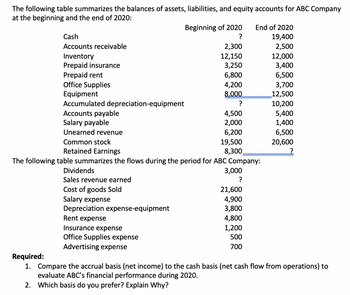

The following table summarizes the balances of assets, liabilities, and equity accounts for ABC Company at the beginning and the end of 2020: Cash Accounts receivable Inventory Prepaid insurance Prepaid rent Office Supplies Equipment Accumulated depreciation-equipment Accounts payable Salary payable Beginning of 2020 ? Dividends Sales revenue earned Cost of goods Sold Salary expense Depreciation expense-equipment Rent expense Insurance expense Office Supplies expense Advertising expense 2,300 12,150 3,250 6,800 4,200 8,000 ? 4,500 2,000 Unearned revenue 6,200 Common stock 19,500 Retained Earnings 8,300 The following table summarizes the flows during the period for ABC Company: 3,000 ? 21,600 4,900 3,800 End of 2020 19,400 2,500 12,000 3,400 6,500 3,700 12,500 10,200 5,400 1,400 6,500 20,600 4,800 1,200 500 700 Required: 1. Compare the accrual basis (net income) to the cash basis (net cash flow from operations) to evaluate ABC's financial performance during 2020. 2. Which basis do you prefer? Explain Why?

The following table summarizes the balances of assets, liabilities, and equity accounts for ABC Company at the beginning and the end of 2020: Cash Accounts receivable Inventory Prepaid insurance Prepaid rent Office Supplies Equipment Accumulated depreciation-equipment Accounts payable Salary payable Beginning of 2020 ? Dividends Sales revenue earned Cost of goods Sold Salary expense Depreciation expense-equipment Rent expense Insurance expense Office Supplies expense Advertising expense 2,300 12,150 3,250 6,800 4,200 8,000 ? 4,500 2,000 Unearned revenue 6,200 Common stock 19,500 Retained Earnings 8,300 The following table summarizes the flows during the period for ABC Company: 3,000 ? 21,600 4,900 3,800 End of 2020 19,400 2,500 12,000 3,400 6,500 3,700 12,500 10,200 5,400 1,400 6,500 20,600 4,800 1,200 500 700 Required: 1. Compare the accrual basis (net income) to the cash basis (net cash flow from operations) to evaluate ABC's financial performance during 2020. 2. Which basis do you prefer? Explain Why?

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. The year end adjustments are required to understand the accrual basis. Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Can you also fill in ‘?’ parts for me? thank you.

Transcribed Image Text:The following table summarizes the balances of assets, liabilities, and equity accounts for ABC Company

at the beginning and the end of 2020:

Cash

Accounts receivable

Inventory

Prepaid insurance

Prepaid rent

Office Supplies

Equipment

Accumulated depreciation-equipment

Accounts payable

Salary payable

Beginning of 2020

?

Dividends

Sales revenue earned

Cost of goods Sold

Salary expense

Depreciation expense-equipment

Rent expense

Insurance expense

Office Supplies expense

Advertising expense

2,300

12,150

3,250

6,800

4,200

8,000

?

4,500

2,000

Unearned revenue

6,200

Common stock

19,500

Retained Earnings

8,300

The following table summarizes the flows during the period for ABC Company:

3,000

?

21,600

4,900

3,800

End of 2020

19,400

2,500

12,000

3,400

6,500

3,700

12,500

10,200

5,400

1,400

6,500

20,600

4,800

1,200

500

700

Required:

1. Compare the accrual basis (net income) to the cash basis (net cash flow from operations) to

evaluate ABC's financial performance during 2020.

2. Which basis do you prefer? Explain Why?

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning