Tammy had the following aggregate results from her 2019 investing activity: STCG $300,000 LTCG $450,000 STCL -$260,000 LTCL -$390,000 After the capital gain and loss netting procedure listed below 1.Classify as short-term or long-term based on holding period: •Short-termheld less than 12 months •Long-term held longer than 12 months 2. Net short-term and long-term gains and losses to obtain a net short-term and a net long-term position for the year. Collectibles gains and losses, gains on qualified small businessstock, and unrecaptured Section 1250 gains are treated as long-term gains and losses inthe netting procedure. Short-term capital gain $ XX Short-term capital loss (XX) Net short-term gain (loss) Short-term capital gain or loss Long-term capital gain $ XX Long-term capital loss (XX) Net long-term gain (loss) Long-term capital gain or loss 3.If long-term and short-term positions are the same(both gains, both losses), no further netting is done. 4.If long-term and short-term positions are opposite(1 gain, 1 loss), net again to produce either a gain or loss.

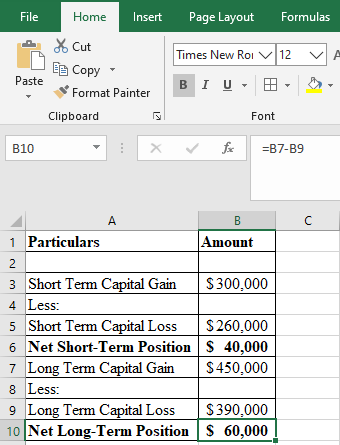

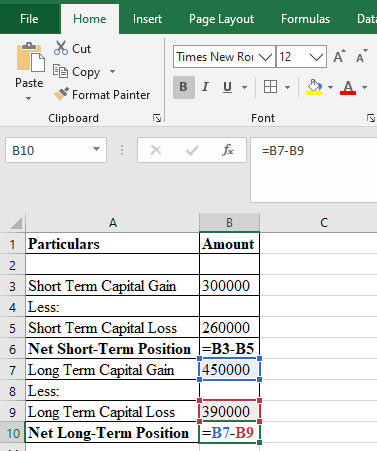

Tammy had the following aggregate results from her 2019 investing activity:

- STCG $300,000

- LTCG $450,000

- STCL -$260,000

- LTCL -$390,000

After the

1.Classify as short-term or long-term based on holding period:

•Short-termheld less than 12 months

•Long-term held longer than 12 months

2. Net short-term and long-term gains and losses to obtain a net short-term and a net long-term position for the year. Collectibles gains and losses, gains on qualified small businessstock, and unrecaptured Section 1250 gains are treated as long-term gains and losses inthe netting procedure.

Short-term capital gain $ XX

Short-term capital loss (XX)

Net short-term gain (loss) Short-term capital gain or loss

Long-term capital gain $ XX

Long-term capital loss (XX)

Net long-term gain (loss) Long-term capital gain or loss

3.If long-term and short-term positions are the same(both gains, both losses), no further netting is done.

4.If long-term and short-term positions are opposite(1 gain, 1 loss), net again to produce either a gain or loss.

When after disposing of a capital asset, either a gain or a loss is incurred, and to calculate a net effect of these gains or losses, the procedure of netting is performed. The procedure of netting is followed when the net positions of short and long terms are different, i.e. one is in loss and one is in gain.

The procedure of netting is followed as per the given equation:

As provided,

Short Term Losses or Gains occurs when the asset was held and sold within 12 months, and Long Term Losses or Gains occurs when the asset was held and sold after 12 months.

As per the given information, Net positions of the capital gains or losses will be calculated as below:

Formulation:

Step by step

Solved in 3 steps with 3 images