The company's chater authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock and the following are the transactions for consideration: 1) KY Jewelers purchased a piece of land from the original owner. In payment for the land, KY Jewelers issues 300,000 shares of common stock with $1.00 par value. The land has been appraised at a marked value of $1,200,000. 2) The company sold 120,000 shares of common stock with $1 par value. 3) Issued 25,500 shares of $20 par value preferred stock. Shares were issued at par 4) Earned net income of $764,000 5) Dividend declared and paid -$0.15 per share on common stock 6) Dividend declared and paid -$5 per share on preferred stock A) Prepare Journal entries for the above B) Prepare closing entries for the above

The company's chater authorizes 1,000,000 shares of common stock and 100,000

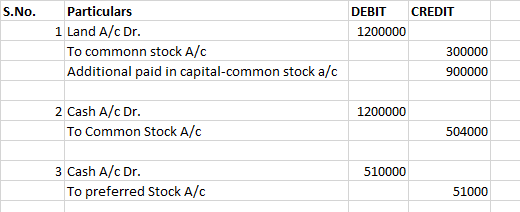

1) KY Jewelers purchased a piece of land from the original owner. In payment for the land, KY Jewelers issues 300,000 shares of common stock with $1.00 par value. The land has been appraised at a marked value of $1,200,000.

2) The company sold 120,000 shares of common stock with $1 par value.

3) Issued 25,500 shares of $20 par value preferred stock. Shares were issued at par

4) Earned net income of $764,000

5) Dividend declared and paid -$0.15 per share on common stock

6) Dividend declared and paid -$5 per share on preferred stock

A) Prepare

B) Prepare closing entries for the above

A & B :

Step by step

Solved in 2 steps with 2 images