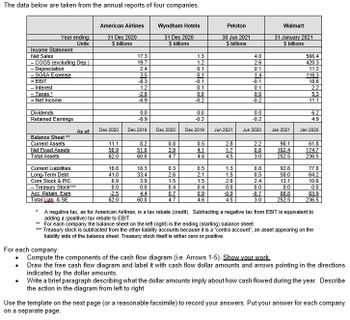

The data below are taken from the annual reports of four companies. ● Year ending: Units: Income Statement Net Sales - COGS (excluding Dep.) Depreciation - SG&A Expense EBIT - Interest - Taxes * = Net Income Dividends Retained Earnings Balance Sheet ** Current Assets Net Fixed Assets Total Assets Current Liabilities Long-Term Debt Com Stock & PIC - Treasury Stock*** Acc. Retain. Earn Total Liab. & SE * As of: American Airlines 31 Dec 2020 $ billions Dec 2020 11.1 50.9 62.0 16.6 41.0 6.9 0.0 -2.5 62.0 17.3 19.7 2.4 3.5 -8.3 1.2 -2.6 -6.9 0.0 -6.9 Dec 2019 8.2 51.8 60.0 18.3 33.4 3.9 0.0 4.4 60.0 Wyndham Hotels 31 Dec 2020 $ billions Dec 2020 0.8 3.9 4.7 0.3 2.6 1.5 0.4 0.7 4.7 1.3 1.2 0.1 0.1 -0.1 0.1 0.0 -0.2 0.0 -0.2 Dec 2019 0.5 4.1 4.6 0.5 2.1 1.5 0.4 0.9 4.6 Peloton 30 Jun 2021 $ billions Jun 2021 2.8 1.7 4.5 1.3 1.5 2.6 0.0 -0.9 4.5 4.0 2.6 0.1 1.4 -0.1 0.1 0.0 -0.2 0.0 -0.2 Jun 2020 2.2 0.8 Too 3.0 0.8 0.5 2.4 0.0 -0.7 3.0 Walmart 31 January 2021 $ billions Jan 2021 90.1 162.4 252.5 92.6 58.0 13.1 0.0 88.8 252.5 566.4 420.3 11.2 116.3 18.6 2.2 5.3 11.1 6.2 4.9 Jan 2020 61.8 174.7 236.5 77.8 64.2 10.6 0.0 83.9 236.5 A negative tax, as for American Airlines, is a tax rebate (credit). Subtracting a negative tax from EBIT is equivalent to adding a (positive) tax rebate to EBIT. ** For each company the balance sheet on the left (right) is the ending (starting) balance sheet. *** Treasury stock is subtracted from the other liability accounts because it is a "contra account", an asset appearing on the liability side of the balance sheet. Treasury stock itself is either zero or positive. For each company: Compute the components of the cash flow diagram (i.e. Arrows 1-5). Show your work. Draw the free cash flow diagram and label it with cash flow dollar amounts and arrows pointing in the directions indicated by the dollar amounts. Write a brief paragraph describing what the dollar amounts imply about how cash flowed during the year. Describe the action in the diagram from left to right Use the template on the next page (or a reasonable facsimile) to record your answers. Put your answer for each company on a separate page.

The data below are taken from the annual reports of four companies. ● Year ending: Units: Income Statement Net Sales - COGS (excluding Dep.) Depreciation - SG&A Expense EBIT - Interest - Taxes * = Net Income Dividends Retained Earnings Balance Sheet ** Current Assets Net Fixed Assets Total Assets Current Liabilities Long-Term Debt Com Stock & PIC - Treasury Stock*** Acc. Retain. Earn Total Liab. & SE * As of: American Airlines 31 Dec 2020 $ billions Dec 2020 11.1 50.9 62.0 16.6 41.0 6.9 0.0 -2.5 62.0 17.3 19.7 2.4 3.5 -8.3 1.2 -2.6 -6.9 0.0 -6.9 Dec 2019 8.2 51.8 60.0 18.3 33.4 3.9 0.0 4.4 60.0 Wyndham Hotels 31 Dec 2020 $ billions Dec 2020 0.8 3.9 4.7 0.3 2.6 1.5 0.4 0.7 4.7 1.3 1.2 0.1 0.1 -0.1 0.1 0.0 -0.2 0.0 -0.2 Dec 2019 0.5 4.1 4.6 0.5 2.1 1.5 0.4 0.9 4.6 Peloton 30 Jun 2021 $ billions Jun 2021 2.8 1.7 4.5 1.3 1.5 2.6 0.0 -0.9 4.5 4.0 2.6 0.1 1.4 -0.1 0.1 0.0 -0.2 0.0 -0.2 Jun 2020 2.2 0.8 Too 3.0 0.8 0.5 2.4 0.0 -0.7 3.0 Walmart 31 January 2021 $ billions Jan 2021 90.1 162.4 252.5 92.6 58.0 13.1 0.0 88.8 252.5 566.4 420.3 11.2 116.3 18.6 2.2 5.3 11.1 6.2 4.9 Jan 2020 61.8 174.7 236.5 77.8 64.2 10.6 0.0 83.9 236.5 A negative tax, as for American Airlines, is a tax rebate (credit). Subtracting a negative tax from EBIT is equivalent to adding a (positive) tax rebate to EBIT. ** For each company the balance sheet on the left (right) is the ending (starting) balance sheet. *** Treasury stock is subtracted from the other liability accounts because it is a "contra account", an asset appearing on the liability side of the balance sheet. Treasury stock itself is either zero or positive. For each company: Compute the components of the cash flow diagram (i.e. Arrows 1-5). Show your work. Draw the free cash flow diagram and label it with cash flow dollar amounts and arrows pointing in the directions indicated by the dollar amounts. Write a brief paragraph describing what the dollar amounts imply about how cash flowed during the year. Describe the action in the diagram from left to right Use the template on the next page (or a reasonable facsimile) to record your answers. Put your answer for each company on a separate page.

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Hi and thanks for your question! Unfortunately, your question violates our terms of use. Try rephrasing your question or asking a new one below. We've credited a question back to your account. Apologies for the inconvenience.

Your Question:

Transcribed Image Text:The data below are taken from the annual reports of four companies.

●

Year ending:

Units:

Income Statement

Net Sales

- COGS (excluding Dep.)

Depreciation

- SG&A Expense

EBIT

- Interest

- Taxes *

= Net Income

Dividends

Retained Earnings

Balance Sheet **

Current Assets

Net Fixed Assets

Total Assets

Current Liabilities

Long-Term Debt

Com Stock & PIC

- Treasury Stock***

Acc. Retain. Earn

Total Liab. & SE

*

As of:

American Airlines

31 Dec 2020

$ billions

Dec 2020

11.1

50.9

62.0

16.6

41.0

6.9

0.0

-2.5

62.0

17.3

19.7

2.4

3.5

-8.3

1.2

-2.6

-6.9

0.0

-6.9

Dec 2019

8.2

51.8

60.0

18.3

33.4

3.9

0.0

4.4

60.0

Wyndham Hotels

31 Dec 2020

$ billions

Dec 2020

0.8

3.9

4.7

0.3

2.6

1.5

0.4

0.7

4.7

1.3

1.2

0.1

0.1

-0.1

0.1

0.0

-0.2

0.0

-0.2

Dec 2019

0.5

4.1

4.6

0.5

2.1

1.5

0.4

0.9

4.6

Peloton

30 Jun 2021

$ billions

Jun 2021

2.8

1.7

4.5

1.3

1.5

2.6

0.0

-0.9

4.5

4.0

2.6

0.1

1.4

-0.1

0.1

0.0

-0.2

0.0

-0.2

Jun 2020

2.2

0.8

Too

3.0

0.8

0.5

2.4

0.0

-0.7

3.0

Walmart

31 January 2021

$ billions

Jan 2021

90.1

162.4

252.5

92.6

58.0

13.1

0.0

88.8

252.5

566.4

420.3

11.2

116.3

18.6

2.2

5.3

11.1

6.2

4.9

Jan 2020

61.8

174.7

236.5

77.8

64.2

10.6

0.0

83.9

236.5

A negative tax, as for American Airlines, is a tax rebate (credit). Subtracting a negative tax from EBIT is equivalent to

adding a (positive) tax rebate to EBIT.

** For each company the balance sheet on the left (right) is the ending (starting) balance sheet.

*** Treasury stock is subtracted from the other liability accounts because it is a "contra account", an asset appearing on the

liability side of the balance sheet. Treasury stock itself is either zero or positive.

For each company:

Compute the components of the cash flow diagram (i.e. Arrows 1-5). Show your work.

Draw the free cash flow diagram and label it with cash flow dollar amounts and arrows pointing in the directions

indicated by the dollar amounts.

Write a brief paragraph describing what the dollar amounts imply about how cash flowed during the year. Describe

the action in the diagram from left to right

Use the template on the next page (or a reasonable facsimile) to record your answers. Put your answer for each company

on a separate page.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,