Suppose you take out a 45-year $250,000 mortgage with an APR of 6%. You make payments for 3 years (36 monthly payments) and then consider refinancing the original loan. The new loan would have a term of 15 years, have an APR of 5.7%, and be in the amount of the unpaid balance on the original loan. (The amount you borrow on the new loan would be used to pay off the balance on the original loan.) The administrative cost of taking out the second loan would be $2200. Use the information to complete parts (a) through (e) below. a. What are the monthly payments on the original loan? $ 1340.71 (Round to the nearest cent as needed.) b. A short calculation shows that the unpaid balance on the original loan after 3 years is $246,431.77, which would become the amount of the second loan. What would the monthly payments be on the second loan? $2039.80 (Round to the nearest cent as needed.) c. What would be the total amount you would pay if you continued with the original 45-year loan without refinancing? $723,983.40 (Round to the nearest cent as needed.) d. What would be the total amount you would pay with the refinancing? $ 417,629.56 (Round to the nearest cent as needed.) e. Compare the two options and decide which one you would choose. What other factors should be considered in making the decision? The best option would be to refinance the loan, assuming that you can afford the monthly payments.

Suppose you take out a 45-year $250,000 mortgage with an APR of 6%. You make payments for 3 years (36 monthly payments) and then consider refinancing the original loan. The new loan would have a term of 15 years, have an APR of 5.7%, and be in the amount of the unpaid balance on the original loan. (The amount you borrow on the new loan would be used to pay off the balance on the original loan.) The administrative cost of taking out the second loan would be $2200. Use the information to complete parts (a) through (e) below. a. What are the monthly payments on the original loan? $ 1340.71 (Round to the nearest cent as needed.) b. A short calculation shows that the unpaid balance on the original loan after 3 years is $246,431.77, which would become the amount of the second loan. What would the monthly payments be on the second loan? $2039.80 (Round to the nearest cent as needed.) c. What would be the total amount you would pay if you continued with the original 45-year loan without refinancing? $723,983.40 (Round to the nearest cent as needed.) d. What would be the total amount you would pay with the refinancing? $ 417,629.56 (Round to the nearest cent as needed.) e. Compare the two options and decide which one you would choose. What other factors should be considered in making the decision? The best option would be to refinance the loan, assuming that you can afford the monthly payments.

Advanced Engineering Mathematics

10th Edition

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Erwin Kreyszig

Chapter2: Second-order Linear Odes

Section: Chapter Questions

Problem 1RQ

Related questions

Question

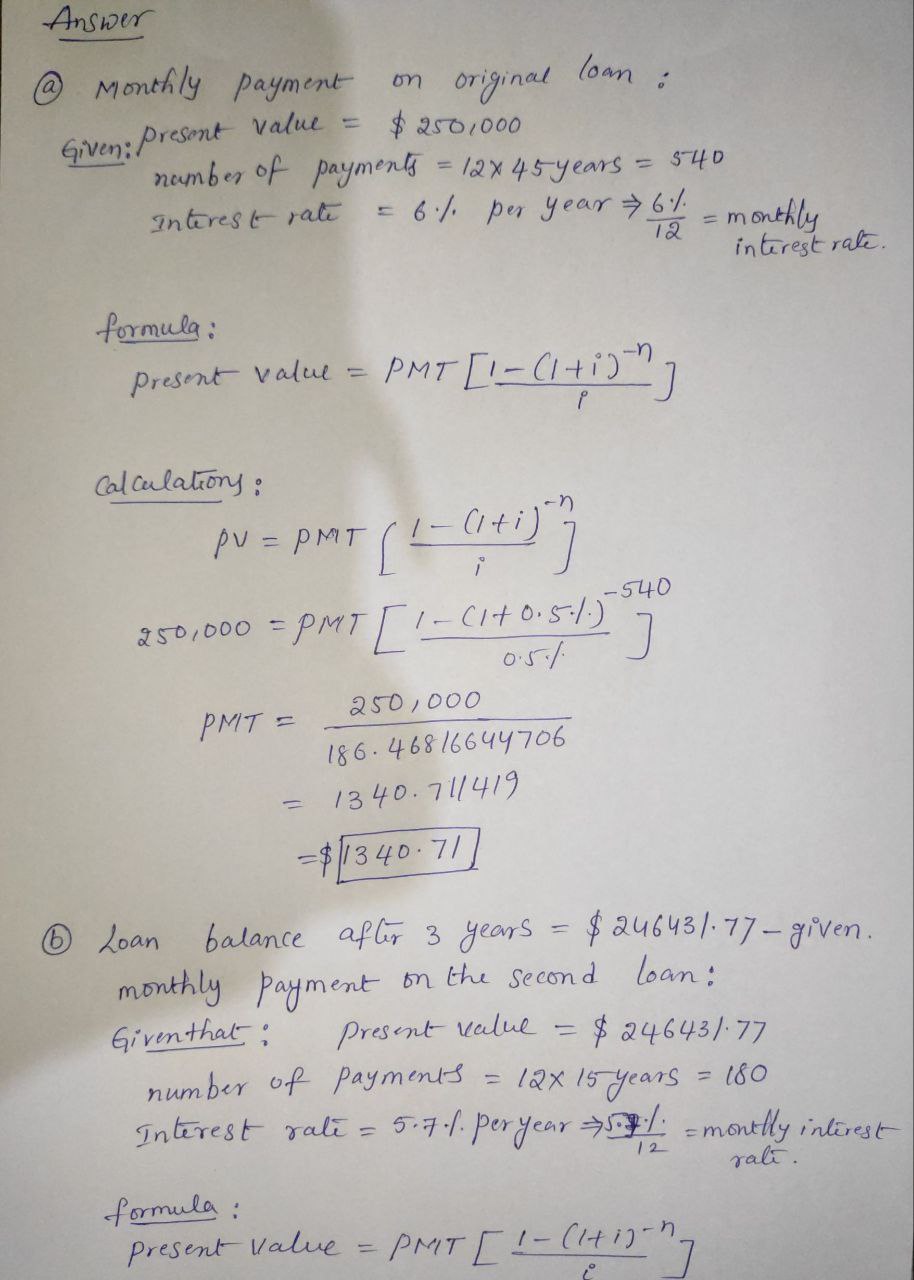

Please solve parts a through e. Attached is an example.

Transcribed Image Text:Suppose you take out a 45-year $250,000 mortgage with an APR of 6%. You make payments for 3 years (36

monthly payments) and then consider refinancing the original loan. The new loan would have a term of 15 years, have

an APR of 5.7%, and be in the amount of the unpaid balance on the original loan. (The amount you borrow on the

new loan would be used to pay off the balance on the original loan.) The administrative cost of taking out the second

loan would be $2200. Use the information to complete parts (a) through (e) below.

a. What are the monthly payments on the original loan?

$ 1340.71 (Round to the nearest cent as needed.)

b. A short calculation shows that the unpaid balance on the original loan after 3 years is $246,431.77, which would

become the amount of the second loan. What would the monthly payments be on the second loan?

$2039.80 (Round to the nearest cent as needed.)

c. What would be the total amount you would pay if you continued with the original 45-year loan without refinancing?

$723,983.40 (Round to the nearest cent as needed.)

d. What would be the total amount you would pay with the refinancing?

$ 417,629.56 (Round to the nearest cent as needed.)

e. Compare the two options and decide which one you would choose. What other factors should be considered in

making the decision?

The best option would be to

refinance the loan,

assuming that you can afford the monthly payments.

Transcribed Image Text:Suppose you take out a 35-year $125,000 mortgage with an APR of 6%. You make payments for 2 years (24

monthly payments) and then consider refinancing the original loan. The new loan would have a term of 15 years, have

an APR of 5.9%, and be in the amount of the unpaid balance on the original loan. (The amount you borrow on the

new loan would be used to pay off the balance on the original loan.) The administrative cost of taking out the second

loan would be $1800. Use the information to complete parts (a) through (e) below.

a. What are the monthly payments on the original loan?

(Round to the nearest cent as needed.)

Expert Solution

Step 1

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:

9781337798310

Author:

Peterson, John.

Publisher:

Cengage Learning,