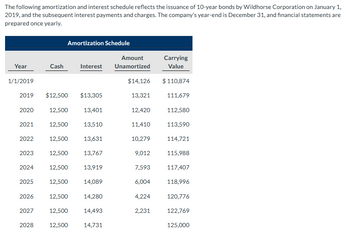

The following amortization and interest schedule reflects the issuance of 10-year bonds by Wildhorse Corporation on Janu 2019, and the subsequent interest payments and charges. The company's year-end is December 31, and financial statemen prepared once yearly. Year 1/1/2019 2020 2021 2019 $12,500 $13,305 12,500 2022 2023 2024 2025 2026 2027 Cash 2028 Amortization Schedule 12,500 12,500 12,500 12,500 12,500 12,500 12,500 Interest 12,500 13,401 13,510 13,631 13,767 13,919 14,089 14,280 14,493 14,731 Amount Unamortized $14,126 13,321 12,420 11,410 10,279 9,012 7,593 6,004 4,224 2,231 Carrying Value $ 110,874 111,679 112,580 113,590 114,721 115,988 117,407 118,996 120,776 122,769 125,000

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps