit in thousands of dollars, the firm's planners developed the following profit forecasts for the medium- and large-scale expansion projects. Medium-Scale Large-Scale Expansion Profit Expansion Profit f(x) f(y) Low 50 0.18 0.18 Demand Medium 150 0.50 100 0.50 High 200 0.32 300 0.32 a. Compute the expected value (to 2 decimals) for the profit associated with the two expansion alternatives. thousand Medium $ 148 thousand $ 146 Large Which decision is preferred for the objective of maximizing the expected profit? Medium preferred. b. Compute the variance (to 2 decimals) for the profit associated with the two expansion alternatives. Medium Large Which decision is preferred for the objective of minimizing the risk or uncertainty? Medium preferred. Hide Feedback Partially Correct

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:The J. R. Ryland Computer Company is considering a plant expansion to enable the company to begin

production of a new computer product. The company's president must determine whether to make the

expansion a medium- or large-scale project. Demand for the new product is uncertain, which for planning

purposes may be low demand, medium demand, or high demand. The probability estimates for demand are

0.18, 0.50, and 0.32, respectively. Letting x and Y indicate the annual profit in thousands of dollars, the firm's

planners developed the following profit forecasts for the medium- and large-scale expansion projects.

Medium-Scale

Large-Scale

Expansion Profit

Expansion Profit

f(x)

f(y)

Low

50

0.18

0.18

Demand

Medium

150

0.50

100

0.50

High

200

0.32

300

0.32

a. Compute the expected value (to 2 decimals) for the profit associated with the two expansion alternatives.

thousand

Medium

$

148

thousand

$

146

Large

Which decision is preferred for the objective of maximizing the expected profit?

Medium

preferred.

b. Compute the variance (to 2 decimals) for the profit associated with the two expansion alternatives.

Medium

Large

Which decision is preferred for the objective of minimizing the risk or uncertainty?

Medium

preferred.

Hide Feedback

Partially Correct

Expert Solution

Step 1

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman