The Giant Machinery has the current capital structure of 65% equity and 35% debt. Its net income inthe current year is $250,000. The company is planning to launch a project that will requires aninvestment of $175,000 next year. Currently the share of Giant machinery is $25/share.Required: How much dividend Giant Machinery can pay its shareholders this year and what is dividendpayout ratio of the company? Assume the Residual Dividend Payout Policy applies.

The Giant Machinery has the current capital structure of 65% equity and 35% debt. Its net income inthe current year is $250,000. The company is planning to launch a project that will requires aninvestment of $175,000 next year. Currently the share of Giant machinery is $25/share.Required: How much dividend Giant Machinery can pay its shareholders this year and what is dividendpayout ratio of the company? Assume the Residual Dividend Payout Policy applies.

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 15P

Related questions

Question

The Giant Machinery has the current capital structure of 65% equity and 35% debt. Its net income in

the current year is $250,000. The company is planning to launch a project that will requires an

investment of $175,000 next year. Currently the share of Giant machinery is $25/share.

Required:

How much dividend Giant Machinery can pay its shareholders this year and what is dividend

payout ratio of the company? Assume the Residual Dividend Payout Policy applies.

Expert Solution

Step 1

Given information:

Net profit of company is $250,000

Investment required is $175,000

Market value of stock is $25

Capital structure: Equity is 65%, Debt is 35%

Step 2

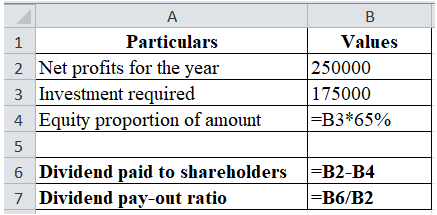

Calculation of dividend paid to shareholders and dividend pay-out ratio:

Excel workings:

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning