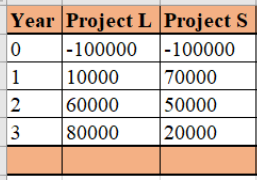

The information below is for a firm that seeks to invest in any of the two projects namely Project L and S with an initial investment of K100,000 Here are the projects' net cash flows (in thousands of kwachas): Year 0 1 2 3 Project L -100,000 10,000 Project S -100,000 70,000 Depreciation, salvage values, net working capital requirements, and tax effects are all included in these cash flows. The Chief Financial Officer (CFO) also made subjective risk assessments of each project, and he concluded that both projects have risk characteristics that are similar to the firm's average project. The cost of capital is 10%. You must determine whether one or both of the projects should be accepted. 60,000 50,000 80,000 20,000

The information below is for a firm that seeks to invest in any of the two projects namely Project L and S with an initial investment of K100,000 Here are the projects' net cash flows (in thousands of kwachas): Year 0 1 2 3 Project L -100,000 10,000 Project S -100,000 70,000 Depreciation, salvage values, net working capital requirements, and tax effects are all included in these cash flows. The Chief Financial Officer (CFO) also made subjective risk assessments of each project, and he concluded that both projects have risk characteristics that are similar to the firm's average project. The cost of capital is 10%. You must determine whether one or both of the projects should be accepted. 60,000 50,000 80,000 20,000

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Transcribed Image Text:QUESTION 2

The information below is for a firm that seeks to invest in any of the two projects

namely Project L and S with an initial investment of K100,000

Here are the projects' net cash flows (in thousands of kwachas):

Year

0

1

2

3

80,000

20,000

Project

L

Project S

Depreciation, salvage values, net working capital requirements, and tax effects

are all included in these cash flows. The Chief Financial Officer (CFO) also made

subjective risk assessments of each project, and he concluded that both projects

have risk characteristics that are similar to the firm's average project. The cost of

capital is 10%. You must determine whether one or both of the projects should be

accepted.

(a)

(b)

-100,000

10,000

-100,000 70,000

(c)

60,000

50,000

What is capital budgeting?

Calculate the project's NPV for project L and S. State which project should

be selected if the projects are:

i independent

ii) Exclusive

Calculate the payback period for project L and S. State which project

should be selected if the projects are:

i independent

ii) Exclusive

Expert Solution

Step 1

Given,

Step by step

Solved in 3 steps with 5 images

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education