Suppose that the Fed sets the interest rate and adjusts the money supply accordingly (i.e., horizontal LM curve) and the economy is in recession. (a) In this part, suppose also that private business investment spending depends only on sales expectations. What kind of policy mix would be able to increase output? Why? Explain. [Hint: Begin with showing the implications of assumptions first.] (b) In this part, suppose also that private business investment spending depends on both sales expectations and the rate of interest. How would your answer in part (a) change? What if the interest rate is already equal to zero (i.e., the zero lower bound). What kind of policy mix would be able to increase output? Why? Explain.

Suppose that the Fed sets the interest rate and adjusts the money supply accordingly (i.e., horizontal LM curve) and the economy is in recession. (a) In this part, suppose also that private business investment spending depends only on sales expectations. What kind of policy mix would be able to increase output? Why? Explain. [Hint: Begin with showing the implications of assumptions first.] (b) In this part, suppose also that private business investment spending depends on both sales expectations and the rate of interest. How would your answer in part (a) change? What if the interest rate is already equal to zero (i.e., the zero lower bound). What kind of policy mix would be able to increase output? Why? Explain.

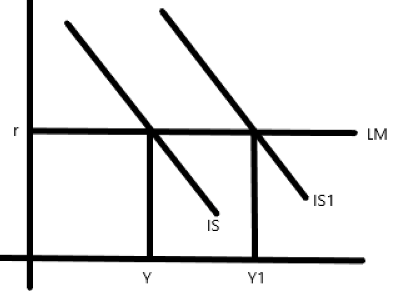

a) If the economy is in recession then there will be a leftward shift in IS curve because the demand for investment decreases. To shift IS curve towards right government will increase its spending. Rightward shift in IS curve will increase output and expected sales will also increase because of better infrastructure.

Expansionary policy should be used to increase the output.

Step by step

Solved in 2 steps with 1 images